U.S. steel prices have had a spectacular run this year, mostly attributed to trade protectionism.

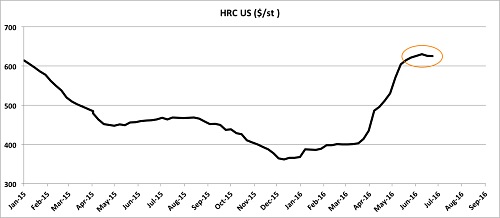

Hot-rolled coil in the U.S. has risen over 70% on the year-to-date. Although trade cases are what helped U.S. steel prices the most, the domestic rally was also supported by rising steel prices in China, too.

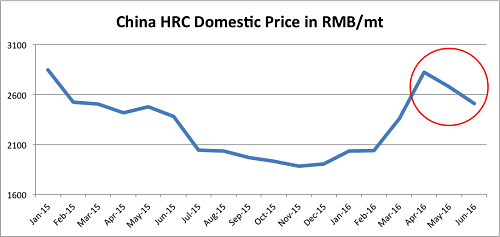

Chinese Steel Prices Fall

Prices in China surged this year for two reasons:

First, this year we saw an improvement in steel market demand in China thanks to stimulus measures. Second, the world’s biggest steel producer vowed to cut production capacity by 45 million metric tons this year and 100-150 mmt over the next three to five years. This combination of demand and supply measures boosted sentiment in the steel market and prices in China rose.

The world steel sector has urged China to reform its steel sector because of growing international pressure on the country to halt its surging steel exports. But China, so far, is failing to produce results.

China produced more steel than the rest of the world combined in May. According to the World Steel Association, China produced 70.5 million metric tons of crude steel products in May, up 1.8% from the levels of a year earlier and just shy of the record 70.65 mmt level hit in March 2016.

So production keeps rising…but is demand offsetting that increase, at least? Nope. Exports keep rising. In May, China exported 9.4 mmt of steel, a 2.3% increase compared with a year earlier. For the first five months of the year exports are up 6.4%. Given these numbers, 2016 could turn out as another record year for Chinese steel exports.

The continued growth of these figures worries steel investors. That is being reflected in the price action. Hot-rolled coil prices in China have fallen more than 20% from their April peak, and the decline could be even more severe if the effects of mini-stimulus wane over the coming months.

US Steel Prices Lose Momentum

So far, domestic prices have been immune to the decline in Chinese steel prices, but over the past few weeks we’ve noticed that the rally has lost momentum. U.S. steel prices haven’t moved much over the past few weeks.

Falling U.S. steel imports made prices rally this year. However, the rate of decline last month was the lowest in 10 months. In fact, absolute import levels have increased on a monthly basis since February.

An increase in steel imports later this year serves as one of the biggest risks facing U.S. steelmakers, considering the current price gap between domestic and international prices. Should service centers come back into the market and restock with imports, domestic mills may see some price pressure.

Steel Stock Prices Also Struggle

A good benchmark for investors’ sentiment on U.S. steel prices is the Dow Jones U.S. Steel Index, which tracks major steel producers around the globe.

Domestic steel prices directly impact the stock prices of these companies. Since May we have witnessed that investors’ enthusiasm for these companies has vanished, an early sign that domestic steel prices could suffer a correction.

What This Means For Metal Buyers

Falling steel prices don’t necessarily mean lower domestic prices, but the recent rally in U.S. prices seems overextended, and some secondary indicators are suggesting that prices might struggle to build on this year’s gains.