MetalMiner’s monthly Construction MMI®, a price index of metals used within the construction industry, dropped 2.2 percent this month.

What We Know

1. The latest figure for total construction spending in the US increased. It rose very slightly (0.1%) from November to December 2013, representing a 5.3% increase on a year-on-year basis in December 2013. According to the analysts at Gerdau Market Update, “most sectors are showing solid growth and momentum with the exception of education, public safety and religious facilities.”

2. But the steel market’s current anemia isn’t helping. Ten of Gerdau’s ‘present situation’ steel demand indicators are “still depressed by historical standards – of which five are from the construction sector.” These include but aren’t limited to infrastructure expenditures, non-residential construction starts, and construction employment.

What We Don’t Know–And Are Interested to Find Out

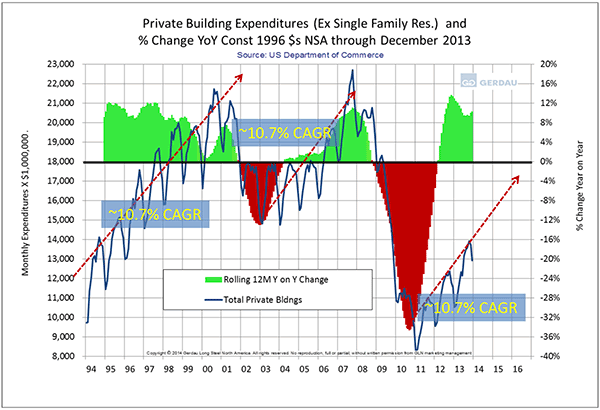

1. Will the US market keep growing above its pre-recession levels? Some (potentially) good long-term news for the US construction sector: The compound annual building growth rate (CAGR) “has returned to its historic post-recovery rate of approximately 10.7%”, according to Gerdau, as represented in the chart below. “If the rate continues at the same slope, a spending level of $17 BN per month will be realized in 2016, roughly the average rate throughout the boom period between 2002 and 2007.” Will external macroeconomic factors – or other black swans – disrupt this trend?

2. Will mortgage rates go up in 2014? According to Bloomberg, homebuilders are more optimistic overall than what recent sales numbers are showing, which could be based on 1) a response to lack of supply, and 2) “concern that mortgage rates are likely to rise later this year as the Fed cuts back on purchases of mortgage-backed securities.”

3. Will China’s dampening economic growth hamper prices? The global wild card as far as construction-sector commodities, such as iron ore and rebar, are concerned, is always China. SHFE rebar prices hit a record low recently, and iron ore prices have fallen 10 percent so far this year…

What This Means for Metal Buyers

Some of the price drops we’ve seen over the past month, reflected in the current index reading, may not hold, while some price rises (US shredded scrap, for example), may also be under pressure to drop – be sure to check out our latest Monthly MMI analysis coming out this week. Overall, with ITR Economics, for instance, revising their outlook from H2 2014 recession to simply “weakness,” the upcoming year may see neither huge jumps nor huge falls for the construction sector.

This Month’s Key Price Drivers

Chinese rebar was down 3.9 percent for the month. Last month, Chinese H-beam steel prices dropped by 1.7 percent.

The Weekly US Rocky Mountain bar fuel surcharge fell 1.1 percent after rising the previous month. The Weekly US Gulf Coast bar fuel surcharge dropped 0.5 percent.

However, after rising 3.2 percent, US shredded scrap finished the month higher again, its fifth straight month of gains. The weekly US Midwest bar fuel surcharge rose 2.1 percent over the past month.

Prices for the Chinese low price of 62% Australian iron ore fines remained constant this past month. Chinese aluminum bar and European 1050 aluminum both were flat.

The Construction MMI® collects and weights 9 metal price points used within the construction industry to provide a unique view into construction industry price trends over a 30-day period. For more information on the Construction MMI®, how it’s calculated or how your company can use the index, please drop us a note at: info (at) agmetalminer (dot) com.

by Taras Berezowsky