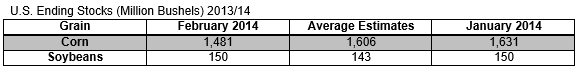

Grain stocks were reported lower in February due to a strong rise in exports for corn, soybeans, and wheat, according to the USDA. U.S. corn ending stocks for 2013 were lowered by 150 million bushels, more than analysts expected, due to high foreign demand. Soybean ending stocks were unchanged and the USDA continues to set the floor for stocks at 150 million bushels.

Corn

U.S. corn ending stocks were projected 150 million bushels lower due to increased exports. Lower corn prices have made U.S. corn more attractive to foreign buyers. The season-average farm price for corn was raised 10 cents on both ends of the projected range to $4.20 to $4.80 per bushel.

Global corn production was not changed due to lower reports in Argentina and Russia that were offset by increases reported in Ukraine. Coarse grain supplies were projected 2.1 million tons higher for 2013/14 due to higher beginning stocks and production. Global consumption was also raised 5 million tons with higher corn feeding for the European Union, Canada, South Korea, and Egypt.

Soybeans

U.S. soybean supplies for 2013/14 were increased by 5 million bushels to 3.46 billion bushels due to higher projected imports. Soybean exports for 2013/14 were projected at 1.51 billion bushels, up 15 million from last month reflecting the record pace of shipments and sales through January.

Projected ending stocks for 2013/14 soybeans were unchanged at 150 million bushels as increased exports were offset by a reduction in residual use and an increase in imports. The 2013/14 season-average price range was projected at $11.95 to $13.45, up 20 cents on both ends.

Global soybean production was raised 0.9 million tons to a record 287.7 million. Soybean production for Brazil was increased 1 million from last month to a record 90 million tons due to higher yields reflecting higher early harvest results in the center-west.

Wheat

U.S. wheat ending stocks for 2013/14 were projected 50 million bushels lower due to higher expected food use and exports. Imports were raised 10 million bushels as railroad congestion and inclement weather slow Canadian wheat shipments to Pacific Coast terminals, encouraging additional shipments to the U.S. market.

Exports were projected 50 million bushels higher due to strong sales and shipments and reduced competition from Argentina. The season-average farm price for all wheat was narrowed 5 cents on both ends of the projected range to $6.65 to $6.95 per bushel.

Global wheat supplies for 2013/14 were lowered 1.1 million tons with lower beginning stocks for Argentina and Russia and a 0.8-million-ton reduction in world production.

Outlook

Exports were the headline in today's WASDE report and will be the main focus throughout the 2014 season. Record setting production out of areas like the U.S. and South America have put pressure on prices, but it has been met with continued demand worldwide.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

US Soybean Supplies For 2013/14 Increased 5 Million Bushels

Published 02/11/2014, 01:10 AM

US Soybean Supplies For 2013/14 Increased 5 Million Bushels

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.