In a decision that is likely to strongly impact the U.S Shale Oil Industry, OPEC has decided to maintain their current level of crude oil production which will further strain the current supply imbalance. The move, primarily led by Saudi Arabia, is likely to put additional pressure on the fledgling shale oil industry at a time when the sector has experienced substantial growth.

OPEC’s decision to maintain production despite a global decline in oil prices is a strategy aimed directly at the heart of growing US output. The current US oil shale boom was predicated on prices remaining above the key $65.00 level, but as prices have declined domestic producers have found their marginal revenue falling. Subsequently, there have been further rig stand-downs in the Permian and Bakken shale plays leading some to question whether the shale boom is effectively over.

However, increased efficiency and innovation within the industry is starting to see costs fall, with some sources reporting a 30% improvement in their costs/revenue/funding mix that is likely to see more efficient production. If WTI prices can base around the $60.00 a barrel level then we might just see production ramp-up in a sign that the battle isn’t over just yet.

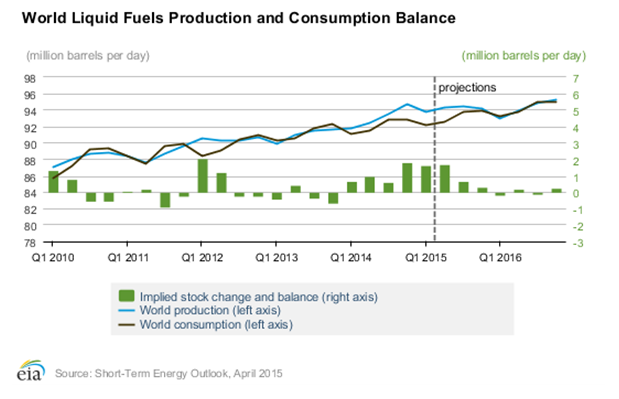

OPEC’s strategy has clearly been to encourage the significant supply imbalance in an attempt to damage the US domestic industry which explains the lack of production cuts over the past six months. However, any game theorist will tell you the law of unintended consequence rules when considering strategy and in this case, instead of encouraging a massive shuttering of production, it has led to additional investment in efficiency and lowering cost structures.

So it therefore begs the question…just how far is OPEC prepared to let the price decline, over the long term, before cutting production? The answer likely involves a question of political and financial will versus accepting a growing U.S domestic industry and at this stage OPEC is demonstrating plenty of will to continue the pain.