Trade balance figures from China showed a somewhat better picture compared to the expectations. Data for January showed that exports in dollar-denominated terms rose 9.1% during the month while imports fell 1.5%. This left the trade surplus at $39.1 billion for the month.

The data was better than the expectations which showed that both imports and exports would fall.

The European trading session showed that Germany's GDP for the fourth quarter remained flat against expectations of a 0.1% increase. Meanwhile, the Eurozone's GDP was unchanged at 0.2% for the same period.

The U.S. trading session saw the delayed retail sales report coming out. Data for December showed that retail sales fell 1.2% on the month in December while core retail sales fell 1.8%. The data stoked concerns of the downside risks, and the USD pared gains as a result.

Earlier today, China’s inflation report released earlier today during the Asian trading session showed that headline inflation grew at a slower pace of just 1.7% on the year in January. Producer prices index advanced just 0.1% on the year, marking a steady decline over the past few months.

More figures to close off the trading week

The European trading session will start with the release of Italy’s trade balance figures and will be followed up later in the day with the release of the Eurozone’s trade balance figures.

The U.K.’s retail sales report is due, and the data is expected to show a 0.2% increase in retail sales. This following a 0.9% decline in the month before.

The NY trading session will see the Empire State Manufacturing Index report coming out. Forecasts point to an increase in activity with the index expected to rise 7.6 from 3.9 previously. Import prices data from the United States should fall by 0.2% marking the third month of decline following a 1.0% decline in the month before.

The industrial production figures should show a modest pick up with activity rising 0.1%, slightly slower than the 0.3% increase from the month before.

The data concludes with the release of the UoM’s consumer sentiment and inflation expectations data.

EUR/USD Intraday Analysis

EUR/USD (1.1285): The EUR/USD currency pair posted a modest recover off the lows, supported by the bullish divergence. However, price action continued to ease following the retest of the breakout level. The Stochastics oscillator is singling a bullish divergence near the lows. The resistance at 1.1327 remains a key level for the EUR/USD. Price action needs to breakout past this level to confirm the upside bias. Failure to break the resistance could, however, keep the euro currency range bound.

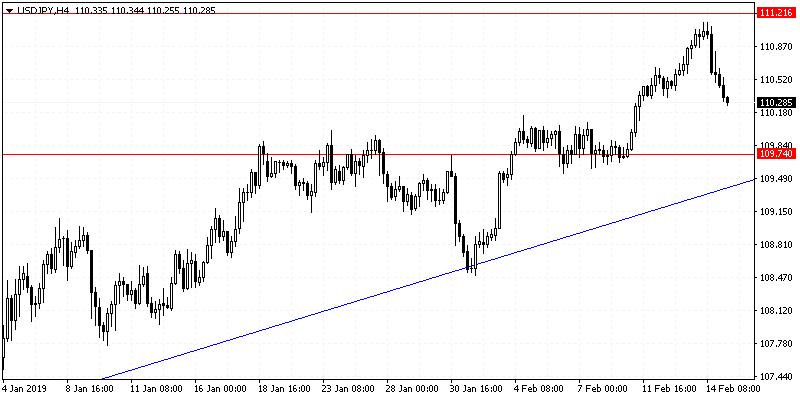

USD/JPY Intraday Analysis

USD/JPY (110.28): The USD/JPY currency pair reversed the gains just a few pips short of the resistance level at 111.21. The declines have been swift with prices recovering more than 50% of the gains made within the range. We expect the USD/JPY to remain flat within 111.21 and 109.74 levels in the near term. If the current declines continue, then the USD/JPY currency pair could retest the lower support at 109.74 level to the downside.

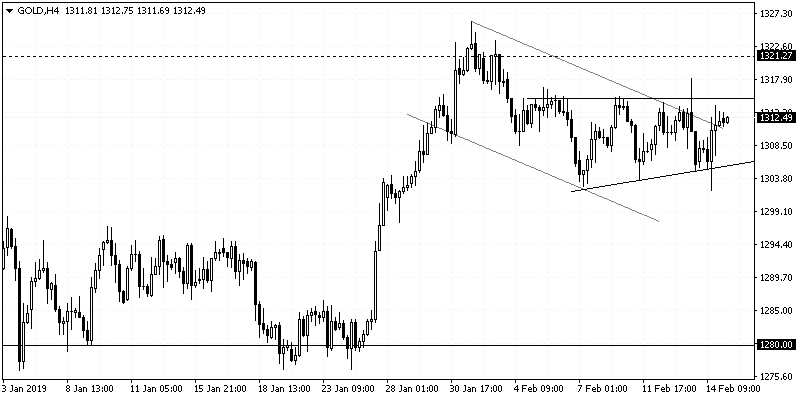

XAU/USD Intraday Analysis

XAU/USD (1312.49): Gold maintained its sideways range near the top end of the rally. Price action remained choppy while the ascending triangle pattern remains intact near the top. The upside breakout could potentially trigger further gains as gold will then need to test the resistance at 1321.25. With the daily chart’s bullish flag still intact, there is a scope that the upside momentum could push prices higher. To the downside, gold prices will need to a breakdown below the minor rising trend line to invalidate the upside bias