Stronger-than-expected July Retail Sales at 0.8% vs. 0.3% forecast helped the USD rally after analysts questioned whether QE3 will be implemented this year. Bigger-than-expected increases in the July Producer Price Index (PPI) 0.3% vs. 0.2% forecast will make today’s Consumer Price Index (CPI) numbers even more important. Looking ahead, July CPI is forecast at 0.2% vs. 0.0% previously m/m. August NY Fed is forecast at 6.5 vs. 7.39 previously.

The Euro (EUR)

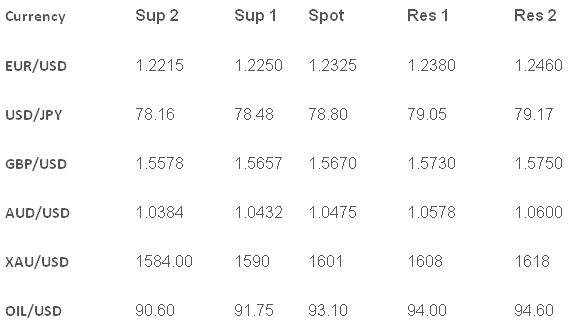

Some better-than-expected German Q2 GDP figures helped the euro hit day highs above 1.2380 but this was short lived as the major fell back to lower 1.2300 region after the strong US data. Some negative headlines emerged later regarding Greece asking for an extension of the austerity deadline by two years. Germany has recently stated it will not renegotiate bailout terms with Greece and it is becoming more politically difficult for German politicians to be lenient.

The Sterling (GBP)

The GBP/USD remained close to the 1.5700 level but could not push above the level once again with USD strength in the US session. GBP/JPY is supporting the major with a nice move higher yesterday on the back of the USD/JPY. Looking ahead, August MPC Vote forecast at 0-9-0. Also July UK Claimant count forecast at 6k vs. 6.1k previously.

The Japanese Yen (JPY)

The stronger-than-forecast US data helped the USD/JPY break above resistance at Y78.70 to hit multi-week highs just under Y79. The market is still requiring the Bulls to prove themselves after many failed rallies with most traders still looking to range trade the pair while the Y78-80 range holds. The yen crosses are mixed with the EUR/JPY still near historic lows so any reversal could be quite dramatic.

Australian Dollar (AUD)

The AUD/USD is struggling this week breaking down below 1.0500 supports overnight as profit takers took control. The uptrend is still in play and it is healthy to have the market correct lower but as is always the case reversals and downtrends begin with corrections. Support is seen at 1.0450-1.0380 area and the 200DMA is still significantly further away at 1.0300. EUR/AUD and GBP/AUD are both surging higher and threatening to break uptrends. Update August Australian Consumer Sentiment at -2.5% vs. 3.7% previously.

Oil and Gold (XAU)

XAU/USD fell for a second day on the QE3 questioning after the strong US retail data. OIL/USD was steady at $93 with the strong US data not a negative for the energy commodity.

Pairs To Watch

EUR/JPY: Safer way to express Eurozone Optimism?

USD/JPY: Technically break higher but dangerous to get excited?

TECHNICAL COMMENTARY

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

US Retail Sales Questions Need For QE3

Published 08/15/2012, 05:29 AM

Updated 03/09/2019, 08:30 AM

US Retail Sales Questions Need For QE3

U.S. Dollar Trading (USD)

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.