The U.S. restaurant industry was a little under the weather in the latter half of 2013. The downbeat mood was accentuated by Fed’s “taper talk,” the temporary government shutdown in October and concerns regarding consumer spending trends. The consumer confidence index was under pressure, declining from September to November straight due to the government shutdown and concerns regarding consumer spending over the next six months. But sentiment had started steadily improving, though the recent stock market weakness could potentially reverse that.

The industry is dependent on broad macroeconomic factors, with dining out being a largely discretionary activity. The economic climate largely influences restaurant choices for customers. We believe issues related to "Obamacare," volatility in housing data and fuel prices and excess supply may continue to cast shadows on the long-term picture. Additionally, an extensive focus on value proposition along with moderate pricing power could prove unfavorable for margins if exercised on a long-term basis.

However, we expect the outlook for the restaurant industry to get better driven by innate fundamental strengths, reflecting an improving economic backdrop. Statistics bear out this relatively favorable environment. Restaurant-and-foodservice sales are anticipated to be $683.4 billion in 2014, up 3.6% year over year, as per the National Restaurant Association. In real terms, this will mark the fifth consecutive year of growth in restaurant sales. The strength in the U.S. restaurant industry is backed by pent-up demand from consumers to live and eat well.

A recent survey by the National Restaurant Association revealed that the Restaurant Performance Index (RPI), measuring the present condition and outlook on the U.S. restaurant industry, was 101.2 in November, up 0.3% sequentially and the highest since Jun 2013. The Current Situation Index, which measures comparable store sales, traffic count, labor costs and capital expenditures in the industry was 101.2 in November, also up 0.3% sequentially and the highest in the last six months. The latest index is indicative of the underlying strength in the industry.

Moreover, yearly hikes in dividends on a regular basis by some restaurateurs like The Cheesecake Factory Inc. (CAKE), Brinker International, Inc. (EAT) and McDonald's Corp. (MCD) underscore their efforts to consistently return shareholder and franchisee value irrespective of the economic peaks and valleys.

OPPORTUNITIES

Domestic and International Unit Expansion

After emerging from a lackluster economy that lasted for three years, most of the companies had stepped up their pace of restaurant openings.

Not content with domestic expansion alone, the companies were looking to test waters as well as developing taste buds in foreign shores. Restaurateurs are primarily concentrating on the emerging markets that provide ample opportunities for expansion. The burgeoning middle income population in emerging countries encourages these companies to shift their spotlight from the somewhat saturated domestic market. DineEquity, Inc. (DIN), Red Robin Gourmet Burgers Inc. (RRGB) and The Cheesecake Factory have been quite active on this front.

Refranchising, Revamping & Innovating Menus – a Common Trend

Though refranchising was common in the restaurant sector, it has gotten a boost lately given the benefits of this business model even in an anemic economy. The franchise-centric model helps to reduce volatility in earnings and enhances cash flow generation. Companies like Burger King Worldwide, Inc. (BKW), Domino's Pizza, Inc. (DPZ) and Yum! Brands, Inc. (YUM) are examples of highly franchised brands.

Additionally, restaurants are responding in different ways to address heightened competition in a somewhat over-supplied domestic market. Most industry players are remodeling their restaurants to give an up-market feel as well as rolling out new and smaller prototypes to augment the perception of value and drive traffic, thereby reducing construction and occupancy costs and enhancing returns on capital. Darden Restaurants, Inc. (DRI) and The Wendy's Company (WEN) have been working along these lines.

This is not the end. Having stabilized their financial positions, the operators are constantly striving to add offerings to their menu card in order to cater to the ever-changing palates of customers while making better food presentation. McDonald's Corp., Brinker International, Inc. and Buffalo Wild Wings Inc. (BWLD) are keenly focusing on this strategy.

A few like Burger King have introduced a coaches program under which it has coaches keep an eye on its low-performing outlets. This program helps in improving operations, thereby ensuring guest satisfaction. Besides providing conventional food items like sandwiches, pizzas and beverages, a couple of companies like CEC Entertainment Inc. (CEC) and Buffalo Wild Wings provide exclusive social gaming opportunities to its customers that help in boosting guest traffic.

Restaurateurs are offering loyalty programs at their units to enhance value dining. This is a ploy to encourage sales at a time when customers are spending less on dining and need added incentives. Most of the operators rely on social media for promotions by incorporating Facebook (FB), online review sites, Twitter (TWTR) and blogs aggressively into their marketing mix. National Television advertising is also an important tool for promotion.

Digital Ordering & Delivery Gaining Precedence

The National Restaurant Association notes that technology will make pervasive inroads into the restaurant sector. Smartphone apps will lure consumers to the restaurants while video menu boards in quick-service restaurants and the growing application of tabletop devices in casual dining give operators some of the latest tools to push sales. A National Restaurant Association survey shows that 24% of consumers between 18 and 34 years consider a restaurant’s technology options when selecting where to go.

Restaurateurs are fast catching up on this growing trend of digital ordering. So far, Domino's Pizza has been a huge beneficiary of this trend. The Domino’s brand generates more than $2.0 billion in global digital sales per year. As a matter of fact, the company’s mobile ordering system together with traditional online ordering accounts for more than 30% of its revenues globally, and is likely to account for more than 50% of total sales over the long term.

Though delivery was common in the restaurant sector, especially among pizza chains, increasingly busy lifestyles have given it a boost. A couple of dining chains like Burger King and BJ’s Restaurants Inc. (BJRI) now cater to deliveries. Apart from this, catering initiatives are also doing the trick for companies like Panera Bread Co. (PNRA - Analyst Report) and Chipotle Mexican Grill, Inc. (CMG).

Currently, Fiesta Restaurant Group, Inc. (FRGI) carries a Zacks Rank #1 (Strong Buy). A few companies with a Zacks Rank #2 (short-term Buy rating) include Carrols Restaurant Group, Inc. (TAST), Cracker Barrel Old Country Store, Inc. (CBRL) and Texas Roadhouse, Inc. (TXRH). Despite its Zacks Rank #3 (Hold), we are optimistic about Red Robin Gourmet Burgers based on its strong third quarter results and future outlook. Similarly, we are also positive on Zacks Ranked #3 (Hold) company Cheesecake Factory given the momentum in its underlying businesses.

WEAKNESSES

Limited Pricing Power: U.S. consumers are facing the brunt of government budget cuts, higher gasoline prices, payroll tax increases and delayed tax refund checks. These factors have put a break to discretionary spending. The U.S. Department of Agriculture forecasts that food-at-home inflation as well as food-away-from-home inflation index in the U.S. is expected to grow in the range of 2.5–3.5% in 2014.

This would likely leave less room for consumer companies to exercise pricing action which would put pressure on restaurant sales. Moreover, this would keep the overall cost environment for food commodities tight. Food costs account for about one-third of restaurant sales, thus making the industry vulnerable to food cost inflation.

Global Economy Yet to Recover at Full Swing: Consumer companies are far from immune to macroeconomic tensions like implementation of austerity measures in Europe owing to the sovereign debt crisis and decelerating growth in Asia.

The big chains have considerable exposure in European nations like France and Germany and in Asian countries like China. Although debt-ridden European regions have started witnessing improvements, they have yet to reach pre-crisis levels. Despite improving economic data, German customers remain extremely value-sensitive. Among the emerging nations, China and Brazil have their own share of problems. Japan also continues to be a dampener as it is still on the way to recovery from the 2012 earthquake.

Affordable Care Act to Hurt Margins: Since the sector plays a key role in the nation's employment picture, the recent Affordable Care Act by President Obama, commonly known as Obamacare, is expected to have an adverse impact on the operators' margins starting 2014.

The law entails companies to provide coverage for workers or face government penalties, though it is not applicable for employees who log less than 30 hours per week on an average. To avoid these austerities, most companies are trying out different labor models like involving more part-timers and cutting work hours, which would hurt margins of the restaurant chains.

Change in Consumer Preference: The latest trend in U.S. eateries is to serve a healthy menu, owing to consumer preference for fresh, organic, nutritious and low calorie food. Rising health concerns and increasing awareness about obesity and related diseases have led to the shift in consumer preference toward healthy and “good for you” products. Focus on child nutrition is also a priority. Though a few companies like Burger King, Kellogg Company (K) and The Hershey Company (HSY) are coming up with low-calorie offerings, the fuss about nutrition will continue to pose challenges.

There are some names that induce our cautious to bearish outlook. These include Arcos Dorados Holdings Inc. Cla (ARCO), Diversified Restaurant Holdings, Inc. (BAGR) and Tim Hortons Inc. (THI), each carrying a Zacks Rank #4 (Sell) while Bravo Brio Restaurant Group, Inc. (BBRG), Jamba, Inc. (JMBA) and Ruby Tuesday, Inc. (RT) carry a Zacks Rank #5 (Strong Sell). Famous Dave's of America Inc. (DAVE), Kona Grill Inc. (KONA) and Krispy Kreme Doughnuts, Inc. (KKD hold a Zacks Rank #3 (Hold).

Zacks Industry Rank – Negative Outlook

Within the Zacks Industry classification, the restaurant industry is grouped within the broader Retail sector. We rank all 260+ industries in the 16 Zacks sectors based on the earnings outlook and fundamental strength of the constituent companies in each industry. To learn more visit: About Zacks Industry Rank. http://www.zacks.com/zrank/about-zacks-industry-rank.php

As a guideline, the outlook for industries in the top 1/3rd of all Industry Ranks or a Zacks Industry Rank of #88 and lower is 'Positive,' the middle 1/3rd or industries with Zacks Industry Rank between #89 and #176 is 'Neutral' and the bottom 1/3rd or Zacks Industry Rank of #177 and higher is 'Negative.'

The Zacks Industry Rank for the restaurant industry is currently at #228. This is in the bottom 1/3rd of all industries ranked, highlighting the group’s near-term Negative outlook.

Earnings Trends

In this fourth quarter 2013 earnings season, results from nearly 102 S&P 500 companies have already been declared. The restaurant industry falls under the broader Retail-Wholesale sector, which has an earnings as well as revenue beat ratio (percentage of companies coming out with positive surprises) of 27.3% for the fourth quarter.

Earnings growth of 7.2% was seen at the sector in the fourth quarter, down from 10.7% growth in the third quarter of 2013 due to higher inflation costs. On the revenue front, the sector recorded an increase of 6.2% in the fourth quarter, up from a 3.8% increase in the prior quarter.

Looking at the Consensus earnings expectations for fourth quarter of 2013, earnings are expected to decline 0.1% in the fourth quarter of 2013. For 2014, the sector is poised to expand around 9.1% with 11.1% growth in the first quarter itself.

Revenue is expected to grow 2.2% in the fourth quarter of 2013. For the next year, the sector is poised to expand around 4.4% with 10.5% growth in the first quarter 2014.

For more details about earnings for this sector and others, please read our ‘Earnings Trends’ report.

Among the companies which have reported earnings this season, Darden Restaurants posted dismal fiscal second quarter 2014 results with earnings missing the Zacks Consensus Estimate and also declining year over year due to higher expenses. Weak results reflect underperformance in its core brands, Red Lobster and Olive Garden.

Brinker International’s fiscal second quarter 2014 earnings and revenues however beat the Zacks Consensus Estimate by a penny and 1.0%, respectively driven by strong comps. Meanwhile, McDonald's reported better-than-expected fourth quarter 2013 earnings, while revenues missed the consensus mark.

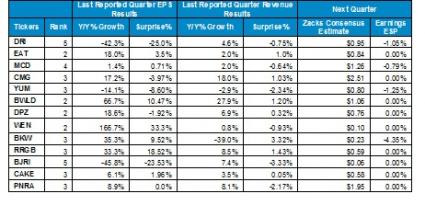

A look at the Earnings ESP in the table below shows that Yum! Brands and Burger King Worldwide could miss the Zacks Consensus Estimate in the next quarter (fourth quarter 2013).

Bottom Line

In hindsight, the performance of the restaurant sector was more or less satisfactory in recent times. For 2014, the industry is expected to generate growth as it focuses on inspired ways of meeting consumer demand. However, the sector will continue to face headwinds from a weak consumer spending environment and higher food and labor costs. Overall, the restaurant industry is expected to sustain its pace of recovery in 2014, albeit at a slower clip, as it contends with several global economic concerns.

Our proprietary Zacks Rank indicates the movement of the stocks over the short term (1 to 3 months). At present, respectively 22.0% and 33.0% stocks hold a positive and neutral outlook, while the remaining 45.0% is negative.