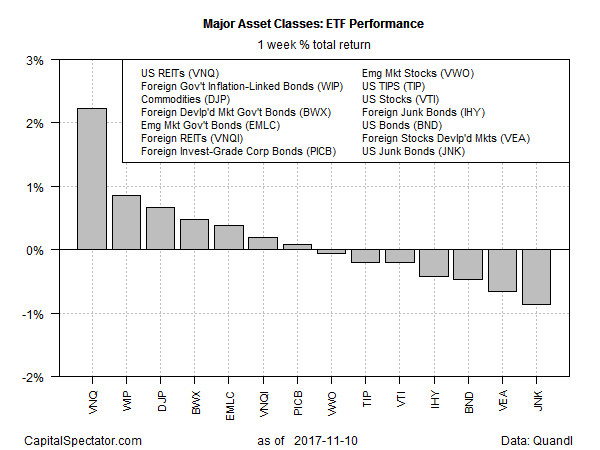

Real estate investment trusts (REITs) in the US surged last week, posting the strongest gain among the major asset classes, based on a set of exchange-traded products. The rise marks the second weekly increase in a row for securitized real estate.

Vanguard REIT (NYSE:VNQ) jumped 2.2% over the five trading days through Nov. 10. The advance lifted the ETF to its highest close in over a year.

Last week’s bottom performer: US junk bonds. SPDR Barclays High Yield Bond (NYSE:JNK) tumbled 0.9%, suffering its third straight weekly loss. The ETF closed on Friday at its lowest price in two months.

“With spreads tighter, the chance that investors earn their coupon is certainly lower than what it was a year or two ago,” says Eric Stein, co-director of global income at Eaton Vance. “If we have an inflationary world with higher rates, or risk-off and deflationary world, that could be challenging for high-yield.”

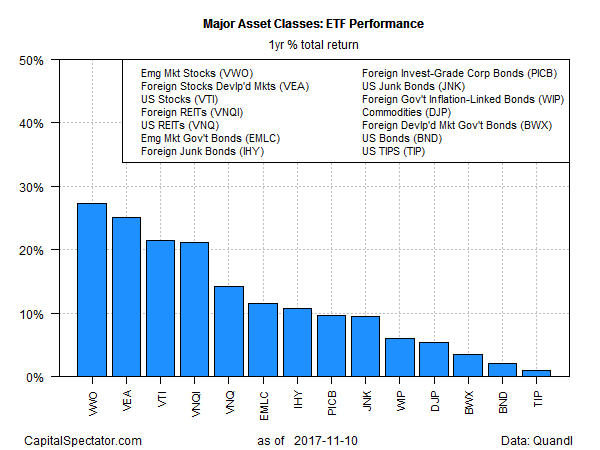

For the one-year change, all the major asset classes are in positive terrain at the moment. Leading the field: emerging markets stocks. Vanguard FTSE Emerging Markets (NYSE:VWO) is up 27.3% for the trailing one-year period.

A close second: foreign stocks in developed markets. Vanguard FTSE Developed Markets (NYSE:VEA) is currently posting a 25.0% total return for the past 12 months through last week’s close.

The weakest performer for the trailing one-year trend among the major asset classes: inflation-indexed Treasuries. The iShares TIPS Bond (NYSE:TIP) closed higher by a thin 1.0% on Friday vs. the year-earlier level after factoring in distributions.