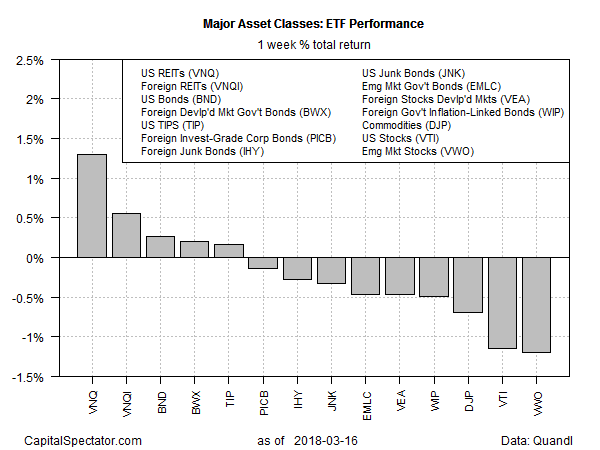

Real estate investment trusts (REITs) in the US posted a second straight gain last week, topping performances for the major asset classes, based on a set of exchange traded products.

Vanguard Real Estate (NYSE:VNQ) jumped 1.3% for the five trading days through Mar. 16. Adding in the previous week’s gain translates into VNQ’s best two-week run in more than a year, albeit after months of weakness.

Last week’s performances were mixed overall for the major asset classes. On the downside, emerging markets stocks suffered the biggest decline. FTSE Emerging Markets (NYSE:VWO) fell 1.2% last week.

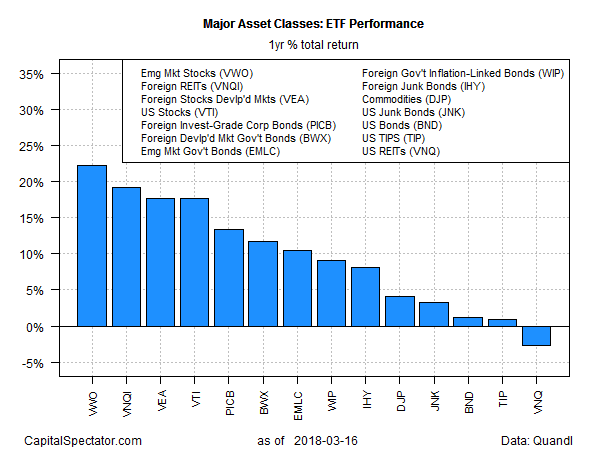

For the one-year trend, the leader and laggard pair is exactly opposite to last week’s results. Equities in emerging markets (VWO) continued to post the strongest total return (+22.3%) while US REITs (VNQ) are in last place with a 2.7% loss.

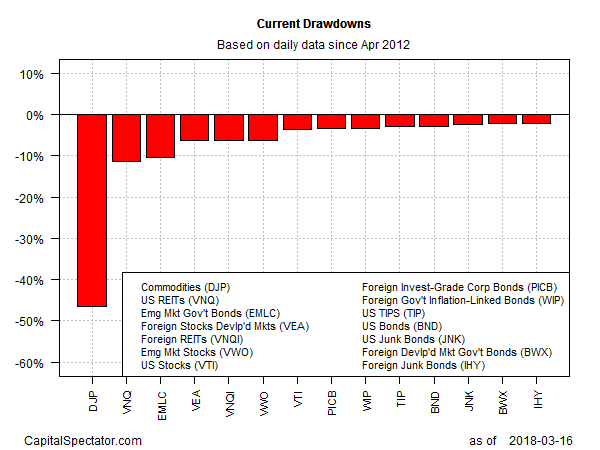

Stacking up the major asset classes based on current drawdown reveals that broadly defined commodities are still suffering from the biggest peak-to-trough decline for the major asset classes. The drawdown for iPath Bloomberg Commodity (NYSE:DJP) at last week’s close was a steep -46%. Meanwhile, foreign junk bonds via VanEck Vectors International High Yield Bond (NYSE:IHY) has the smallest drawdown at the moment of just -2.1%.