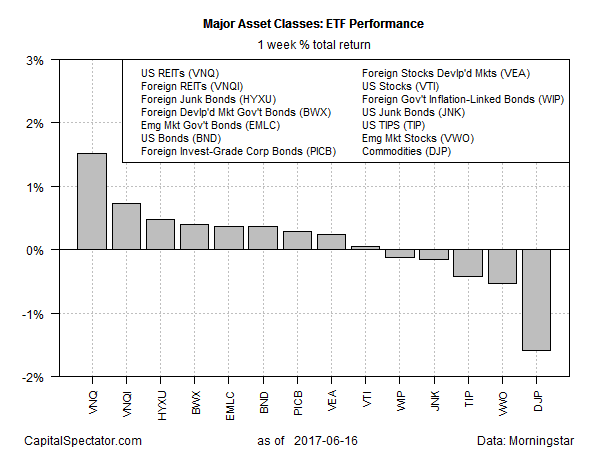

US real estate investment trusts (REITs) posted the strongest performance last week among the major asset classes, based on a set of exchange-traded products. The gain extends a rebound for securitized real estate that began in mid-May.

Vanguard REIT (NYSE:VNQ) increased 1.5% over the five trading days through Friday, May 16. The rise marks the fifth straight advance for the fund.

The robust of performance of REITs in recent weeks has surprised some investors. REITs, after all, are prized for their relatively high payouts. VNQ’s 12-month trailing yield is 4.4%, according to Morningstar.com, roughly double the current yield of the 10-year Treasury Note. By some accounts, yield-sensitive REITs are vulnerable in a rising interest-rate environment and so last week’s rate hike by the Federal Reserve – the third in the last six month – underlines a risk factor for these securities.

But Dave Gilreath of Sheaff Brock Investment Advisors is bullish on the asset class, explaining that rising rates have been kind to the securities. “Actually, they’ve usually done better during periods of rising rather than declining rates because the same improvements in macroeconomic conditions that prompt rate increases also lead to improved REIT performance,” he said last week.

Meanwhile, broadly defined commodities faded after a brief rally earlier in the month. But gravity prevailed once more. Last week’s biggest loser: iPath Bloomberg Commodity (NYSE:DJP), which fell 1.6%, touching its lowest close in more than a year.

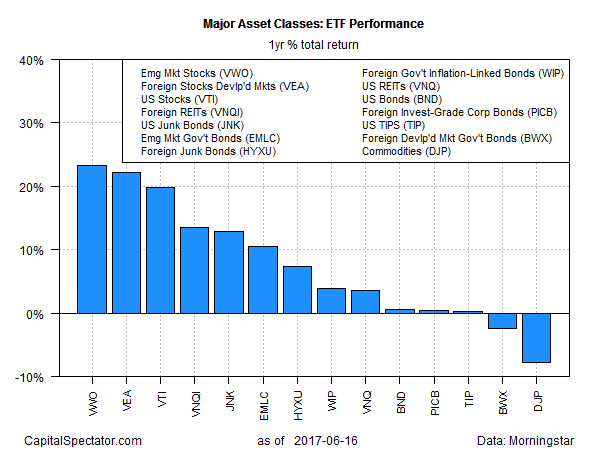

Moving on to one-year results, emerging-markets equities still hold the top spot. Although Vanguard FTSE Emerging Markets (NYSE:VWO) fell fractionally for a second week, the ETF continues to shine as a 12-month performer, posting a solid 23.5% total return in year-over-year terms – the best gain among the major asset classes, as of June 16.

On the flip side, commodities are still dead last. DJP is off 7.8% in year-over-year terms, leaving the exchange-traded note near its lowest close in more than 12 months.