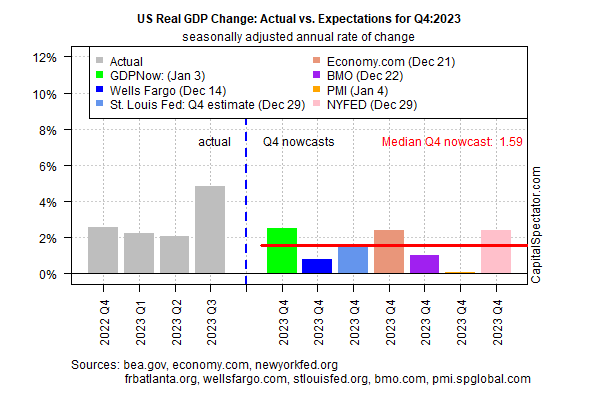

This month’s official report of US fourth-quarter economic activity, scheduled for release on Jan. 25, will likely confirm that output expanded at a moderate pace, according to a set of nowcasts compiled by CapitalSpectator.com.

The US Bureau of Economic Analysis is projected to report that growth slowed to a 1.6% gain (seasonally adjusted annual rate), which is the current median nowcast. That’s a sharp slowdown from Q3’s blistering but unsustainable increase. The good news: the current estimate for the final quarter of 2023 strongly suggests that the US ended last year on with a solid, albeit slowing tailwind.

Today’s median Q4 nowcast is unchanged from the previous update, published on Dec. 27. Note, too, that the current 1.6% median estimate is also in line with recent updates.

“Some New Year cheer is provided by the PMI [survey data] signaling an acceleration of growth in the vast services economy, which reported its largest rise in output for five months in December,” says Chris Williamson, chief business economist at S&P Global Market Intelligence. “The improvement overshadows a downturn recorded in manufacturing to indicate that the overall pace of US economic growth likely accelerated slightly at the end of the year.”

The key question is whether the expected slowdown in Q4 is a sign that the economy is losing momentum that will continue in 2024 and threaten the expansion. The alternative view is that economic momentum is stabilizing at a sustainable pace after unusual volatility triggered by the lingering effects of the pandemic.

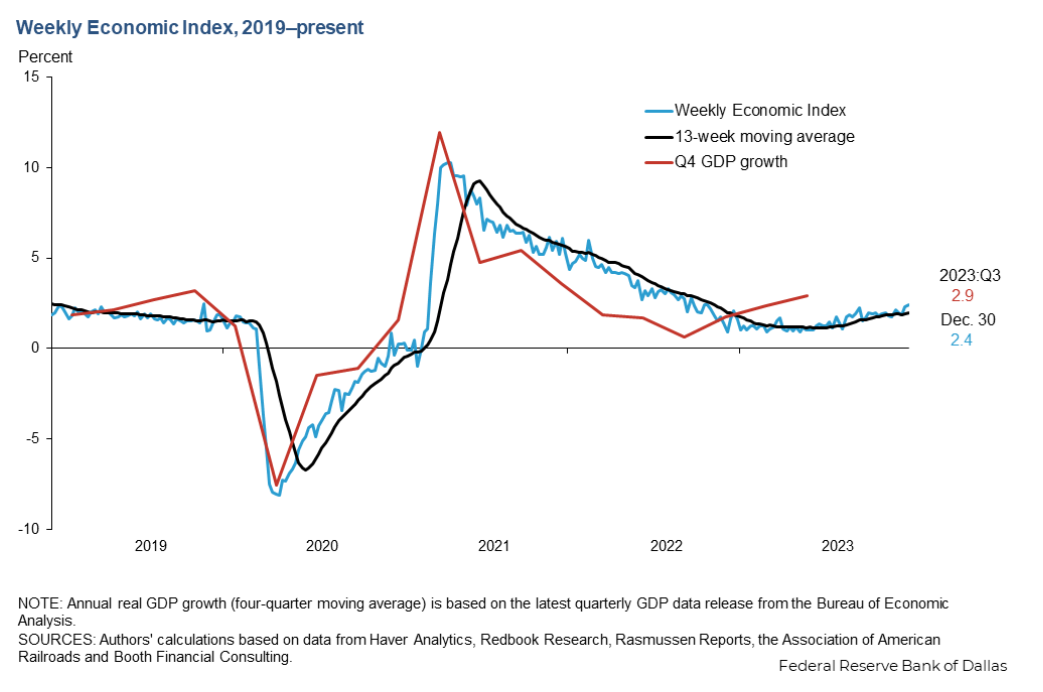

One reason for cautious optimism: the Dallas Fed’s Weekly Economic Index (a multi-factor measure of US economic activity) rose to its highest level in over a year through Dec. 30. Based on this measure of economic activity, the US macro trend is strengthening, which suggests a pickup in growth is in store for early 2024.

A key source of optimism that persuades some analysts that the US can continue growing: consumer spending and a robust labor market. “We expect a Goldilocks economy—one that offers full employment, economic stability, and moderating inflation,” Commonwealth Financial Network told clients recently.

Yet the economy’s bears persist in warning that recession risk will likely bite at some point in the year ahead. Although the economy proved to be more resilient than many forecasters expected in 2023, some argue that a downturn has only been delayed.

Perhaps, but this much is clear: recession risk remains low at the moment and will likely remain so for the immediate future. Predicting what happens beyond a two-to-three-month window, as always, is wide open for debate.