Over the past few months, we have focused—for obvious reasons—on the pandemic and the resulting economic crisis. However, there are other important events that may substantially affect the gold price.

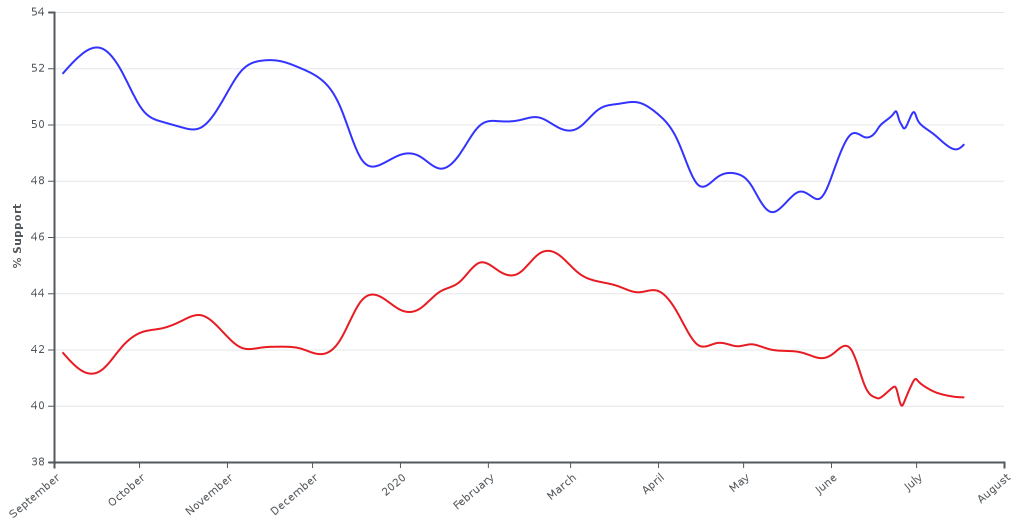

One of the most important is the U.S. presidential election in November. And the polls suggest that we could see a change of President in the White House. As the chart below shows, Joe Biden (blue line) has an average polling margin of 9 percent over incumbent President Donald Trump (red line).

Will Biden win? That's a great question. Polls say so, but who trusts polls these days? We believe that it is possible, given that some voters could be dissatisfied with the Trump administration's handling of the epidemic, and especially if a second wave of the coronavirus is not contained quickly and a double-dip recession ensues. Trump could share his fate with George H.W. Bush, who lost to Bill Clinton during the early 1990s recession. However, if the economy improves, the race could tighten between now and election day.

What would President Biden imply for the US economy and the gold market?

Well, although I don't support Trump's trade policy, I'm not impressed with Biden's economic agenda. Under his economic revival plan, the federal government would spend $700 billion on research and development for new technologies and energy initiative, and on American goods and services. What is key here is that Biden plans to pay for these and other programs by raising taxes "on corporations and the wealthy". In particular, he wants to hike the corporate tax rate from the current 21 to 28 percent. I may be wrong, but Wall Street would not welcome higher taxes, especially during a fragile recovery. So, the stock market could drop if Biden wins.

But it does not have to... So far, investors are totally unfazed by the polls forecasting Biden's success. After all, a lot can still happen before November. The markets may be waiting until the outcome of the Presidential race looks clearer. It's also possible that investors expect Biden will moderate his proposals after the election, or that they are focusing on other parts of his agenda. For example, Biden's trade policy is less protectionist than Trump's and he may end the trade wars with China (and other countries).

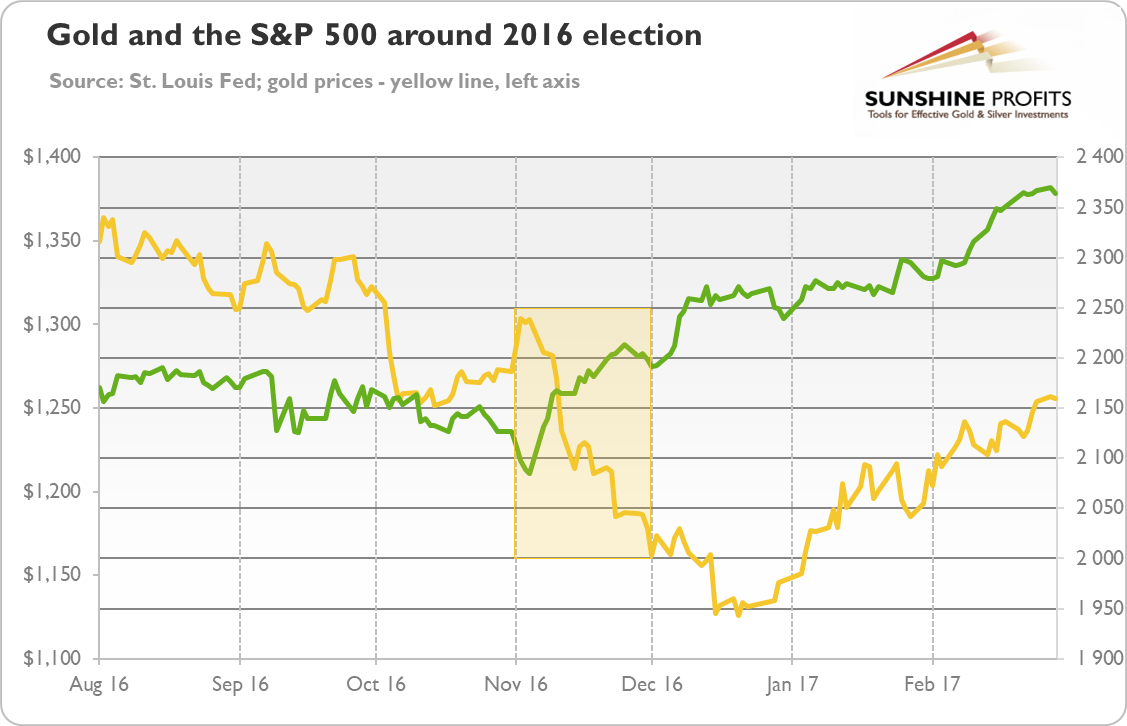

Hence, the possible effect of a Biden win on equities and the gold market is ambiguous. Theoretically, given that the stock market rallied and the price of the yellow metal plunged after Trump's victory in 2016 (see the chart below), we should expect the reverse if Trump loses.

But this reasoning could be too simplistic. Both the stock and gold market could easily interpret Biden's victory in a bullish manner, as investors tend to do during bull markets. Or, after initial, short-term volatility, the underlying upward trends could resume. After all, Biden is generally acceptable to investors. He is not as radical as Bernie Sanders or Elizabeth Warren. He is actually more mainstream in several areas than Trump. And the financial markets managed to operate and even thrive under Trump and Obama—whose vice-president was Biden.

So, no matter who resides in the White House after the election, the current macroeconomic conditions should remain generally favorable for precious metals. Favorable conditions including soaring fiscal deficits (according to the CBO, the federal budget deficit was $2.7 trillion in the first nine months of fiscal year 2020, $2.0 trillion more than the deficit recorded during the same period last year) and federal debt (according to the IMF, general government debt is expected to rise to 160 percent of GDP by 2030 without further rounds of fiscal stimulus), as well as negative real interest rates, and the fastest pace of growth in the money supply in modern history.

No matter who wins, we do not expect radical changes in the accommodative fiscal and monetary policies, and the overall macroeconomic outlook, until the economy fully recovers from the coronavirus crisis. Investors should remember that although politics is important, what the Fed does is also if not more important for the stock and gold markets. We do not expect the U.S. Central Bank to abandon its dovish bias, no matter who resides in the White House. Neither Trump nor Biden would like to see an end to extravagant government spending and stimulus packages.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our Gold & Silver Trading Alerts.