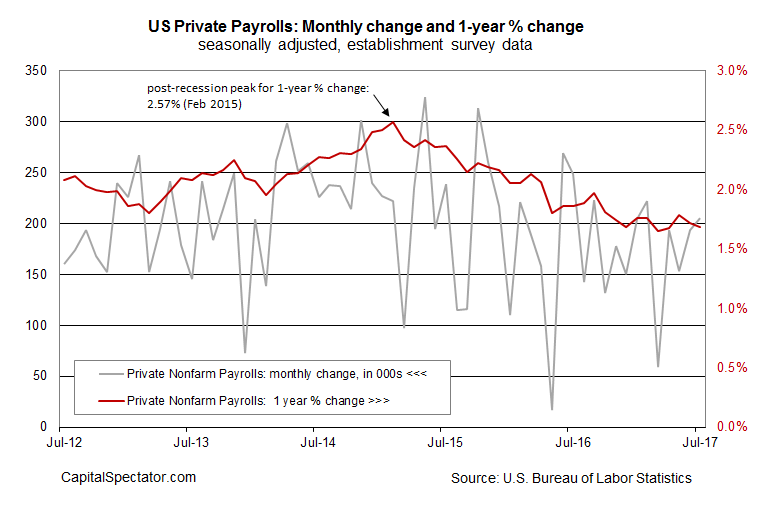

US companies added workers at a faster rate in July, expanding payrolls by 205,000, up from an upwardly revised 194,000 in the previous month. That’s a healthy improvement, although the noisy monthly changes hide the fact that the year-over-year trend for payrolls continues to decelerate.

Private payrolls increased 1.68% in July vs. the year-earlier month, fractionally lower than the 1.72% annual pace in June. A rounding error, perhaps, but the latest year-on-year increase leaes the trend close to the slowest advance in six years, marked by a 1.65% rise in March.

A roughly 1.7% annual advance for private payrolls is still encouraging. Yet the persistence of the slowdown in jobs creation, which has been in force for more than two years, suggests that the eight-year-old economic expansion – the third-longest on record since the mid-1800s – may soon be facing new headwinds.

That’s not obvious in the monthly comparisons. The crowd will likely focus on the fact that July’s private payrolls accelerated to the best pace in five months.

“It was strong across the board. It puts (the Fed) still on track to start the program to wind down the book in September and it’s a long ways off in December for the next rate hike,” Justin Lederer, an interest rate strategist at Cantor Fitzgerald, tells Reuters.

Tony Bedikian, head of global markets for Citizens Bank, agrees. “Kind of an all-around strong headline number,” he observes. “More people are coming into the labor force and finding jobs. It’s difficult to find anything really negative in the report.”

The caveat is that month data is noisy, which is to say that focusing on the short-term data can be misleading at times.

To be fair, the annual trend’s decline is gradual and so the slowdown could roll on for some time before it creates trouble for the labor market or the economy. In fact, it’s reasonable to wonder if the downshift has stabilized around the 1.7% rate. One reason for entertaining this idea: the annual pace has been in a tight range since March, averaging 1.7%, which implies that the economy has found a sweet spot for moderate, steady growth.

Perhaps, but the bigger picture for the last several years still tells us that a downshift in the rate of growth has momentum. That’s not a concern for the near term, courtesy of a still-moderate year-over-year positive trend.

If the annual pace continues to slide, however, the outlook could change. In the months ahead, keep an eye on whether the year-over-year data in private-employment growth falls below the recently established six-year trough – 1.65% in March. If the trend sets a new low, it’ll be tougher to ignore gravity’s pull for evaluating the economic outlook.