Markets calm ahead of U.S. data

It’s been another mixed start to trading in Europe on Tuesday, while U.S. futures are marginally higher as we await a raft of data from the U.S. this week.

Traders are seemingly a little more relaxed about the current situation, with the Fed having cut interest rates at each of the last two meetings and talks between the U.S. and China ongoing. I don’t think traders are fully satisfied in either case but minimum expectations are just about being met.

We’ll get a number of data points this week which will allow us to further assess the economic well-being of the world’s largest economy. The U.S. jobs report on Friday is naturally front of mind but prior to that we’ll get more PMI surveys that are gaining some traction, as investors everywhere seek out pockets of weakness that are forming.

The euro area numbers this morning were as bad as you’d expect, while the UK offered some better news although even here, it remained in contraction territory. ISM and Markit PMIs will be in focus now for the U.S., as will commentary from various Fed officials who have thus far seemed quite satisfied with the impact of their rate cuts.

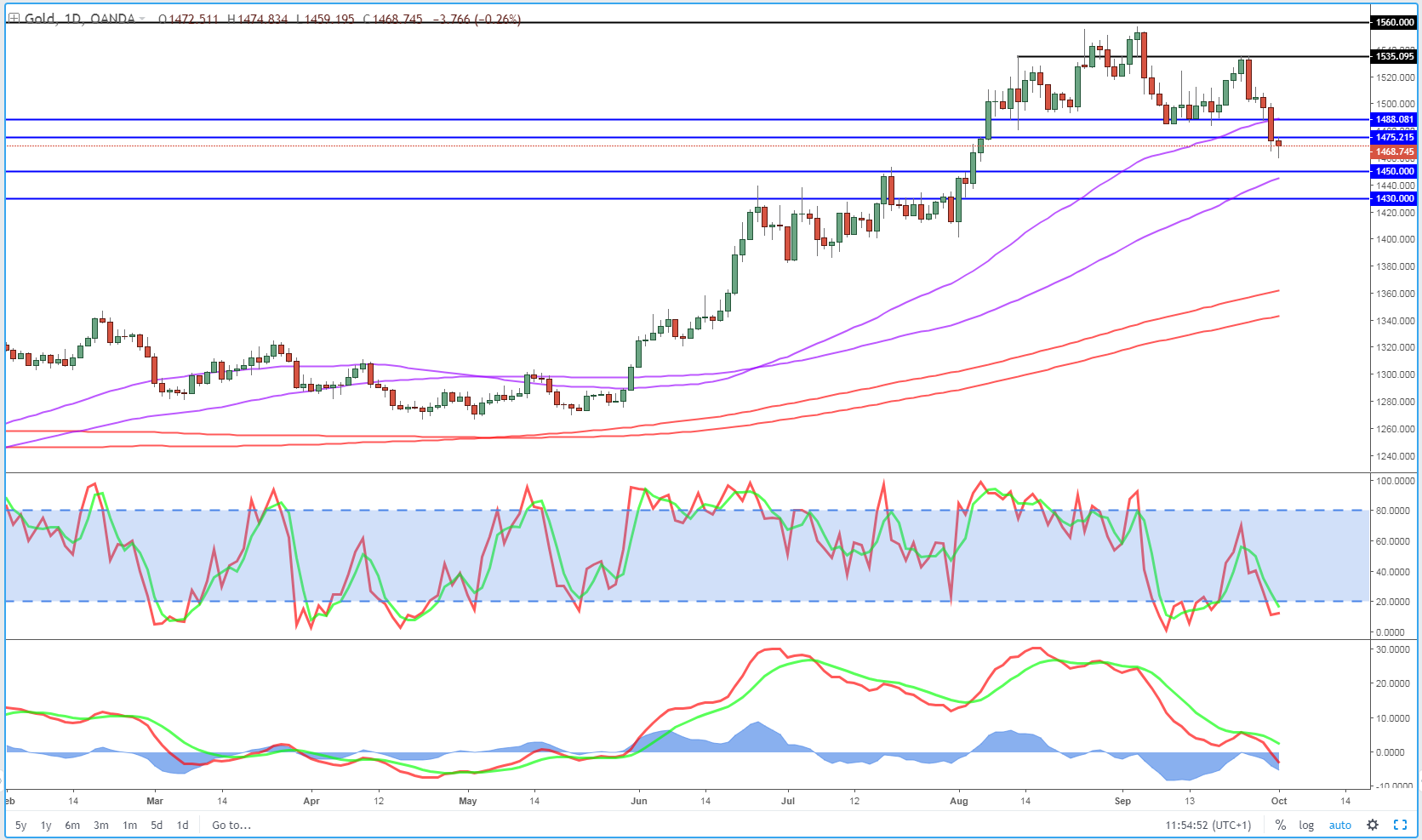

Gold finally tumbles through $1,480 support

Gold has finally broken through $1,480 support and could be facing further losses in the coming weeks as sentiment shifts towards the yellow metal. The move has been coming for some time and a failure to break $1,535 last week was the final nail in the coffin, with gold tumbling almost 5% in the week that followed.

It’s found some support around $1,460 following the initial drop but could come under further pressure in the coming weeks. In the meantime, it will be interesting to see whether it tests $1,480 from below, with the level having been such a notable level of support since August.

Gold Daily Chart

Odds of another rate cut this year have been slipping and are now below 70% while talks are ongoing between the U.S. and China, offering some hope of a deal at some point in the future. This has supported the dollar and hit gold as a result, which has benefited throughout the summer on hopes of multiple rate cuts and unsuccessful negotiations.

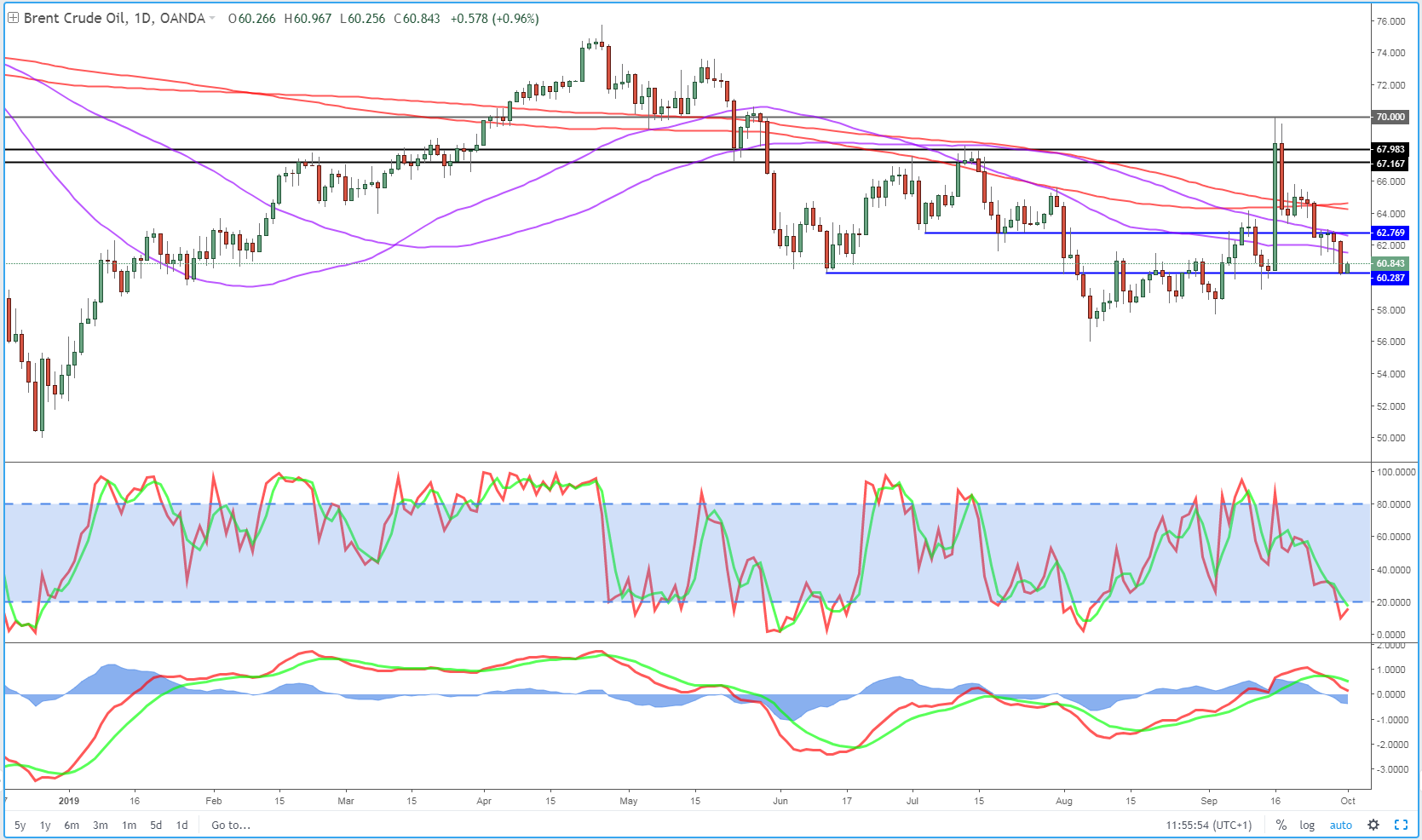

Oil falls below pre-attack levels

Oil prices are recovering slightly after falling almost 4% on Monday on reports that Saudi Arabia has fully restored output at the facilities that were attacked only two weeks ago. There was a lot of skepticism around whether they would manage to fully restore these facilities but this remarkable turnaround has apparently been delivered.

Brent slipped below $60 a barrel at the start of the week, while WTI breached $54, both below the Friday close prior to the attacks. That wipes out any risk premium so soon after the attacks, with the calm response from Saudi Arabia, the US and others drawing a similar response to traders. I imagine sensitivity to further risks remains high though.

Brent Daily Chart

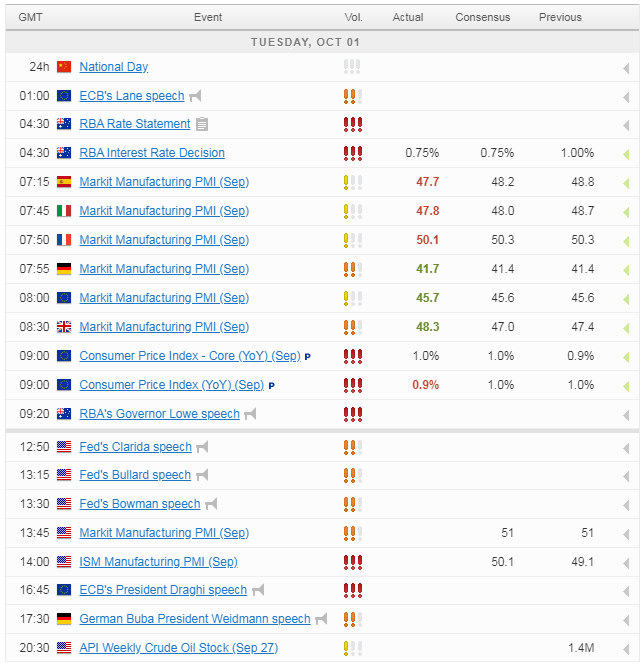

Economic Calendar