After a torrid run, the US has produced some positive news on growth with the ISM manufacturing bouncing back up from two-year lows and construction spending surging higher at the beginning of 2019

By James Knightley, ING Chief International Economist

ISM Rises From 2-Year Lows

The March ISM manufacturing index has risen from two-year lows to stand at 55.3 versus the consensus of 54.5. Given 50 is the break-even level, this is consistent with healthy activity in the manufacturing sector with the details showing decent improvements in production and new orders. Meanwhile, the employment gauge jumped five points to 57.5, which hopefully is a very positive sign for Friday’s US employment report. Customer inventories also continue to be run down, which bodes well for continued growth in new orders in the coming months. Another encouraging aspect of the report is the breadth of improvement. Sixteen out of 18 manufacturing sectors are reporting growth with 14 seeing rising new orders and 13 seeing rising employment.

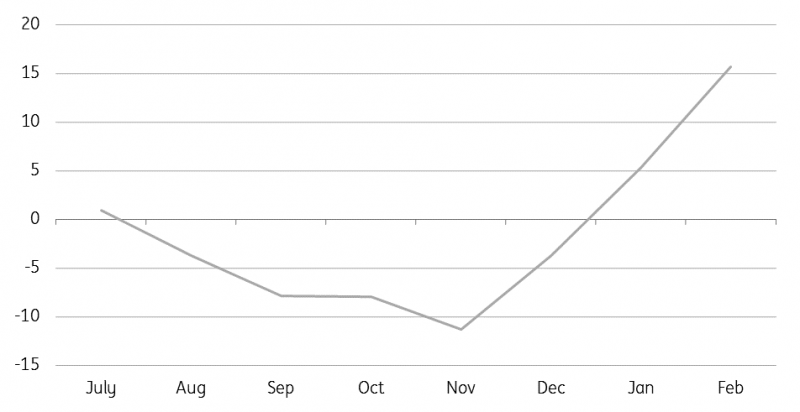

US construction spending to make major 1Q growth contribution (3-month annualized growth)

Construction Surges Higher

Separately, the construction sector has started the year in a very strong position. After having seen output rise 2.5% MoM in January (initially reported as +1.3%), it rose a further 1% MoM in February versus expectations of a 0.2% fall. Residential construction has now seen three consecutive months of strong growth after having had a torrid 2018 while non-residential construction is currently rising 4.8% YoY.

The Federal Reserve Remains Patient

The rather volatile nature of recent US economic data reports fully justifies the Federal Reserve’s “patient” stance toward monetary policy. Our position remains that while the economy does face more headwinds this year, there are reasons for optimism, most notably the strong household fundamentals.

If we can also get a positive resolution to the ongoing trade talks, this could remove a considerable amount of uncertainty and give businesses the confidence to put more money to work. While we think the Fed is unlikely to hike rates again, we don't expect to see any interest rate cuts this year.

Content Disclaimer

This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more