The euro took further losses against its main currency rivals in trading yesterday, as pessimism in the euro-zone economic recovery caused investors to revert their funds back to the US dollar.The EUR/USD fell as low as 1.3281, while against the GBP, the common currency dropped close to 50 pips. Turning to today, traders will want to continue monitoring any announcements out of the euro-zone for clues regarding risk appetite in the marketplace. Negative news could continue to weigh down on the euro.

Economic News

USD - USD Extends Bullish Trend amid Positive US News

The US dollar largely maintained its bullish trend throughout yesterday's trading session, as signs of an improving US economy sent investors to the greenback. A positive US Unemployment Claims figure, along with recent comments from Fed Chairman Bernanke have helped the dollar against its main rivals, including the euro and Japanese yen. The EUR/USD dropped below the 1.3300 level during the afternoon session before staging a minor recovery. Against the yen, the buck reached as high as 81.25 following the release of the unemployment figure.

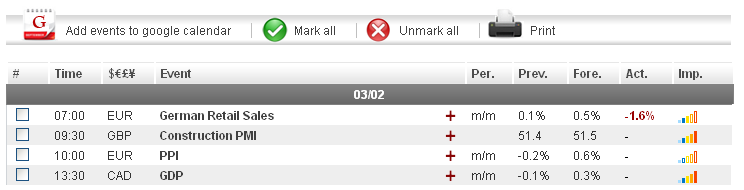

Turning to today, a lack of significant US news means that any announcements out of the euro-zone are likely to determine risk appetite in the marketplace. With confidence in the euro-zone economic recovery relatively low at the moment, any additional negative news out of the EU Economic Summit today is likely to boost the greenback further. Furthermore, traders can look forward to a hectic trading week next week, as a batch of significant US data is set to be released.

EUR - EUR Remains Bearish Going into Today's Session

After tumbling against virtually all of its main counterparts on Wednesday, the euro remained bearish throughout the day yesterday. Fears regarding the ongoing euro-zone debt crisis, despite the European Central Bank's latest round of refinancing, led to investors reverting back to the common currency's main rivals. The EUR/USD dropped below the 1.3300 level during the European session. Against the Australian dollar, the euro dropped close to 80 pips, dropping as low as 1.2340

As we close out the week, euro traders will want to monitor the second day of the EU Economic Summit for any announcements regarding the current state of euro-zone economies. Any negative news may result in the common-currency extending its recent bearish trend. Traders will also want to note that next week, a number of potentially significant economic indicators are set to be released. Chief among these is the US Non-Farm Employment Change, which is largely considered the most important event on the forex calendar. The figure consistently results in heavy market volatility, and the euro could see large movements as a result.

JPY - JPY Levels Out After Losses

The USD/JPY stabilized around 81.16 Thursday afternoon after the dollar made a huge jump on the Japanese currency the previous day, following positive comments from US Fed Chairman Bernanke. The greenback is also bouncing off of the Bank of Japan's monetary easing move that, since being implemented weeks ago, has set off a downward trend for the yen. While the USD/JPY does seem to be stable for now, analysts have not yet expressed confidence that the yen has fully bottomed out following the measures taken by the BOJ.

Traders should note that heavy fluctuations are predicated next week as a batch of significant U.S. news is forecasted to be released. Positive US news may cause the yen to extend its recent bearish trend. That being said, should any of the news come in below expectations, investors may revert back to safe-haven assets and boost the yen.

Crude Oil - Crude Oil Stabilizing

Crude oil values leveled out on Thursday as overall demand for the commodity is still relatively high. Earlier in the week, oil turned bearish as concerns that high prices have negatively impacted the global economic recovery. That being said, ongoing concerns regarding tensions with Iran led to a rebound during yesterday's session. Crude traded as high as $107.64 a barrel during the European session, after hitting as low as $106.51 during morning trading.

As we close out the week, traders will want to continue monitoring the situation in Iran, as well as the current state of the euro-zone economic recovery. Any increase in risk aversion due to the euro-zone debt crisis may cause oil to drop today.

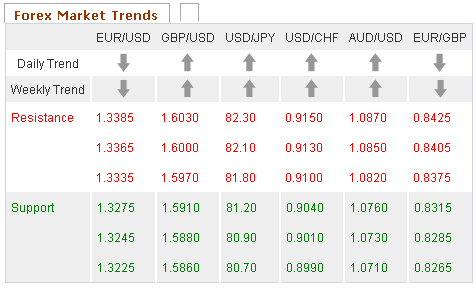

Technical News

EUR/USD

The daily chart's Slow Stochastic has formed a bearish cross, indicating that downward movement could occur in the near future. This theory is supported by the Williams Percent Range on the same chart, which has moved into overbought territory. Going short may be the wise choice.

GBP/USD

The Williams Percent Rang on the daily chart is currently at -10 and angling downward, indicating that bearish movement could occur in the near future. The Slow Stochastic on the same chart appears to be forming a bearish cross. Traders will want to keep an eye on this indicator. If a cross forms, downward movement may occur.

USD/JPY

Most long term technical indicators are showing this pair trading in neutral territory, meaning that no significant movements are forecasted at this time. Traders will want to keep an eye on the weekly chart's Relative Strength Index, as it is currently close to the overbought zone. If it crosses into overbought territory, it may be a sign of impending downward movement.

USD/CHF

The weekly chart's Slow Stochastic has formed a bullish cross, indicating that upward movement could occur in the coming days. Furthermore, the Relative Strength Index on the daily chart has crossed into oversold territory. Going long may be a wise choice for this pair.

The Wild Card

CAD/JPY

A bearish cross on the 8-hour chart can be taken as a sign that downward movement could occur in the near future. In addition, The Williams Percent Range on the daily chart has crossed into the overbought zone. Forex traders may want to go short in their positions today ahead of a possible downward breach.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

US News Forecasted to Generate Volatility Today

Published 03/02/2012, 03:58 AM

Updated 02/20/2017, 07:55 AM

US News Forecasted to Generate Volatility Today

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.