The marketplace was relatively quiet throughout the European session yesterday, as cautious investors were hesitant to open new positions during a meeting of eurozone finance ministers discussing a new round of bailout funds for Greece. Furthermore, a lack of progress in negotiations with regards to the US “fiscal cliff” created uncertainty in the current state of the global economy. Today, the US Core Durable Goods Orders and CB Consumer Confidence figures are forecasted to generate market volatility, with any disappointing data likely to weigh down on the US dollar vs. the safe-haven Japanese yen.

Economic News

USD - Dollar May Come Under Additional Pressure Today

The USD/JPY turned bearish yesterday, as concerns regarding the upcoming “fiscal cliff,” a series of automatic spending cuts and tax increases scheduled to take place at the end of the year if Congressional leaders fail to reach a budget agreement, weighed down on the dollar.

The pair fell more than 30 pips during the morning session, eventually trading as low as 81.91, before bouncing back to the 82.15 level. The dollar saw little movement against its higher-yielding currency rivals yesterday, as investors spent the day waiting for news regarding a new round of Greek bailout funds.

Turning to today, in addition to developments in the “fiscal cliff” negotiations, dollar traders will want to note several pieces of US news. Both the Core Durable Goods Orders and CB Consumer Confidence figures, scheduled to be released at 13:30 and 15:00 GMT respectively, may cause the greenback to fall against the yen if they come in below their forecasted values. Additionally, traders should pay attention to a speech from Fed Chairman Bernanke at 13:30. If the Fed Chairman's speech indicates any kind of slowing down in the US economic recovery, the dollar could take losses as a result.

EUR - Euro Trades Flat to Start off Week

The euro saw little movement against virtually all of its main currency rivals during European trading yesterday, as investors were largely hesitant to open new positions before knowing whether a Greek bailout package was approved by EU finance ministers. While the EUR/JPY fell more than 50 pips during early morning trading, eventually trading as low as 106.06, the pair was quickly able to recover and spent most of the day around 106.50. Against the US dollar, the common currency spent nearly the entire day trading around 1.2960.

Today, the euro is likely to see significantly more volatility then yesterday, following the release of a batch of US data. If any of the news indicates progress in the global economic recovery, investors may shift their funds to riskier assets, which would likely help the euro against the safe-haven yen during afternoon trading. Tomorrow, traders will not want to forget to pay attention to an Italian debt auction. Any decrease in Italian borrowing costs could help the euro against its main currency rivals.

Gold - Gold Begins Week at 5-Week High

Gold prices saw little movement during the European session yesterday, as investors chose to wait for any news regarding a new round of Greek bailout funds before opening fresh positions. Still, the precious metal was able to hold onto virtually all of its gains from last Friday, and spent the day trading around $1750 an ounce, a five-week high.

Today, US news is forecasted to impact gold prices. In addition to several potentially significant indicators set to be released during afternoon trading, gold traders will want to continue monitoring the ongoing “fiscal cliff” negotiations between Congressional leaders. If the negotiations remain stalled, risk aversion could lead to additional gains for gold.

Crude Oil - US News Set to Impact Oil Prices Today

The price of crude oil took moderate losses during the European session yesterday, as a lack of progress in negotiations among US Congressional leaders regarding upcoming automatic spending cuts and tax increases, led to fears that demand for oil could drop. The price of crude fell more than $0.50 a barrel, eventually reaching as low as $87.33 toward the end of the day.

Turning to today, oil traders will want to pay attention to a batch of US news, specifically the Core Durable Goods Orders and CB Consumer Confidence figures. If either indicator comes in below expectations, investors may take the news as a sign that demand for oil in the US will drop, which would weigh down on prices during afternoon trading.

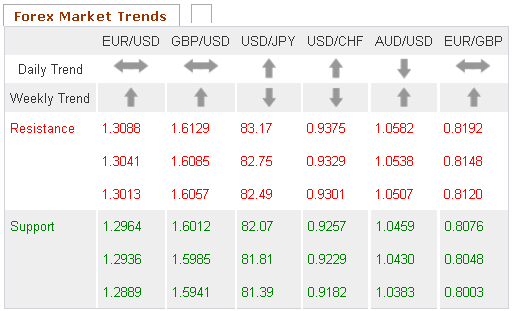

Technical News

EUR/USD

The Stochastic Slow on the daily chart is forming a bearish cross, indicating that a downward correction could occur in the near future. Additionally, the Williams Percent Range on the same chart has crossed into overbought territory. Opening short positions may be a wise choice for this pair.

GBP/USD

The Bollinger Bands on the weekly chart are beginning to narrow, signaling that this pair could see a price shift in the coming days. Furthermore, the MACD/OsMA on the same chart has formed a bearish cross, indicating that the price shift could be bearish. Opening short positions may be the smart choice for this pair.

USD/JPY

The Relative Strength Index on the weekly chart is approaching the overbought zone, signaling that this pair could see a downward correction in the coming days. This theory is supported by the same chart's Williams Percent Range, which has crossed above the -20 line. Going short may be the wise choice for this pair.

USD/CHF

While the weekly chart's Williams Percent Range has crossed into the oversold zone, most other long-term technical indicators place this pair in neutral territory. Traders may want to take a wait and see approach, as a clearer picture is likely to present itself in the near future.

The Wild Card

USD/NOK

The Relative Strength Index on the daily chart is approaching the oversold zone, indicating that an upward correction could occur in the near future. Additionally, the Slow Stochastic on the same chart is close to forming a bullish cross. This may be a good time for forex traders to open long positions ahead of possible upward movement.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

US News Expected To Impact Marketplace Today

Published 11/27/2012, 02:35 AM

Updated 02/20/2017, 07:55 AM

US News Expected To Impact Marketplace Today

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.