After a 2-½ year high, natural gas prices seem to be in consolidation mode as a moderation in summer heat indicates less cooling demand in the coming weeks.

Front-month gas futures on the New York Mercantile Exchange’s Henry Hub settled at $3.66 per mmBtu, or million metric British thermal units, on the New York Mercantile Exchange’s Henry Hub on Wednesday, setting the course for the market's second weekly decline in a row.

Prior to this, Henry Hub futures had risen in 10 out of 12 weeks. Even amid last week’s drop, the market managed to post its highest level since December 2018 at $3.822 mmBtu.

Gas prices are cooling in tandem with the expected slide in temperatures in the coming weeks.

While demand this week remained strong, bolstered by persistent heat in the West and upper high pressure over large swaths of the East Coast, forecasts in the near term called for less cooling needs, trade portal naturalgasintel.com noted.

It quoted forecaster NatGasWeather as saying that weather systems tracking the Great Lakes and East this weekend and next could cut several CDDs, or Cooling Degree Days, from earlier forecasts.

CDDs, used to estimate demand to cool homes and businesses, measure the number of degrees a day's average temperature is above 65 degrees Fahrenheit (18 degrees Celsius).

According to data provider Refinitiv, temperatures last week were near-normal for this time of year, with 85 cooling degree days (CDDs) compared with the 30-year average of 84 CDDs for the period.

Bespoke Weather Services had a similar outlook in a blog posted by naturagasintel.com:

“We continue to see a general lack of heat in the pattern compared to what was expected previously, with the 15-day period, along with July as a whole, looking to come in easily cooler than the five- and 10-year normal.”

In total, Bespoke’s projections showed gas-weighted degree days for July at slightly under 350, “which would be the lowest July total since 2015, and well under last July’s total of 386.”

The forecasts overshadowed data elsewhere that was favorable for the market. Gas production declined for a second day and dipped below 90 bcf, or billion cubic feet, in early estimates Wednesday. That was notably below recent highs of 92-93 bcf.

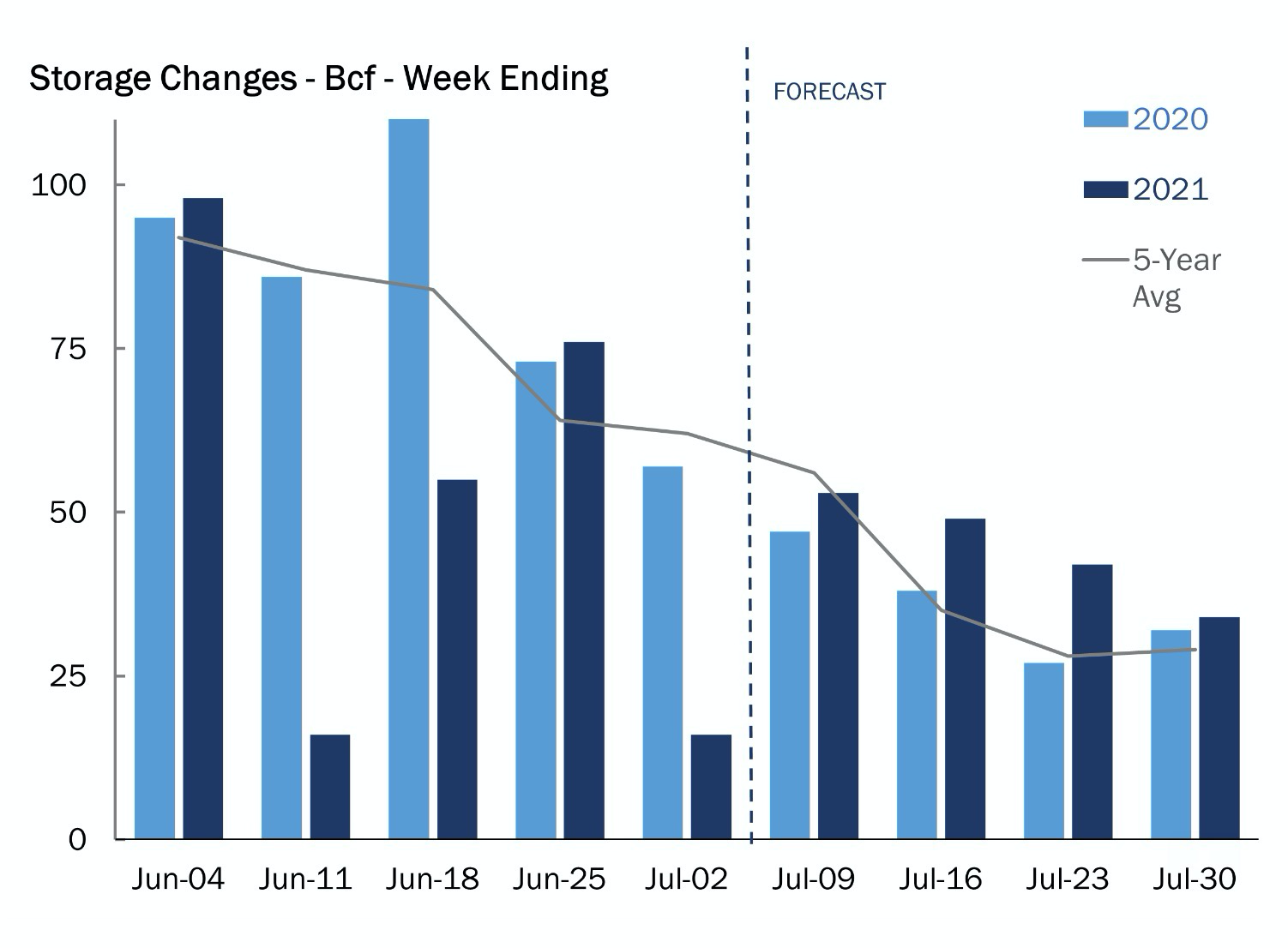

Source: Gelber & Associates

The weather data and production come as the Energy Information Administration prepares to release at 10:30 AM ET today its weekly natural gas storage.

According to forecasts from analysts tracked by Investing.com, US storage levels for natural gas had probably risen by 47 bcf last week—almost triple the previous week’s 16 bcf—due to less burning of the fuel for cooling purposes.

That compares with a build of 47 bcf during the same week a year ago and a five-year (2016-2020) average injection of 54 bcf.

In the prior week to July 2, utilities injected just 16 bcf of gas into storage.

If analysts are on target, the injection during the week ended July 9 would take stockpiles to 2.621 tcf, or trillion cubic feet—7.0% below the five-year average and 17.4% below the same week a year ago.

Houston-based gas markets risk consultancy Gelber & Associates, which has estimated a more generous 53 bcf storage build for last week, said higher-than-average storage injections were possible in the coming weeks due to cooler-than-normal temperatures in population-dense areas of the Midwest, South, and East.

Dan Myers, analyst at the consultancy, said in an email shared with clients and Investing.com:

“These injections should bring 2021 storage (2574 Bcf) closer to the total 5-year working inventory average (2763 Bcf) and could begin to moderate high $3.60-plus natural gas prices.”

On the LNG front, feed gas volumes for liquefied natural gas climbed back above 11 bcf Wednesday after hovering closer to 10 bcf for a few days because of maintenance work.

Several analysts have projected that LNG levels could steadily exceed 11 bcf in the second half of the summer—barring surprise maintenance work—and potentially eclipse 12 bcf to set a new record.

Demand for US exports of LNG is running high from both Asia and Europe, following cold winters that depleted stockpiles and several hot weeks at the start of the summer.

Even with recent maintenance work curbing volumes, LNG demand “comparisons have averaged a startling 7.3 bcf/d higher year-over-year for the past three weeks,” EBW Analytics Group said in the blog by naturalgasintel.com.

Disclaimer: Barani Krishnan uses a range of views outside his own to bring diversity to his analysis of any market. For neutrality, he sometimes presents contrarian views and market variables. He does not hold a position in the commodities and securities he writes about.