Natural gas futures plunged to $1.60 per Million British Thermal Units (MMBtu), marking the lowest point since June 2020. This decline came on the heels of a surprisingly low storage draw reported by the US Energy Information Administration (EIA), signaling a shift in the market's dynamics.

The EIA Report: A Closer Look

According to the latest estimates by the EIA, working gas in storage was tallied at 2,535 billion cubic feet (Bcf) as of Friday, February 9, 2024. This figure represents a net decrease of 49 Bcf from the previous week that can be attributed to lower heating demand, due to warmer-than-usual weather conditions.

Interestingly, natural gas stocks stood at 255 Bcf higher compared to the same time last year and were 348 Bcf above the five-year average of 2,187 Bcf. This substantial increase, translating to 15.9% more than the typical seasonal average, underscores the acute imbalance between supply and demand in the natural gas market.

Impact on Natural Gas ETFs

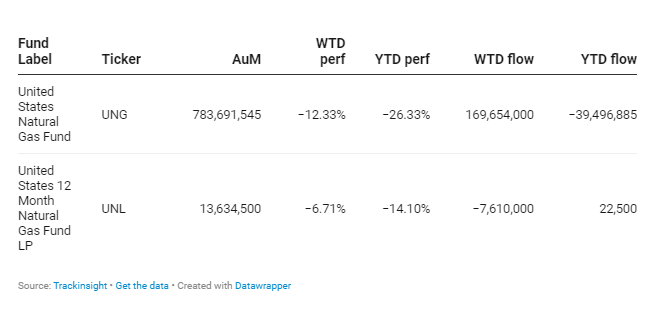

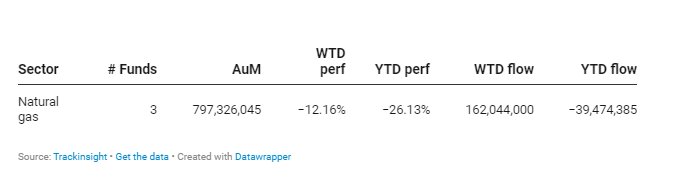

The repercussions of these developments directly hit the Natural Gas Exchange Traded Funds, with a notable decline in performance. The collective data for this group recorded a staggering plunge of 12.16% over the week. This downturn vividly reflects the immediate impact of the EIA's report and the overarching market sentiment towards natural gas.

Group Data

Index Data