While the headline ISM manufacturing index was slightly better than hoped, the uncertainty caused by the protracted nature of US-China trade talks will continue to weigh on the US manufacturing sector, supporting the case for precautionary policy easing from the Federal Reserve

Not as bad as feared

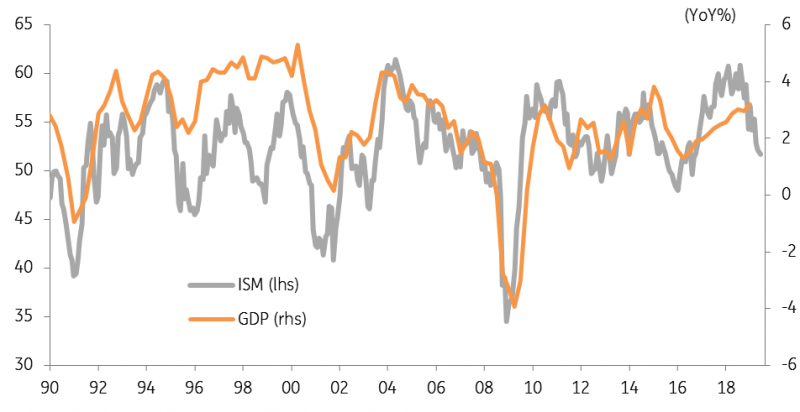

The ISM manufacturing index, historically one of the best lead indicators for overall economic activity in the US economy, fell again in June although not by as much as feared. Regional manufacturing indicators had painted a fairly gloomy picture of the state of US manufacturing, but the fact the headline ISM index merely fell to 51.7 from 52.1 is something of a relief.

That said, there was a very mixed performance within the sub-indices. On the positive side, production rebounded quite nicely to 54.1 from 51.3 versus a break-even level of 50, while inventories actually started to be run down. Moreover, employment rose to 54.5, which is actually above its 6-month average so that is an encouraging signal for a decent rebound in Friday’s US jobs report.

Unfortunately, the new orders component dropped to that key 50 level, which is the weakest performance since December 2015 and offers a clear hint of the anxiety within the sector.

ISM survey suggests weaker GDP growth ahead

But risks are skewed towards the downside

In that regard, this weekend’s meeting between President’s Trump and President Xi went as well as could realistically have been expected in that no additional tariffs have been announced and that trade talks are formally restarting. However, the two sides remain a long way apart with regard to the key sticking points of technology transfer, intellectual property rights, state aid and the dispute resolution mechanism. Unfortunately, our base case remains that the situation is likely to deteriorate, with talks breaking down and another round of tariffs, before the economic pain for both sides leads to concessions and a resolution late this year.

As such the manufacturing sector is going to feel more pain with disruption to supply chains and higher costs hurting business sentiment and risking weaker investment and worker hiring for the sector. With Federal Reserve Chair Jerome Powell last week repeating that “an ounce of prevention is worth more than a pound of cure” the case for an early precautionary 25bp July interest rate cut is strong.

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more