US markets ended the week gaining back all losses incurred during the week. They had their best gains over two days seen in four months as investors concluded the weak NFP was not so bad after all.

The NFP was bad. Make no mistake about this but was it that bad? The US economy add just 113K new jobs in January. We had expected 185K new jobs to be created. The unemployment rate fell to 6.6 percent, we expected it to remain steady at 6.7 percent but the employment force continues to shrink. Data showed improvements in construction and declines in retail and government jobs.

We are averaging 130 to 145K jobs a month in job creation in the six month average, which means the Fed is unlikely to deter tapering now. Also we got improvements in sectors and the unemployment rate came down. Both are good signs.

STOCKS

The DJIA jumped up 1.1 percent or 165.55 points to end the week at 15,794.08. For the week the Dow saw its best week of 2014 closing up 0.6 percent. The S&P 500 was up 1.3 percent or 23.59 points to finish at 1,797.02. Healthcare and industrials led sector gains. For the week, the S&P was up 0.8 percent, showing its first weekly gain of the year as well. The tech heavy Nasdaq Composite surged 1.7 percent to close up 68.74 points at 4,125.86.

As far as volume is concerned, 764 million shares traded, 3.8 billon shares traded hands on the Composite. For every share that fell, three rose on the NYSE.

Asian markets are tracking the US markets higher this morning with the Shanghai Composite leading winners.

The Shanghai Composite has surged ahead 1.7 percent as of now. It is at a new one month high after reopening last Friday from the week long Lunar New Year break. Financial stocks are rallying as the People’s Bank of China (PBOC) is stepping up efforts to protect the financial system against risk from local government debt.

The Nikkei is currently up over one percent at a fresh one week high. This follows Friday’s two percent rally as a weaker yen is helping investor sentiment. The yen has fallen near weekly lows versus the Dollar and euro in early trade today. In Sydney, the ASX 200 is up 0.6 percent and is near its highest levels seen around January 30. We are seeing a rally in metal prices today which is supporting the resource heavy index.

CURRENCIES

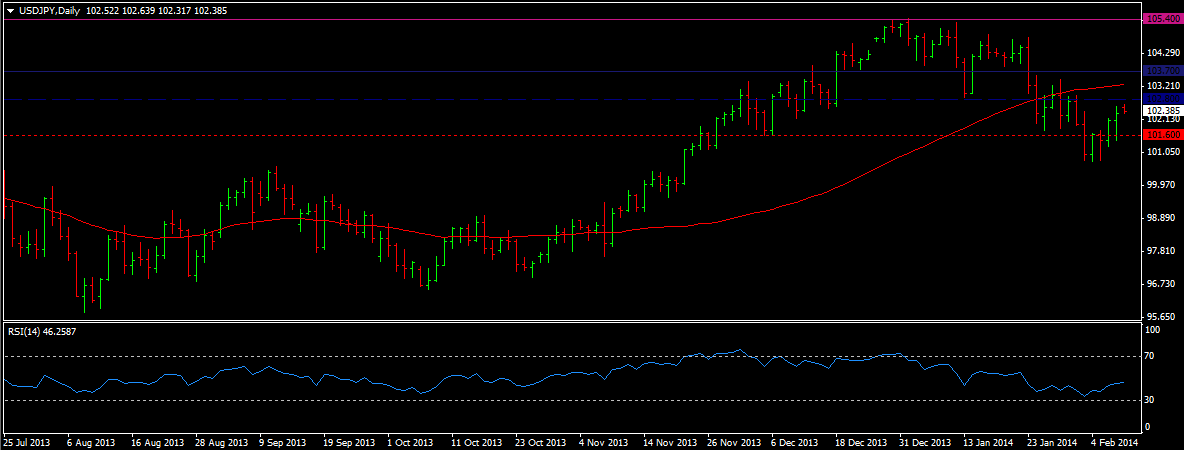

USD/JPY (102.385) hit our target at 102.40 but remains below 102.50 and 103.25/50 for now. This keeps us bearish and a dip to 98 remains in the cards.

EUR/USD (1.3625) the euro remains in the wedge pattern and is showing signs of decreasing bearish momentum. We must go above 1.3660 to stage a rally. Ideally a move above 1.3690 targets 1.37. Till this happens we remain vulnerable for another dip lower. GBP/USD (1.6412) bounced up from 1.6250 rather nicely and could target 1.6450 and then 1.6475. A break of the former level targets 1.6505 and higher.

COMMODITIES

Copper (3.247) continues to inch higher. We are above 3.20 and now targeting 3.25. This will be a slow rally with no expected surges one way or the other. Gold (1268.70) is trading sideways from 1250 to 1275. We need a break above 1274.50 to target 1292 and 1300. There is a possibility that 1275 will hold bringing a dip lower. We have near term resistance at 1270. WTI Crude (99.91) was above 100 at one point. We are testing the resistance at 100 now and could move towards 101.80 if we close above this level. A failure here can see a dip to 98. If the level cracks, we can target 102 and higher.

TODAY’S OUTLOOK

A rather quiet day for data. We will be trading on momentum form Friday’s supposedly not so bad NFP and the US market’s rally. Will it continue or will the bears come back out again later in the day when the US markets reopen?