U.S. markets were up in pre-holiday trade yesterday as consumer confidence and other economic data came in better than expected. Today, all U.S. financial markets are closed for the Thanksgiving Holiday.

The Thomson Reuters gauge of consumer sentiment beat expectations and came in at 75.1. Economists expected 73.5. Leading economic indicators came in with a 0.2 percent rise in October. In other good economic news, jobless applications fell last week as less Americans applied for unemployment benefits. The all-important non-farm payroll report comes out next week.

STOCKS

U.S. markets has yet another day of milestone gains and closes. However the S&P 500, feels like it is losing some momentum.

The DJIA was up 24.53 points to close at 16,097.33. The S&P 500 was also up a little over 4 points to finish over 1,800 at 1807.23. Technology stocks led sector gainers on both indexes. The Nasdaq Composite is now at a 13 year high. We have seen its winning streak go to five straight sessions and the technology heavy index added 27 points to close at 4044.75.

The Nikkei was up over one percent today as the Japanese benchmark has hit a new six month high. The index has gone above Monday’s high at 15,619 thanks to the yen hitting new lows and good retail data. The USD/JPY is now trading near $102 which is a new six month high. In mainland China, the Shanghai Composite has soared 1.3 percent and to its highest level in over a month on comments from central bank governor Zhou Xiaochuan that he is committed to speed up reforms in the liberalizing of interest rates.

Other Pacific Rim Markets were also higher today. The Philippine market was up one percent after Q3 GDP came in better than economists had thought. Their economy grew at 7 percent last quarter. Economist thought it would grow at 7.1 percent. The Thailand SET was up 0.1 percent as their prime minister survived a no confidence vote. Their currency, the Baht came back from its lowest level against the USD dollar to trade at 32.20.

CURRENCIES

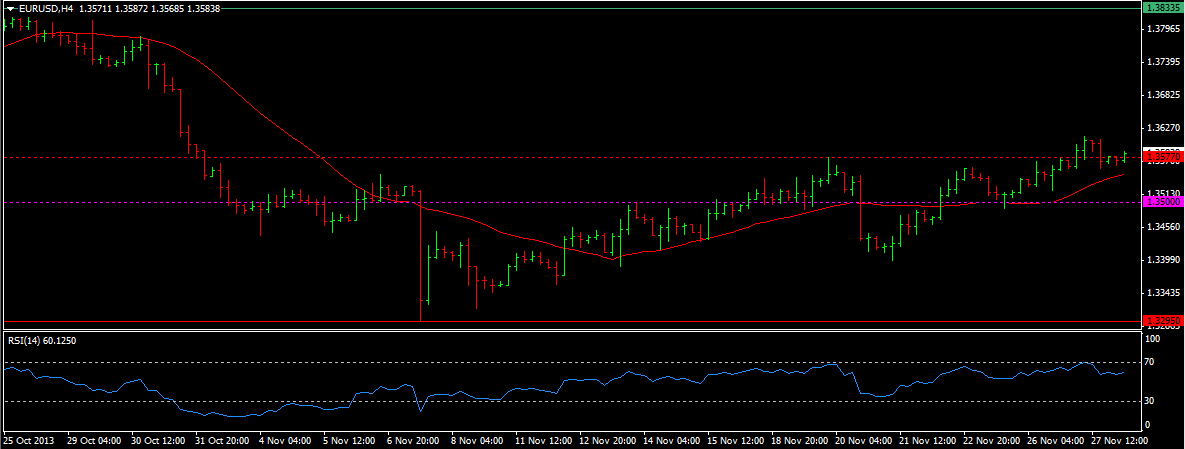

EUR/USD (1.3594) could not stay above 1.6 and moved lower as yield spreads rose again lending support to the Dollar. We have support at 1.3550 and a break below that can move us down towards 1.3490. Resistance today is at the key 1.3630 level.

USD/JPY (102.109) is now at a 2013 high. We should be careful at these levels as a pause could be coming. We will see some profit taking then another sharp rally. That has been the pattern over the last week. We have support at 101.63 and a little lower at 101.20. Resistance is at 102.20. The GBP/USD (1.6314) is spiked higher. Should we close above 1.63, then above 1.6380 expect a full out rally. A fall below 1.6130 is bearish.

COMMODITES

Gold (1236.40) continues to fall from 1254.61 and we are at support at this level. We are targeting 1225 with a break below that aiming for 1200. Silver (19.60) has also fallen and can now target 18.50. We can achieve this with a break below 19.52/1. We will wait and see. Copper (3.22) has risen above 3.20 but we remained range bound until we clear 3.30 or fall below 3.101.

TODAY’S OUTLOOK

ALL U.S. MARKETS ARE CLOSED FOR THE THANKSGIVING HOLIDAY.

This means little data to drive the markets. European markets could be up on the coalition deal in Germany, but expect thinner volumes most of the day.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

US Markets Set New Milestones

Published 11/28/2013, 04:11 AM

Updated 05/14/2017, 06:45 AM

US Markets Set New Milestones

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.