U.S. markets were higher to close the week as the Dow Jones and S&P 500 finished stronger with record highs. Data showing the economy grew faster than expected[i] boosted sentiment. More and more are optimistic with the outlook of the economy.

We are seeing bigger buy tickets from money managers, who have not yet closed their books thanks to optimism. This is helping to fuel this current rally as we enter the last two weeks of the year. We are expecting this rally to continue into the beginning of Q1 2014 as we are seeing more and more capital flow into equities.

In Asia, markets are mostly higher at this time. However, they are being held back as concerns over China’s borrowing pace could lead to another liquidity crunch as higher borrowing costs come into play. The benchmark 7 day repo rate climbed back above 8 percent. On Friday, China injected $49 billion into the financial system over a three day period.

STOCKS

Let us look at the close of the U.S. session last Friday. The DJIA broke through its intraday high set last Thursday to close at 16,287.84. This was a gain of 42.06 points. For the week the Dow Jones was up an impressive three percent.

The S&P 500 hit an intraday high of 1,237.75. This was above the previous record set on November 29. The index finished the day 8.72 points higher at 1,818.31. For the week the S&P was up a nice 2.4 percent. The Nasdaq Composite was also higher on Friday. The tech heavy index was up 46.60 points, or a 1.2 percent jump, to close at 4,104.74. This was its twelfth straight Friday gain and its longest Friday winning streak in three years. For the week the NASDAQ gained 2.6 percent.

Asian and Pacific Rim markets are mostly higher, albeit cautiously thanks to the borrowing news out of China.

Mainland shares are mildly higher this morning as the Shanghai Composite is p nearly 0.4 percent. The Shanghai closed at its lowest level in five months last week. We are still cautious here as we are below 2150. The Nikkei is closed today as it was up 0.7 percent at 15,870.42 on Friday.

The South Korean Kospi rose back above 1995, its highest level in over a week. We are within sight of moving above 2,000 again. A quick look at one of the emerging markets, Thailand’s SET lost 0.5 percent as antigovernment protestors said they wold not participate in the upcoming impromptu elections. The protest leader says they do not believe in their country’s democratic “process anymore.”

CURRENCIES

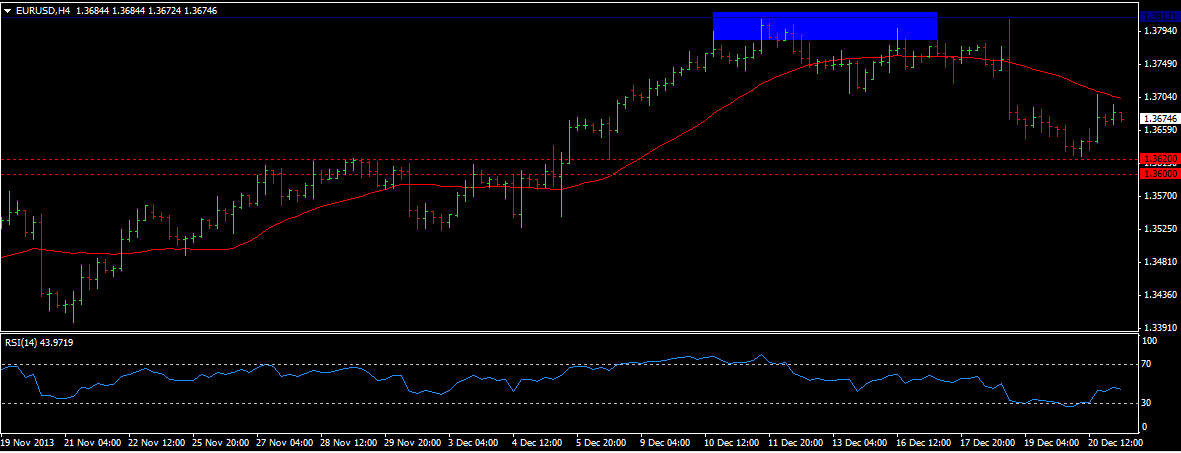

EUR/USD (1.3674) the resistance at 1.3820 is holding well, the support at 1.362 also held. As long as we are above 1.362 we remain bullish to retest 1.3820 and higher. a failure can target 1.3530 then 1.3520.

USD/JPY (104.019) broke out of its range last week to set a new 5 year high. We are now targeting 105.25 and higher. A break above 105.25/50 will target 109. We have weakness on a move below 102.50. GBP/USD (1.6347) got good selling pressure at 1.62 and near 1.63. We got a fresh four year high at 1.6485 out of the deal. As long as we stay above 1.62, we remain bullish targeting 1.65. Our next big resistance line is at 1.6735.

COMMODITIES

WTI Crude (99.22) rose sharply to break back above 99. We are now targeting 100.90 then 101.00.

WTI Brent Crude (111.70) has also risen and testing a resistance level at its current level. If it holds we could dip back to 109 but a break targets 112/112.50. If those levels break we target 114.00.

Gold (1200.00) is in the midst of its steepest downward correction in some time. We are squarely at 1200 now and targeting 1185. We could see some bargain hunters now, but at these levels remain very bearish.

TODAY’S OUTLOOK

We are seeing a nice end of year rally going into the last 9 days of trading before 2013 closes its books. The markets will be event driven by data. Traders are no longer being held down by when the Fed will begin to ease back its QE program as that has already happen. the U.S. will release its Empire manufacturing report and industrial production numbers. Investors are hoping the string of positive data will continue.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

US Markets Finish Higher, China’s Borrowing Costs Watched

Published 12/23/2013, 01:29 AM

Updated 05/14/2017, 06:45 AM

US Markets Finish Higher, China’s Borrowing Costs Watched

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.