The marijuana industry has strong potential especially after legalization for recreational and medicinal use. Moreover, the industry is getting benefits of expansion into other industries like food, beverage, tobacco and cosmetics. Growing legalization of recreational or medical marijuana is likely to bolster investors’ confidence in this industry.

Legalization Considered a Boon for the Industry

Legalization has long been considered a boon for the marijuana industry. Canada has become the first major world economy and the second country after Uruguay to legalize recreational use of marijuana. Effective Oct 17, 2018, Canadians can legally buy and consume marijuana.

Cannabis is getting official approval from many U.S. states for recreational uses, in addition to medical usage. Though pot remains entirely illegal at the federal level, currently 33 U.S. states have greenlighted medical use marijuana, while 10 states have allowed recreational use of marijuana.

Hemp-CBD Market: A New Growth Area

There is growing demand for uses of CBD, a non-psychoactive ingredient in cannabis, in food, drinks and cosmetics. The Hemp Business Journal estimated that sales in the hemp-CBD market will reach to about $1.3 billion by 2022.

The U.S. cannabis companies are still under regulatory prohibitions. Canadian operators are looking for ways to expand their reach by mergers and acquisitions. The hemp-CBD market offers lucrative opportunities for expansion. This is because the 2018 Farm Bill subjects hemp and its derivatives to the agricultural products’ category rather than controlled substances.

Strong Market Potential

Research firm Euromonitor has estimated that the American market for legal marijuana products will reach $20 billion by 2020 from a mere $5.4 billion in 2015. According to the Arcview Market Research, the U.S. legal cannabis market is expected to reach $23 billion by 2022. Research firm Cowen projected that the market size of the U.S. legal cannabis industry will reach $75 billion in by 2030, surpassing the carbonated soft drink market in 2017.

Per a study conducted by Colorado cannabis consulting firm Freedman & Koski, Illinois’ annual marijuana market could be between $1.69 billion and $2.58 billion. Overall, U.S. consumer spending on legal cannabis is expected to reach $22.2 billion by 2022, while Canadian spending is estimated to hit $5.9 billion, per a January report by Arcview Market.

Extremely Volatile Industry

The marijuana industry is considered as extremely volatile. Most of these companies are in their early stages of development and characterized as risky for investors. However, this industry had been providing fabulous returns to investors in 2018 before legalization in Canada.

Since the industry is in its nascent stage, even a minor negative may become the cause of major stock price fluctuations. Notably, in October 2018, the news of supply shortages resulted in panic selling as investor’s look to offload risky stocks. According to some industry experts, 5-10% share price volatility daily should not be considered as unnatural for this industry.

Major Gainers

Major U.S.-listed marijuana companies are likely to gain from the industry’s early-stage boom. As an evidence of strong demand in the United States, pot companies have engaged in deals of late.

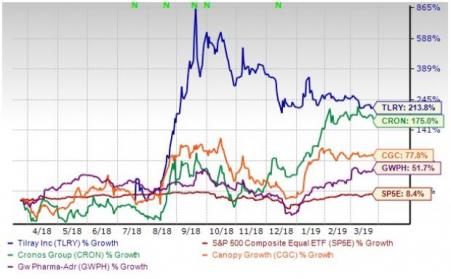

In the last one year, share prices of major marijuana companies such as Tilray Inc. (NASDAQ:TLRY) , Cronos Group Inc. (NASDAQ:CRON) , Canopy Growth Corp. (NYSE:CGC) and GW Pharmaceuticals plc (NASDAQ:GWPH) have jumped 213.8%, 175%, 77.8% and 51.7%, respectively. GW Pharmaceuticals carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy)stocks here.

The chart below shows price performance of four major marijuana stocks in the last one year.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +98%, +119% and +164% in as little as 1 month. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

GW Pharmaceuticals PLC (GWPH): Free Stock Analysis Report

Tilray, Inc. (TLRY): Free Stock Analysis Report

Cronos Group Inc. (CRON): Free Stock Analysis Report

Canopy Growth Corporation (CGC): Free Stock Analysis Report

Original post

Zacks Investment Research