A rebound in utility output has helped lift industrial production while manufacturing output has risen for the first time in five months thanks to car production.

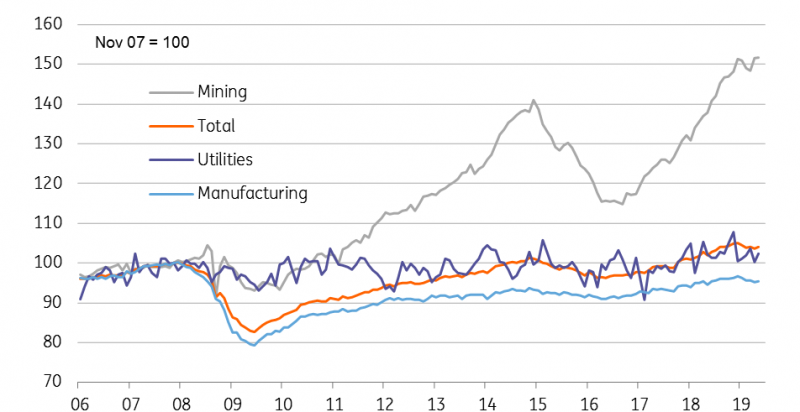

U.S. industrial production rose 0.4% month on month in May, beating the market prediction of 0.2% thanks primarily to a 2.1% bounce in utility output. Mining rose just 0.1%MoM while manufacturing posted a 0.2%MoM gain – the first rise since December. Within manufacturing, vehicle production led the way, rising 2.4%. Strip this component out and manufacturing would have been flat on the month.

While it is better than predicted, the U.S.-China trade uncertainty is clearly weighing on the sector. These tensions and the worries about what protectionism might mean for company supply chains, costs and profitability run the risk that manufacturing firms sit on their hands and stop investing and hiring new workers. Moreover, we have to remember that manufacturing still hasn’t recovered all the output lost through the recession - output remains 4.6% below the peak level in 2007.

Industrial output levels versus 2007 peak

We see little prospect of trade tensions easing in the near-term, so the headwinds for manufacturing will continue. The Federal Reserve looks set to embark on some precautionary policy stimulus by cutting interest rates which will help the sector.

But with weakness here being more than offset by the fact consumers are still willing to spend, we suggest 50bp of rate cuts is more likely this year than the 100bp currently priced by markets.

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more