The ISM manufacturing index has dropped to a 10-year low as trade worries, weak global growth and a strong dollar weigh on the sector. Given the threat of contagion to other parts of the economy further Fed rate cuts are coming

47.8 - Lowest headline ISM reading since 2009

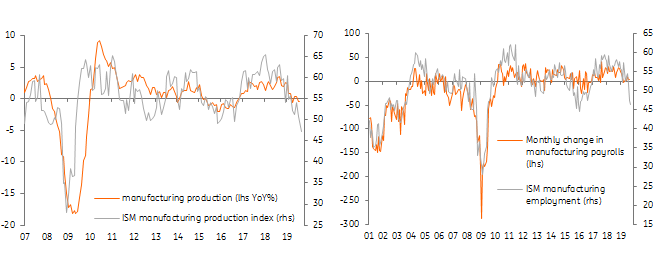

The drop in the headline ISM manufacturing index is a huge surprise. It is has fallen to a 10-year low of 47.8, leaving the index well below the 50 breakeven level. In fact, it was below every single forecast in the market with the production, export orders and employment components looking particularly weak. These figures suggest that further output declines are likely and point to downside risks for Friday’s US jobs report.

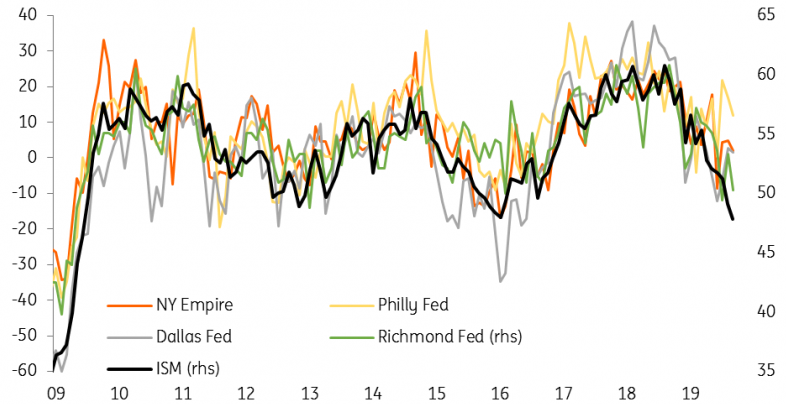

Like last month, the ISM has significantly undershot relative to the regional manufacturing indicators. Indeed, the chart below suggests a rebound above 50 should have been on the cards. We have also had construction spending numbers and this too disappointed, rising just 0.1% month-on-month versus the 0.5% consensus expectation. As such, there are real reasons to be concerned about what is happening in the goods producing sector of the US economy.

Given the worries over trade tensions, the weakening global growth story and the strength of the dollar, which is hurting the relative competitiveness, we don’t expect to see a rebound in the performance of the manufacturing sector anytime soon. For now, the consumer sector continues to perform well, but with Friday’s payrolls report expected to offer further evidence of a slowdown in employment growth and some signs of cracks forming in sentiment surveys, this may not last for long. We think the Fed will provide further “insurance” interest rate cuts to try to limit the slowdown in overall growth. We look for a December rate cut with another 25 basis point move in 1Q20.

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more