Intensifying trade war fears and an inventory overhang are weighing on the manufacturing sector. Regional surveys suggest the national ISM manufacturing index will fall below the breakeven 50 level on Monday, which will only heighten fears of recession for the sector

While markets are hoping that the US and China will settle their differences regarding trade this weekend, the prospect of a deal between Presidents Trump and Xi looks remote. Our trade team expects tariffs to be hiked in coming months. The worry is that recent US data suggests the economy is becoming less resilient to the negative trade headlines with the manufacturing sector seemingly bearing the brunt.

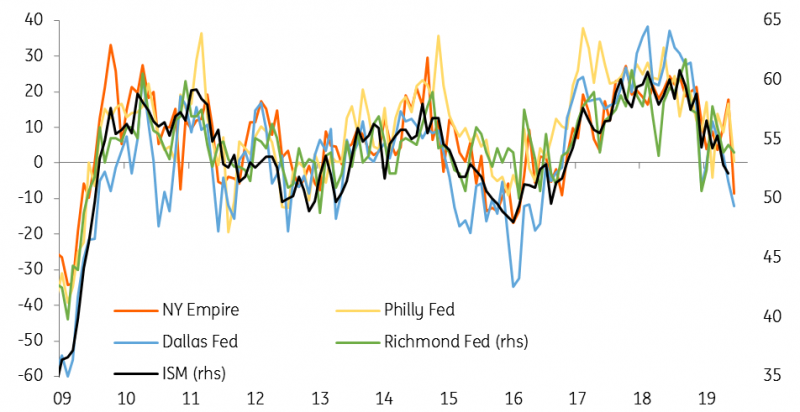

The latest set of regional manufacturing surveys have been dire. The NY Empire survey saw a record fall, the Dallas Fed manufacturing survey is at a three-year low, the Philadelphia Fed survey is a relative outperformer at only a four-month low while today’s Richmond survey managed to modestly beat market expectations, though still fell. Taking these altogether they point to a sizeable drop in the national ISM measure, which is already at its lowest level since October 2016. There is the very real prospect it dips below the break-even 50 level on Monday.

Regional surveys highlight manufacturing weakness

The manufacturing sector already has an inventory overhang and this is depressing new orders while there is also a growing sense of paralysis in the sector. Do firms go through the expensive process of on-shoring production back to the US or looking for non-Chinese suppliers only to find that President Trump has changed his position again and tariffs aren’t hiked? Or do they instead carry on with business as usual and risk higher tariffs that put up costs and hurt profit margins? Faced with such uncertainty many firms may simply sit on their hands and do nothing. This implies a slowdown in investment and hiring, which in turn leads to lower consumer spending and the rising threat of recession.

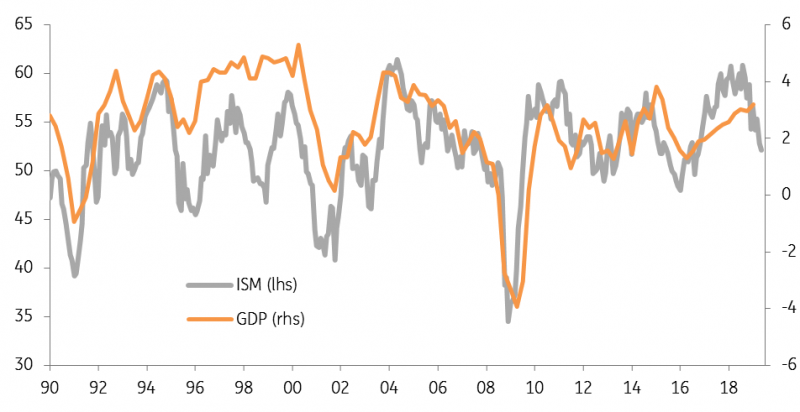

US ISM manufacturing versus GDP growth (YoY%)

The ISM manufacturing index has historically been one of the best lead indicators for US GDP growth, although its predictive power has seemingly become less strong in recent years, reflecting the diminishing importance of the sector in terms of total economic output. Nonetheless, a sub-50 ISM will heighten concerns within the Federal Reserve that the economy is softening and with little prospect that trade tensions will ease in the near term, there is a growing probability the Federal Reserve will choose to act pre-emptively to try and support the economy through lowering interest rates.

We are more cautious than the market in that we expect only 50bp of rate cuts in 2H19 versus the market pricing 75bp. However, should trade talks go badly over the weekend, the ISM breaks below 50 and next Friday’s jobs report offers further evidence of a slowdown in hiring we will seriously have to consider putting in an additional July rate cut into our forecast.

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more