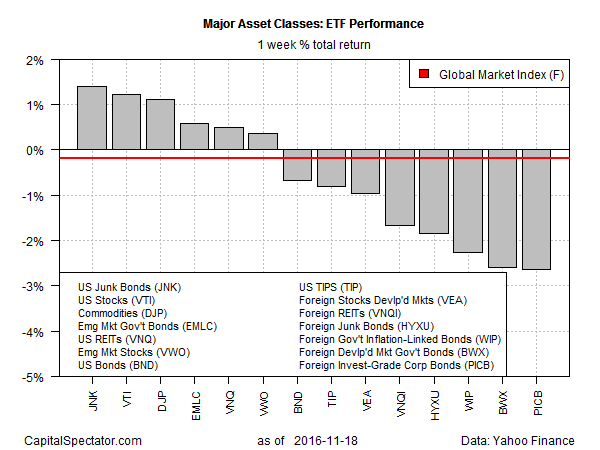

U.S. high-yield bonds led the way higher last week among the major asset classes, based on a set of representative ETFs. Although interest rates increased over the five trading days through Friday, the advance in investment-grade yields—Treasuries in particular—overwhelmed the higher rates in junk bonds. As result, the rate spread for high yield bonds less Treasuries (based on the BofA Merrill Lynch Option-Adjusted Spreads Index) ticked lower, boosting junk bond prices in the week just passed.

The iShares iBoxx $ High Yield Corporate Bond (NYSE:HYG) jumped 1.4% for the week through November 18—the first weekly gain in a month for the ETF.

Last week’s big loser: investment-grade foreign corporate bonds. The combination of higher interest rates and a steadily rising dollar weighed heavily on PowerShares International Corporate Bond (NYSE:PICB), which slumped to its lowest closing price in more than three years.

Although there were several winning corners in global markets last week, the downside bias still dominated via an ETF-based version of the Global Markets Index (GMI.F). This investable, unmanaged benchmark that holds all the major asset classes in market-value weights slipped 0.2% for the five trading days through last Friday.

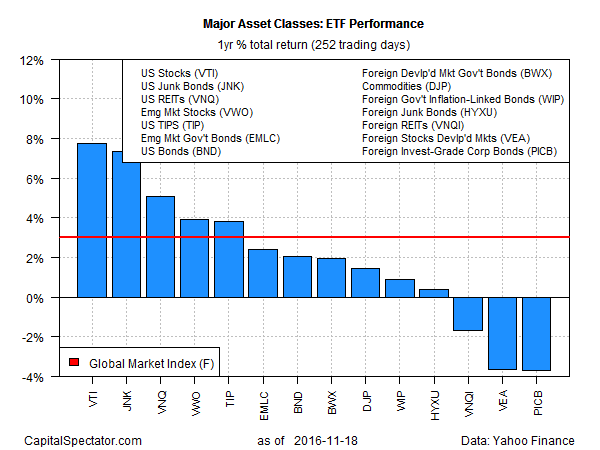

For trailing one-year results, U.S. equities are in the lead. Vanguard Total Stock Market (NYSE:VTI) is ahead 7.6% on a total-return basis for the 12 months through Friday.

Meanwhile, the foreign investment-grade corporate bond market has fallen to last place in the one-year-return column among the major asset classes. PICB is down 3.7% for the trailing 12-month period.

GMI.F’s one-year total return is currently a modest 3.0% increase.