A slow start to 2021

The January US employment report shows that non-farm payrolls rose 49k (consensus 105k) while there were big downward revisions totaling—59k. This is clearly softer than hoped, especially given the good survey numbers on employment we’ve seen through the week. Nonetheless we remain optimistic on the outlook given the rescinding of the California stay-at-home orders and the momentum that is starting to build behind the vaccination program.

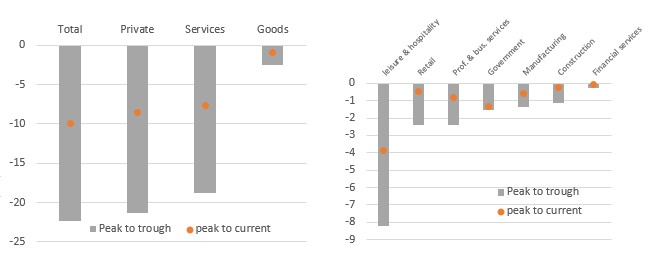

The details show some fairly broad weakness, although there do appear to be oddities. For example, the 10k fall in manufacturing and the 3k fall in construction employment don’t tally with the ISM surveys and the data on construction activity, which are both booming. Retail trade saw a 38k drop while leisure and hospitality saw a 61k decline. This could be a hangover from the California orders and closure of dine-in restaurants in New York and others that came in early December—remember payrolls data is collected the week of the 12th so there could be legacy weakness from this.

Cumulative job losses by sector Feb 2020 peak to trough and Feb 2020 versus Jan 2021 (millions)

Source: Macrobond, ING

Ignore the unemployment rate

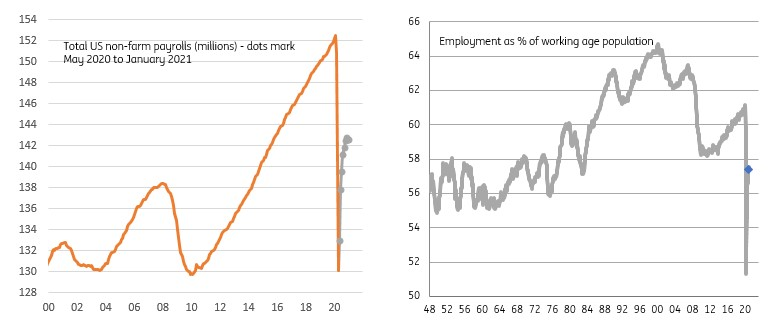

The household survey, which is used to calculate the unemployment rate, showed employment actually rising 201k, but this survey does tend to be volatile. With 406k people leaving the labour force, this was enough to get the unemployment rate down to 6.3% from 6.7%. However, as the chart below shows this is a highly misleading indicator of the state of the jobs market.

Employment levels are still 9.82mn lower than 11 months ago while the proportion of people of working age who actually have a job remains incredibly low by historical standards at just 57.5%. This is on a par with much of the 1970s when female worker participation rates were much lower than they are today and underlines the structural issues in the US labour market with huge numbers of people who are classified as sick and millions more who are carers for others and therefore cannot work. As with all recessions you also tend to see a spike in the number of people retiring early.

Employment levels (millions) and employment as % of working age population

Source: Macrobond, ING

Better numbers are coming

Despite the disappointing report, we are optimistic on the outlook for jobs. February's report should be better given the California re-opening is underway, which means restaurants are operating again (for dine outside) along with hair salons and nail bars in America's most populous state. We also know that New York restaurants are allowed to re-open for dine-in eating from Feb. 14 (at 25% capacity) so that will show up in the March report. The strong ISM employment readings should also suggest more hiring in the next few months.

That said, we aren’t going to get meaningful improvements in the labour market until COVID containment measures are lifted on heavily impacted sectors such as travel, leisure and hospitality. That is likely to be several months away so vaccine performance and vaccination rates are critical for the outlook.

Original Post

Content Disclaimer: The information in the publication is not an investment recommendation and it is not an investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. This publication has been prepared by ING solely for information purposes without regard to any particular user's investment objectives, financial situation, or means.