Yesterday, countries like UK and Canada delivered their inflation figures for the month of October. In Canada, the headline inflation jumped from the previous +4.4% to +4.7%. Today, the economic calendar seems to be a bit on the light side, as one the only worthwhile news on the economic calendar is the US initial and continuing jobless claims.

Another event that might not be on everyone’s agenda today, but is definitely worthwhile to be mentioned and that’s the current currency crisis in Turkey, where inflation continues to rise, due to an exponential devaluation of the Turkish Lira.

Rising Inflation Continues To Be Monitored

Yesterday, countries like UK and Canada delivered their inflation figures for the month of October. In the UK, the core and headline MoM figures rose from +0.4% to +0.7% and from +0.3% to 1.1% respectively. The YoY core reading went from +2.9% to +3.4% and the headline YoY one jumped from +3.1% to +4.2%. The latter one has not been at that level since December 2011. The increase came from a rise in utilities, mainly fuel like gas and electricity.

In Canada, the last time inflation was so high was back in February 2003. The biggest contributors to the high inflation number were transportation and energy. After that food and labor shortages also played their parts in the CPI rise. Overall, we can say that the current supply chain disruption had played a negative role, bringing inflation to levels, last seen a few years ago. In terms of the Bank of Canada (BoC) and its inflation target range, which is between 1% and 3%, such high CPI readings could force the bank to consider the idea of raising the interest rate earlier.

US Initial And Continuous Claims

Today, the economic calendar seems to be a bit on the light side, as a few of the only worthwhile news on the economic calendar are the US initial and continuing jobless claims and the Turkish one-week repo rate announcement. The initial ones are expected to fall, going from 267,000 to 260,000. The market hopes for that to happen, as the previous one came out as a slight disappointment. Although last week the number came out lower than the previous, it was higher than the initial forecast suggested.

A similar story is with the continuous claims, as they are expected to come out on the lower side than the previous or the forecasted numbers. If we look at last week’s figure, the number was also expected to come out lower, at 2095k, but showed up at 2160k. We do not expect both initial and continuous claim figures to be far from their forecasts, but it will be interesting to see if the actual numbers show up higher. If so, this could put a negative spin on the US dollar, but indices may still rise, as it could mean that this might be another reason for the Fed to hold off from raising rates.

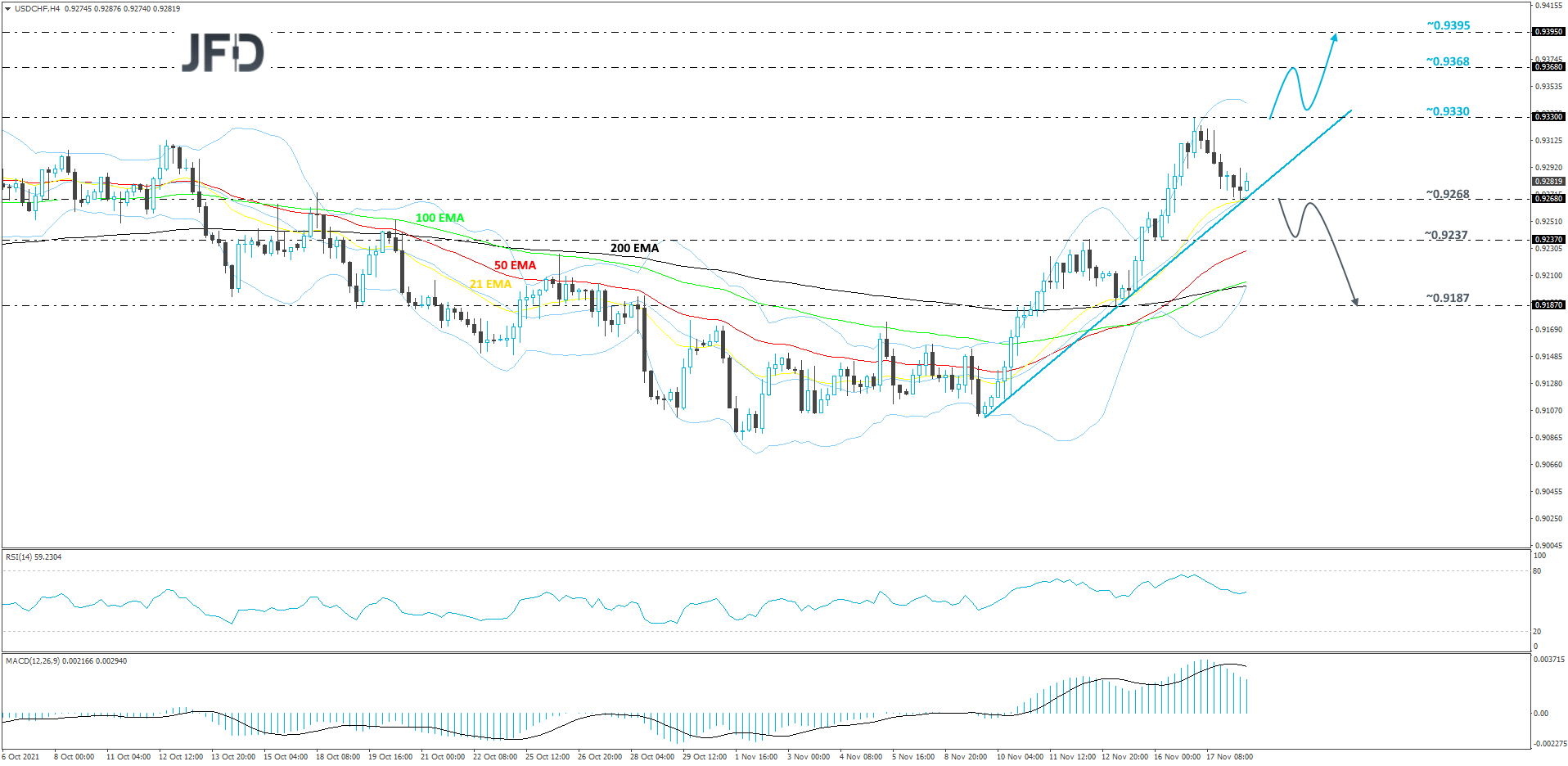

USD/CHF – Technical Outlook

Despite the recent decline, USD/CHF continues to trade above a short-term tentative upside support line taken from the low of Nov. 9. That said, in order to get a bit more comfortable with further advances, we would first like to see a clear pop above the current highest point of November, at 0.9330.

If that pop happens, this will confirm a forthcoming higher high, possibly clearing the way to some higher areas. We will then aim for the 0.9368 obstacle, a break of which may lead USD/CHF to the 0.9395 level. That level marks the high of Apr. 6.

On the downside, a break of the aforementioned upside line and a rate-drop below the 0.9268 zone, could spook the bulls from the field for a while and the pair might drift a bit lower. We would then aim for the 0.9237 obstacle, a break of which may set the stage for a move to the 0.9187 level, marked by the low of Nov. 15.

Turkish Lira In Turmoil

Another event that might not be on everyone’s agenda today but is definitely worthwhile to be mentioned, that’s the current currency crisis in Turkey, where inflation continues to rise, due to an exponential devaluation of the Turkish lira.

This is mainly caused by the unconventional economic policy approach of Turkey’s President, as he continues to pressure the country’s Central Bank to lower the interest rate. After a surprising 200 bps cut in Turkey’s one-week repo rate back in October, it is expected that another one may follow today. If so, the Turkish lira could continue depreciating against all of its major counterparts.

EUR/TRY – Technical Outlook

EUR/TRY continues to run higher, while trading high above a short-term upside support line taken from the low of Oct. 7. Although we are seeing some occasional retracements, it seems that the pair might stay under some buying interest, at least for now.

If the pair continues to trade somewhere above the 12.082 zone, marked near an intraday swing high of Nov. 17 and an intraday swing low of Nov. 18, that may keep the buyers interested for a while. EUR/TRY could push to the current all-time high, at 12.412, a break of which would confirm a forthcoming higher high, placing the rate into the uncharted territory and then sending it further north. We might then aim for the 12.600 territory.

Alternatively, if the pair falls below the 11.954 hurdle, marked by an intraday swing low of Nov. 17, that could lead to a larger correction lower. We may then aim for the 11.805 obstacle, marked by the high of Nov. 16. If the selling doesn’t stop there, the next possible target could be at 11.653, or even the aforementioned upside line.

As For The Rest Of Today’s Events

The US Philadelphia Fed will release its manufacturing index for November. The current expectation is for a rise from the previous 23.8 to 24.0.