By Mike Maharrey

Gold had quite a run in 2024, hitting record highs 40 times. That momentum carried over into 2025, with new record highs above $2,900 an ounce.

One might expect these higher prices to put a drag on demand for gold jewelry, but surprisingly, the impact has been minimal, at least so far in the United States.

Metals Focus surveyed gold jewelry demand in the U.S. and found it has “held up better than expected” given the high price of gold.

The U.S. is the third-largest gold jewelry market in the world, behind China and India. It also tends to be the most price-sensitive. But despite the rising price of gold, jewelry demand only fell by about 4 percent in weight terms in the fourth quarter of 2024.

In value terms, gold jewelry demand set a record of $4 billion in Q4, according to the World Gold Council.

Metals Focus pinpointed several factors that sustained gold jewelry demand.

- A still robust jobs market.

- The ‘need’ to buy for Christmas, even with strained household budgets.

- For much of Q4, the presidential election was out of the way

Analysts also believe there was some level of “acceptance” of higher prices.

Additionally, Metals focus found there was little structural change in the U.S. gold jewelry market. For example, there was almost no movement from the dominant 14-carat jewelry to less expensive 10-carat pieces.

However, Metals Focus analysts said there was a lag in sales in heavier pieces, a move from solid to hollow chains, and an element of “light-weighting” across all product categories.

“That said, chunky designs are popular from a fashion perspective, and the trend for ring stacking remains strong.”

You might expect the rapidly rising price of gold to drive a shift toward silver jewelry. However, Metals Focus researchers said their contacts rarely noted this trend.

Many analysts view the silver jewelry market as "distinct" from the gold jewelry market, “with pieces often bought by different consumers (often younger) for different reasons (typically more closely tied to fashion).”

Silver jewelry consumption in the U.S. dipped about the same as gold – by around 4 percent in weight terms.

Last year also saw a continuation of the swing from generic to higher-margin branded silver.

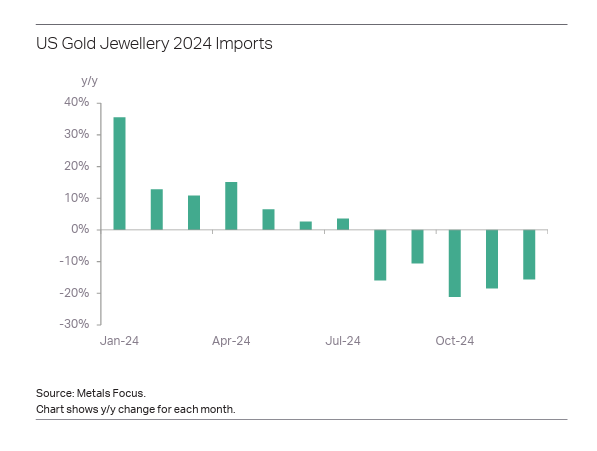

The relatively resilient gold jewelry demand was not reflected in imports, which fell throughout 2024.

“Even if retail stocks in general were not seen as too low, those areas of the supply pipeline covered by imports do appear to have reacted to the price. It will, therefore, be interesting to see if early 2025 enjoys a bounce back for imports.”

Silver jewelry imports also charted a steep drop of around 18 percent. However, the value of imports rose by 6 percent.

Looking ahead, Metals Focus researchers said they were “cautious” about jewelry demand through the rest of 2025.

“Even if we do see engagement numbers recover, the industry will still have to manage a growing share of pieces being ticketed at yet higher prices, and political uncertainties have scarcely eased. As such, the full year could end up 13 percent down on the 2021 peak and even dip below 2019 levels.”

Originally Published on Money Metals.