According to my TradingFloor.com colleague John J. Hardy's article on the historical forex significance of Labor Day, we should begin to see markets pick up in the coming days, as the summer vacation effect starts to wear off and investors return to their trading desks.

To celebrate the new season, we have a few juicy economic data releases for you. Manufacturing data in the US should provide us with an early indicatation of the strength of the economic recovery, while eurozone PPI data and GDP figures for Australia are also due out.

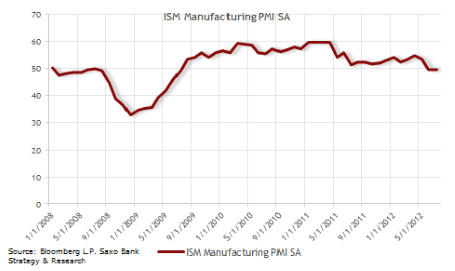

US ISM Manufacturing (14:00 GMT) Tuesday’s manufacturing PMI data will be the first real opportunity since Jackson Hole to test the strength of the US recovery. The manufacturing index came in at 49.8 in July and is delicately poised for a return to a neutral position of 50 in August after two months in contraction. This contrasts with PMI data from the eurozone and China released yesterday which came in lower than expected.

The Markit Manufacturing PMI for the eurozone was revised to 45.1 for August from an initial estimate of 45.3, while the HSBC Manufacturing PMI for China came in at 47.6 from 49.3 in the previous month, pointing to a serious contraction ahead. An upturn in manufacturing activity, combined with strong payroll data next Thursday, would almost certainly keep the doves on the FOMC at bay until the New Year.

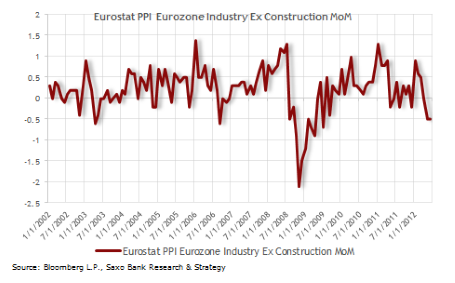

Eurozone PPI (09:00 GMT) Producer price inflation for the 17-country euro bloc is expected to have picked up in July. PPI for the eurozone is forecast to rise by 0.2%, according to analysts’ estimates, after a contraction of 0.5% in June. However, the indicator is likely to come in lower on an annualised basis, falling to 1.6% in July, compared to 1.8% the previous month.

The recent slowdown can largely been attributed to the decline in energy prices, with Eurostat reporting a 1.7 percent fall in prices for June. If energy prices are excluded, PPI came in at 0.9% for the month, marking a consecutive 12-month downward trend in prices.

Australia GDP Q2 (01:30 GMT Wednesday) GDP for Q2 is forecast to have expanded by 0.8% in the second quarter of 2012, down from 1.3% in the previous quarter. Despite the slight improvement in manufacturing data reported on Sunday, weak global demand continues to act as a drag on the country’s mining sector. Latest estimates from the RBA commodity price index showed Australia's commodity prices fell to a 20-month low in August, although it still remains well above the 2003 levels.

Australia’s biggest concern is the recent slowdown in China, one of its largest trading partners, where GDP grew by just 1.8 percent in the second quarter. Monday’s PMI data from China will be an added concern for policymakers in Sydney. But the RBA is unlikely to fret too much in the knowledge that China - unlike its counterparts in the West - has the tools and political support to stimulate its economy if needed.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

US ISM Manufacturing, EZ PPI And AUS Q2 GDP

Published 09/04/2012, 03:05 AM

Updated 03/19/2019, 04:00 AM

US ISM Manufacturing, EZ PPI And AUS Q2 GDP

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.