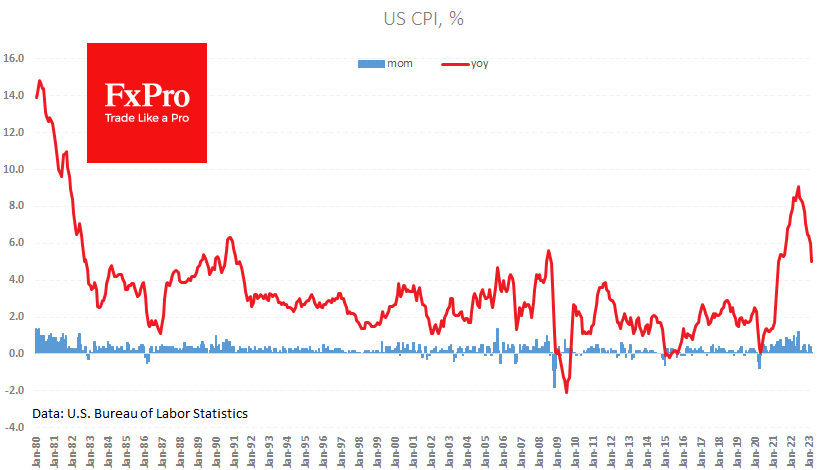

Last month, US inflation fell more than expected due to cheaper energy and food. The CPI rose 5%, down from 6% the previous month and just below the expected 5.1%. We had warned of this possibility.

However, it is challenging to see this as a surprise game-changer in the coming weeks. Moreover, core inflation - the real enemy of the Fed - accelerated from 5.5% to 5.6%. This is 1 point below the September peak, but it is further evidence that reversing this trend will take work.

Although trading robots reflecting the headlines have triggered a rally in equities and a sell-off in the dollar, only the latter has proved resilient. The bond markets, or "smart money", shifted their expectations for the Fed's next move slightly, putting the probability of a quarter-point hike at 68%, down from 72% the day before.

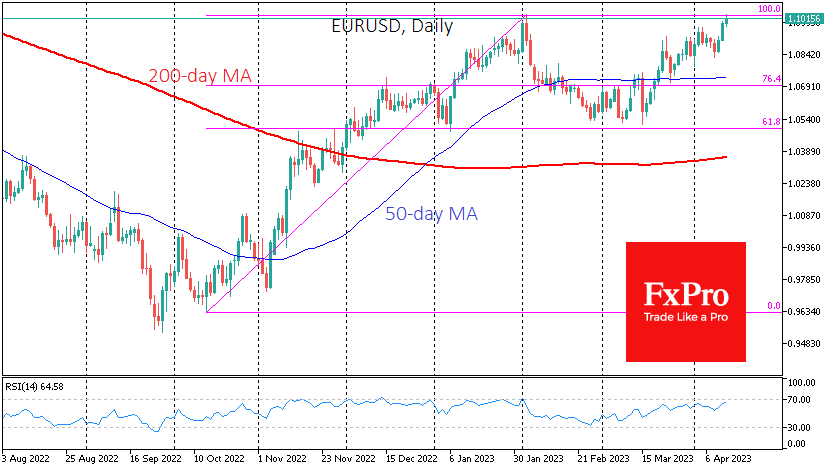

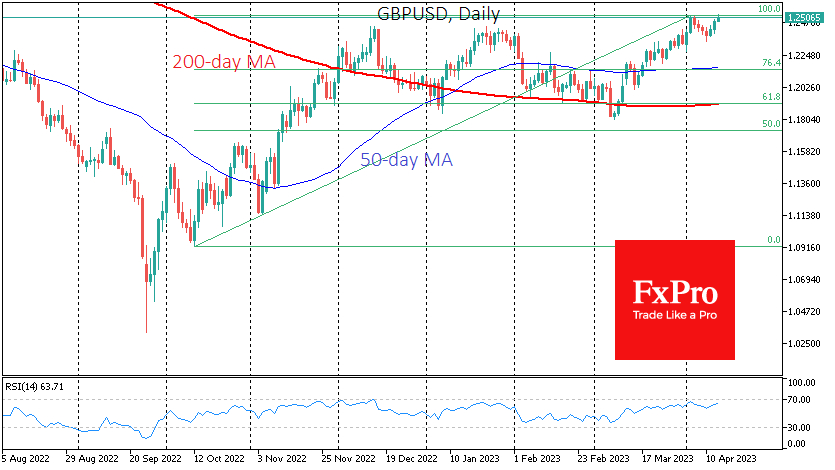

The USD's reaction was much more pronounced. The Dollar Index has lost 0.85% from its pre-release level and is back at 101.0, close to the lows seen in early February. The technical picture is now more supportive of the USD bears. EUR/USD and GBP/USD are testing their 10- and 12-month highs, respectively. This dynamic leads us to view the February pullback in these pairs as a correction, which they overcame by mid-April.

The following key levels on the way up are at 1.13 for the euro and 1.30 for the pound, both of which seem relatively distant targets given the accumulated fatigue from last month's rally.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

U.S. Inflation Weighs on the Dollar

Published 04/13/2023, 08:34 AM

Updated 03/21/2024, 07:45 AM

U.S. Inflation Weighs on the Dollar

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.