A U.S. inflation breakout looks unlikely,” advises Oxford Economics’ chief U.S. economist, Gregory Daco. As forecasts go for the projections of pricing pressure, that ranks as one of the safer bets these days, or so it appears based on recent data and the outlook for today’s January report on consumer prices (due at 8:30 Eastern).

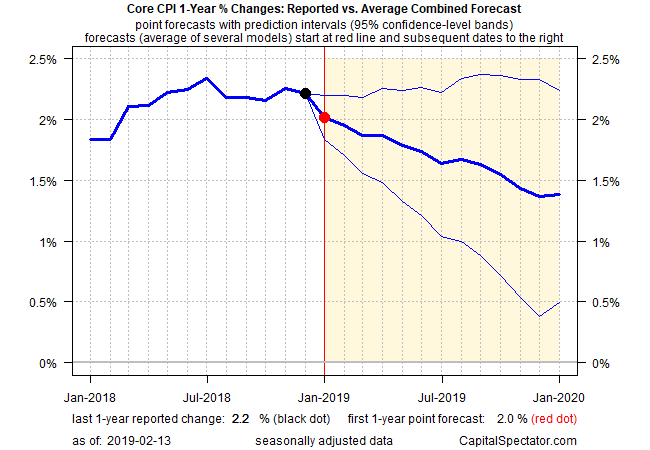

Econoday.com’s consensus forecast sees last month’s core rate of the Consumer Price Index (CPI) slipping to a 2.1% year-over-year increase, down slightly from 2.2% in December. If confirmed, the news will give the Federal Reserve a new round of data in support of its recent pause on raising interest rates.

Although inflation was accelerating in the first half of last year, core CPI peaked last July at 2.3%. In the months since pricing pressure has cooled a bit. As a result, core CPI is running roughly in line with the Fed’s 2.0% inflation target.

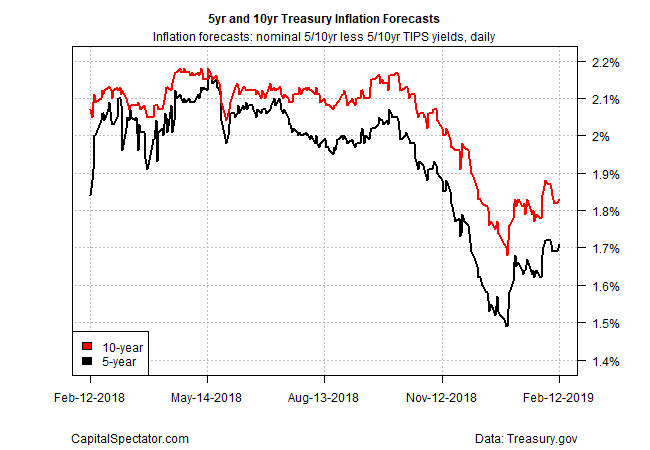

The implied inflation rate via the yield spread on nominal less inflation-indexed Treasuries supports a case for anticipating a modestly softer pricing trend in the near term. Consider the estimate via 5-year maturities: After peaking at nearly 2.1% late last year, this market-based forecast has pulled back and recently settled at roughly 1.7%. Treasury estimates of inflation should be taken with a grain of salt, but the main takeaway here is that the crowd’s pricing in a relatively subdued pricing trend at the moment.

What accounts for relatively muted inflation at a time when economic growth is healthy (according to Fed Chair Powell) and the labor market is strong? One theory is that there’s still a fair amount of labor slack. As Bloomberg reports:

University of Texas at Austin’s Olivier Coibion and co-authors Yuriy Gorodnichenko and Mauricio Ulate say the US simply hasn’t hit full employment. Labor slack still comes with a side of weak price pressure, they argue in a new National Bureau of Economic Research working paper, and inflation is slow because would-be workers remain on the margins.

Whatever the explanation, core inflation looks set to dip to a roughly 2% pace for January, slowly drifting lower in the months ahead, based on the average point forecasts drawn from several econometric models.

As long as economic growth endures, softer inflation is welcome. The question is whether the recent downside bias in inflation, albeit on the margins, is a sign that the U.S. is headed for a weaker macro trend this year? No one knows at this point. But it’s also fair to say that it’s a low-risk factor at a time when the economy is creating new jobs at a strong rate.

In short, something approximating the best of all worlds seems to prevail at the moment – moderate and perhaps decelerating inflation and a strong labor market. It’s perfection… if we can keep it.