- US inflation surprises to the upside, boosting Fed rate bets

- Dollar jumps and stocks drop, before a stunning turnaround

- Yen sinks even deeper, sterling capitalizes on political reversal

Inflation blues

Another shockingly hot US inflation report rocked financial markets yesterday, boosting bets that the Federal Reserve will raise interest rates to almost 5% before this cycle concludes. The core CPI rate overcame forecasts to reach a fresh four-decade high in September, with sticky categories such as medical care and rents driving much of the acceleration.

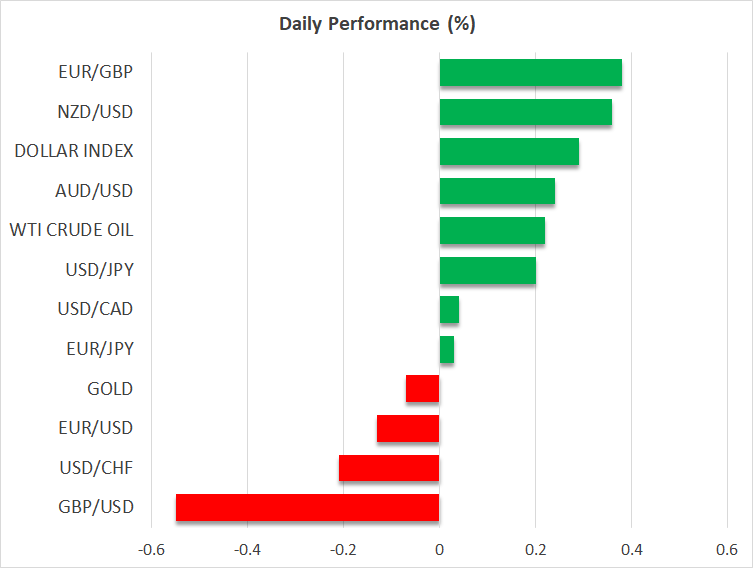

That’s when all hell broke loose. The dollar initially raced higher while shares on Wall Street sliced their way to new lows, as the data poured cold water on speculation that the Fed will hit the pause button anytime soon. But it did not last.

A stunning turnaround ensued, leaving many traders speechless. Stock markets staged a fierce comeback to close the session with gains exceeding 2%, a reversal that was perfectly mirrored in the dollar, which surrendered its opening gains to close in the red.

Making sense of it

There was no clear catalyst behind this change of heart. Yields cooled once the dust settled, but not enough to justify equity and FX moves of such proportions. Instead, this snapback seems like the product of protective hedges being unloaded in the options market, which generated enough upside momentum to trigger a broader wave of short-covering.

The sharp decline in implied volatility (VIX) corroborates this logic. We’ve seen similar trading dynamics play out after several inflation reports this year, with ugly numbers unable to torpedo the market and instead eliciting a relief rally, because positioning was overwhelmingly bearish heading into the event.

All told, nothing has fundamentally changed. Once this short squeeze fizzles out, investors will need to grapple with equity valuations that are still too expensive for the current interest rate regime, a deteriorating macro outlook, and the risk that earnings estimates are slashed if corporate America revises down its guidance in this reporting season.

Big banks such as Morgan Stanley (NYSE:MS), JPMorgan (NYSE:JPM), Wells Fargo (NYSE:WFC), and Citigroup (NYSE:C) will get the earnings ball rolling today with their quarterly results. The commentary around the health of the US consumer will attract the most attention, as investors try to gauge the macro landscape and by extension the likelihood of downward earnings revisions.

Yen crushed, sterling recovers

The Japanese yen continues to sink deeper into the abyss, ravaged by rate differentials widening against it and a terms of trade shock that has wiped out the nation's chronic trade surplus. Currency intervention by the Bank of Japan last month only delayed the inevitable, with the yen hitting fresh two-decade lows against the US dollar this week, since the underlying forces behind this downtrend are still in place.

Dollar/yen is currently trading near 147.50, which was the reversal point back in 1998. Considering the technical and psychological importance of this region, another yen-buying intervention by the Bank of Japan seems increasingly realistic, even if only to chase away some speculators.

Meanwhile, the star performer yesterday was the British pound, which came back swinging amid rumors the government would abandon more elements of its disastrous budget, including the plan to axe a planned increase in corporate taxes. With a semblance of fiscal discipline returning, the worst of this budget crisis might be behind sterling, putting the currency back in the hands of global risk sentiment.

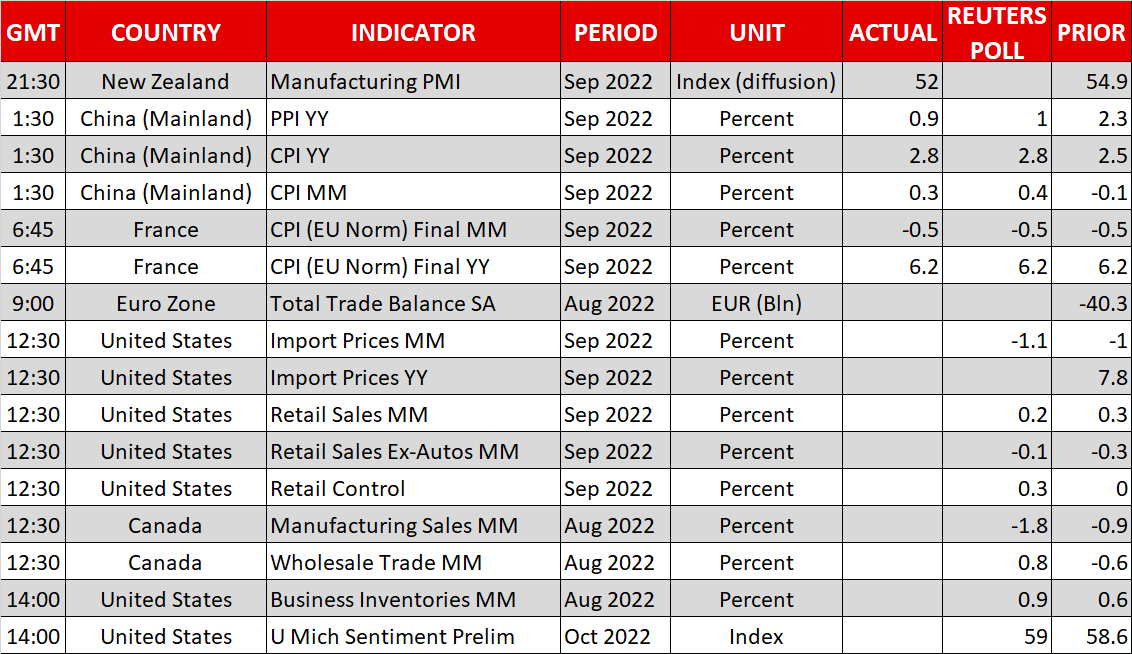

As for today, the latest batch of US retail sales will top the agenda, alongside the Michigan consumer sentiment survey. There’s also a litany of Fed speakers on the schedule, including Board Governors Cook (14:30 GMT) and Waller (16:15 GMT), who will no doubt highlight the central bank’s determination to vanquish inflation.