Big 48 Hours of Data For Fed Policy Makers

US futures are pointing to a higher open on Thursday, as we await a batch of data that will be of interest to Fed policy makers ahead of next month’s meeting.

Of course, Friday’s jobs report is widely regarding as the most important data release each month due to the insight it offers on hiring, wages and therefore potential future inflation pressures. Today’s data though is arguably equally important, if not more so at the moment, as it contains the latest inflation numbers, as per the Fed’s preferred measure, as well as income and spending figures.

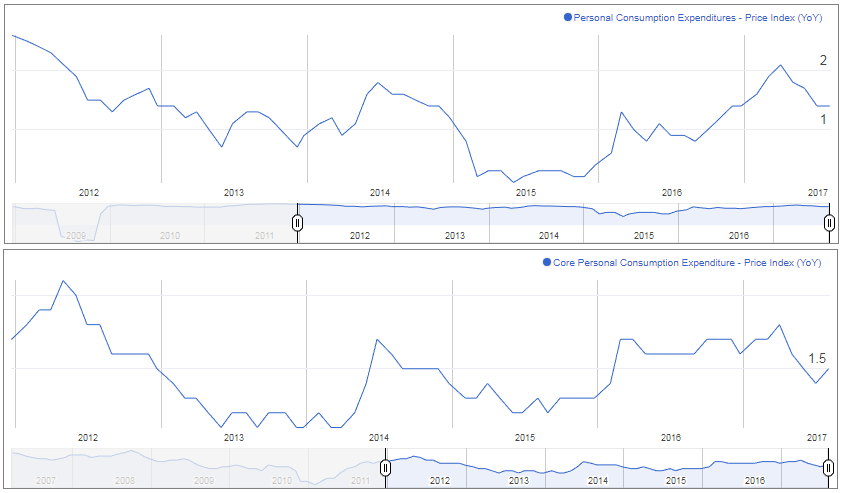

While the Fed has arguably achieved its target on the unemployment side, it still remains well short on inflation so today’s data could be seen as the more important when it comes to determining when and how fast the Fed will raise interest rates going forward. Expectations are for inflation to remain at 1.4%, with core falling slightly, also to 1.4%, leaving the Fed once again trailing well behind its 2% target.

With earnings remaining subdued, albeit on a slightly positive trajectory this year, I’m not sure we’re seeing enough to convince already uncertain policy makers that the current pace of tightening is appropriate. The December meeting, the most likely timing for the final rate hike this year, is fast approaching and without an improvement in the inflation and income data soon, it may well pass with rates unchanged and expectations going forward much lower.

Initial jobless claims and pending home sales data is also due today, although in all likelihood, focus will likely shift to tomorrow’s jobs report after the inflation, income and spending numbers are released. It should therefore be a very interesting end to the week in the markets, even if political and geopolitical events don’t rear their ugly head once again. Of course, we can’t bank on this given their tendency to do so throughout August, which has helped the likes of gold hit 2017 highs and remain near these levels. Risk appetite may be returning but traders are still clearly very cautious.