- US inflation comes in hotter than expected, putting 100bp Fed hike into play

- Yen resumes its downtrend ahead of next week’s Bank of Japan meeting

- Euro/dollar holds parity, BoC delivers king-sized hike, earnings season begins

Fed playbook gets redrawn

Another scorching hot inflation reading from the US unleashed havoc yesterday, sending traders scrambling to recalibrate the trajectory for interest rates. Inflation as measured by the CPI accelerated to 9.1% in yearly terms, the fastest pace in four decades. Most concerning is that price pressures are broadening out beyond the usual suspects of food and energy, creating a bigger headache for Fed officials trying to slay the inflation beast.

Once the dust settled, market participants concluded the Fed might raise interest rates by one percent at its next meeting in two weeks, a scenario that Fed funds futures currently assign a 55% probability to. In other words, a 100bps rate hike in July is now the baseline according to market pricing, and if the Fed doesn’t push back, it is essentially endorsing it.

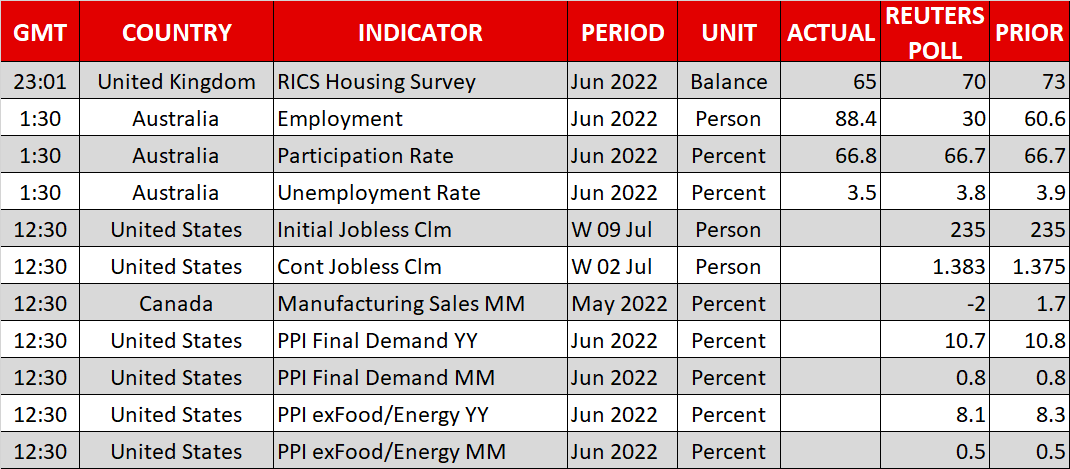

With traders split on how hard the Fed will swing this month, a speech by Fed Governor Waller today at 15:00 GMT could be pivotal as he is one of the last officials to deliver public remarks before the blackout period begins on Saturday. Similarly, today’s producer price data and tomorrow’s releases that include retail sales and the University of Michigan survey just became a lot more important.

In the big picture, it is striking that the more the market anticipates rate increases to be frontloaded this year, the more rate cuts are priced in for next year. Traders are now betting that the Fed will backpedal and start cutting rates by the second quarter of next year, as the rapid fire tightening cycle will break the economy faster.

Euro resists, stocks hold up

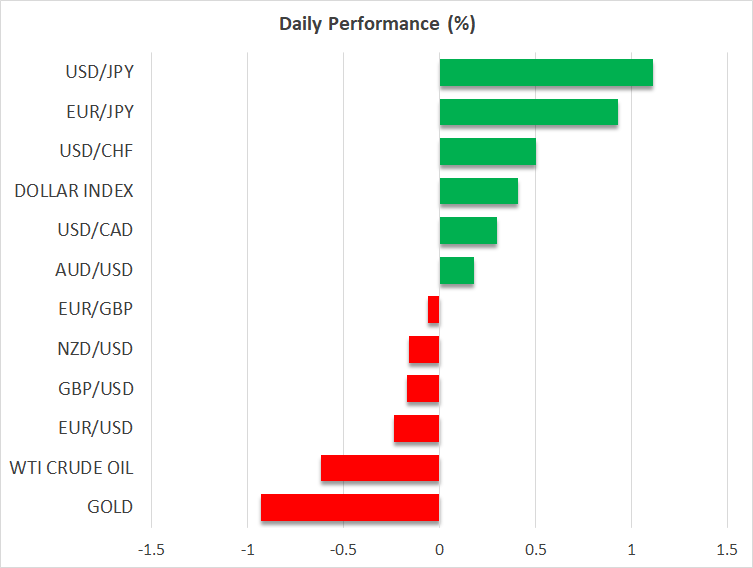

Since investors are interpreting today’s rate increases as next year’s rate cuts, the market reaction was peculiar. Treasury yields fell in the aftermath while the dollar took a step back despite the upside surprise in inflation, with the unwind of protective hedges after the event likely contributing as well.

This allowed euro/dollar to defend the parity line. The mother of all battles is still raging for control of that level, which is acting like a magnet both for buy and sell orders, with massive options expiries distorting the field. Whether it holds might ultimately depend on the path of energy prices, and whether Russia really cuts off the gas to Europe next week.

For similar reasons, stock markets also held their ground. The S&P 500 lost only 0.4% and the Nasdaq even less, which is a relative victory considering the seismic moves in Fed pricing. Some unwinding of short positions and the fact that terminal rates did not move any higher seem to have done the trick.

Unfortunately, bond traders are saying inflation won’t be a problem only because growth will be a horror show, so it seems premature to celebrate the market’s resilience. The earnings season will kick off today with JPMorgan Chase (NYSE:JPM) and Morgan Stanley (NYSE:MS), which will give us a sense of how the consumer is holding up.

Yen crumbles, BoC overdelivers

With the Bank of Japan being the lone wolf that is not considering higher interest rates, the yen has been steamrolled as capital flees the nation in search for higher returns abroad. The yen resumed its downtrend today, bringing its year-to-date losses against the US dollar to a staggering 20%.

Market participants seem to be testing the BoJ's resolve ahead of next week’s policy meeting - will policymakers stand their ground in their attempt to revive inflation or will they bow to political pressure and blink? The yen’s fate hangs in the balance.

Elsewhere, the Bank of Canada caught the markets by storm yesterday when it delivered a supermassive 100bps rate increase, adding credence to the view that the Fed might follow suit. It was essentially a shock-and-awe therapy to bring inflation expectations back down, and although the loonie climbed initially, it surrendered most of its gains as oil prices retreated.