Industrial production in the U.S. increased 0.2 percent in November. What does it mean for the gold market?

The U.S. industrial production rose 0.2 percent last month, but it was flat if we exclude oil and gas extraction. It was slightly below expectations, but it was the third monthly increase in a row. Importantly, expenditures on business equipment climbed 5.2 percent over the last twelve months. Moreover, the capacity utilization for the industrial sector increased from 77.0 to 77.1 percent in November, the highest level since early 2015. Another positive in the report was an upward revision to October’s industrial production from 0.9 percent to 1.2 percent.

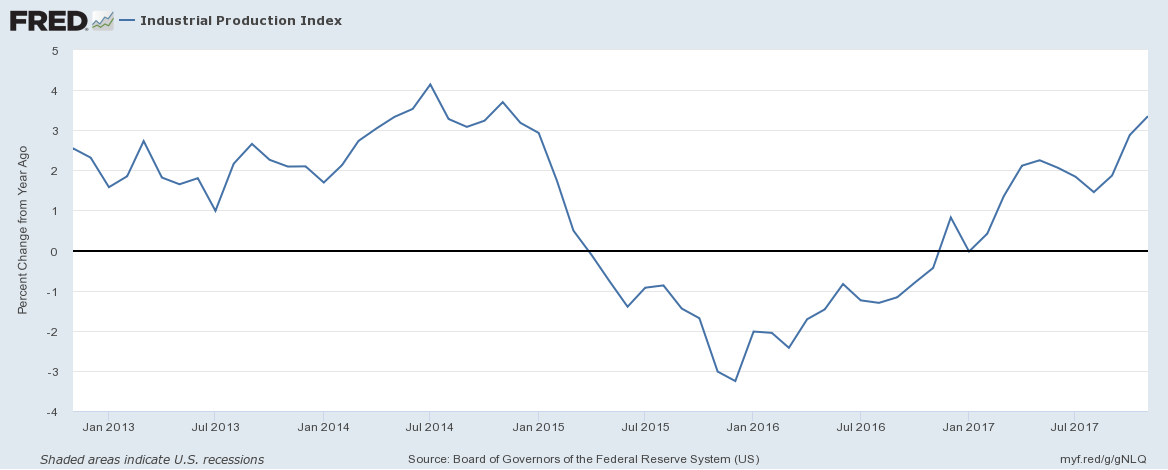

On an annual basis, industrial output accelerated to 3.4 percent growth, the biggest increase since the end of 2014. It means that the recovery in the American manufacturing continues, as one can see in the chart below.

Chart 1: U.S. industrial production over the last five years (as % y-o-y).

In December, we should see further improvement in the manufacturing sector. The Empire State Manufacturing Index dropped slightly from 19.6 in November to 18 this month. It was the second decline in a row, but it still signals improving conditions (as any readings above zero indicate better conditions).

Last but not least, the flash U.S. manufacturing PMI rose from 53.9 in November to 55 in December, a 11-month high. Although the flash U.S. services activity index fell from 54.5 to 52.4 in the same time, it remained above the threshold level of 50.

The bottom line is that the U.S. industry has recently rebounded. The manufacturing sector has been rising this year, which is a good sign for the U.S. economy. The recession is less likely with thriving industry. It is bad news for the gold market – the yellow metal shines mostly during recessions or period of sluggish growth. Looking at the manufacturing activity we are far from such conditions. However, the U.S. industry rebounded partially thanks to a weak U.S. dollar – which is something positive for gold. Hence, the impact of flourishing manufacturing on the gold market is far from being simple. Stay tuned!

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.