The euro was able to maintain its recent bullish trend throughout the European session yesterday, as investors continued to support riskier assets as a result of strong euro-zone debt auctions earlier in the week. Turning to today, traders will want to pay attention to a batch of US news, including the weekly Unemployment Claims figure and Pending Home Sales. With both figures expected to signal growth in the US economy, the dollar may be able to recoup some of its recent losses.

Economic News

USD - US Data May Help Dollar Today

The US dollar was bearish throughout European trading yesterday, as positive euro-zone news from earlier in the week led to increased risk taking among investors. The EUR/USD reached as high as 1.3235 during the morning session. Overall, the dollar dropped some 50 pips vs. the common-currency yesterday. Against the Japanese yen, the dollar reversed its gains from Tuesday. The USD/JPY dropped as low as 81.06, down 50 pips for the day.

Turning to today, traders will want to monitor the US Unemployment Claims and Pending Home Sales figures, set to be released at 12:30 and 14:00 GMT, respectively. Analysts are forecasting that the number of people who filed for unemployment insurance last week dropped slightly from the week before. Furthermore, today's housing data is expected to show a significant increase in sales from last month. Should today's news come in at or above the forecasted 1.4%, the US dollar may be able to recoup some of yesterday's losses.

EUR - Investor Risk Taking Helps Boost EUR

The euro largely held onto gains vs. the US dollar during European trading yesterday, as risk taking among investors continued to support higher yielding assets. The EUR/USD spent much of the day above the psychologically significant 1.3200 level. In addition, the common currency saw significant gains against the British pound, following poor economic news out of the UK. The UK Prelim GDP figure came in at -0.2%, well below the forecasted 0.1%. The news sent the EUR/GBP as high as 0.8220, up over 50 pips for the day.

Turning to today, traders will want to note that US news is likely to generate market volatility among euro pairs. Should the news come in better than expected, the euro could give back some of its recent gains vs. the greenback. At the same time, positive US news could generate some risk taking in the marketplace, which may help the euro move up vs. the safe-haven Japanese yen. Additionally, traders will want to remember that the euro-zone debt crisis still has the potential to bring the common-currency down. Any negative announcements today could result in euro losses.

AUD - Aussie Sees Mild Gains amid Risk Taking

The Australian dollar saw gains against several of its main currency rivals yesterday, following an increase in investor risk taking. The AUD/USD was up close to 40 pips during the European session, reaching as high as 1.0345. Against the British pound, the aussie gained over 100 pips for the day, following worse than expected news out of the UK. The GBP/AUD dropped as low as 1.5546 during morning trading.

Turning to today, traders will want to pay attention to news out of the US, as it is likely to dictate the level of risk taking in the marketplace. Positive indicators could cause the AUD/USD to reverse yesterday's gains. At the same time, should the US news generate additional risk taking in the marketplace, the aussie could see gains vs. the safe-haven Japanese yen.

Crude Oil - Bearish USD Leads to Gains for Oil

Crude oil was bullish throughout yesterday's trading session, as the combination of investor risk taking and expectations of another round of quantitative easing in the US sent the US dollar lower. Typically the price of oil goes up when the USD is bearish, as the commodity becomes cheaper for international buyers. Crude spent much of the day trading above the $104.00 a barrel, its highest level since last Friday.

Turning to today, oil traders will want to keep their eyes on the US Unemployment Claims figure and Pending Home Sales. Should either of the indicators come in better than forecasted, the USD could see some gains, which may cause the price of oil to drop during the afternoon session. That being said, should the USD extend its bearish trend today, oil may be able to move up higher.

Technical News

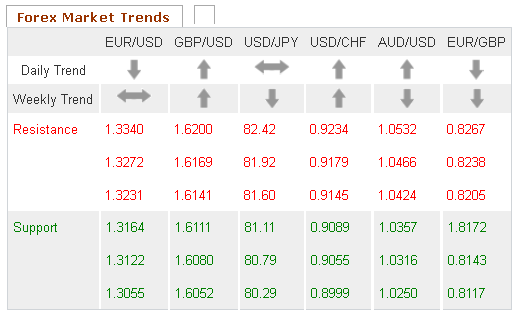

EUR/USD

Most long-term technical indicators show this pair range-trading, meaning that no defined trend can be predicted at this time. The one exception is the Williams Percent Range on the daily chart, which has crossed into overbought territory. Traders will want to take a wait and see approach for this pair, as a downward correction may take place in the near future.

GBP/USD

The Williams Percent Range on both the daily and weekly charts have crossed into overbought territory, pointing to a possible downward correction for this pair. Additionally, a bearish cross on the daily chart's Slow Stochastic supports this theory. Going short may be the wise choice for this pair.

USD/JPY

A bullish cross on the daily chart's MACD/OsMA indicates that this pair could see upward movement in the near future. That being said, most other indicators show this pair range trading at this time. Taking a wait and see approach for this pair may be a wise choice, as a clearer picture is likely to present itself in the coming days.

USD/CHF

The Williams Percent Range on the daily chart has crossed into oversold territory, indicating that a bullish correction could occur for this pair. The Relative Strength Index (RSI) on the same chart is pointing downward, and looks like it may also move into the oversold zone. Traders will want to keep an eye on the RSI. Should it cross below 30, it may be a sign of an impending upward correction.

The Wild Card

NZD/CHF

The daily chart's Slow Stochastic has formed a bullish cross, indicating that this pair could see upward movement. Furthermore, the Williams Percent Range on the same chart has crossed into oversold territory. This may be a good time for forex traders to open long positions ahead of a possible upward correction.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

US Home Sales Figure Set To Generate Volatility

Published 04/26/2012, 02:38 AM

Updated 02/20/2017, 07:55 AM

US Home Sales Figure Set To Generate Volatility

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.