In an environment characterized by high volatility, recent political strife, and fiscal uncertainty, U.S. Treasury bonds may not seem as attractive as they once were. Recency bias — a cognitive shortcut that places undue emphasis on recent events over historical data — may tempt investors to discount U.S. Treasuries as a reliable asset for hedging equity risk.

In 2022, for instance, the Treasury market recorded an annual loss, driven by inflationary pressures that led the Federal Reserve to significantly hike its benchmark rate. Furthermore, the U.S. grappled with a debt-ceiling crisis in January 2023, a situation that exacerbated volatility.

Additionally, Fitch Ratings recently downgraded the United States' Long-Term Foreign-Currency Issuer Default Rating, citing fiscal deterioration, high debt levels, and erosion in governance standards as primary reasons. These conditions, punctuated by ongoing political debates on the debt ceiling and fiscal responsibility, can give investors pause.

Yet, despite these challenges, U.S. Government bonds remain a vital flight-to-safety asset. It's essential to rise above the noise of recent upheavals and consider the historical role U.S. Treasuries have played in diversified portfolios.

The trepidations of today should not overshadow the long-term reliability of this asset class, which continues to offer a degree of stability and risk mitigation that is hard to find elsewhere, along with great versatility given the plethora of variants on the market.

Nominal U.S. Treasurys

Nominal U.S. government issued Treasuries offer a range of maturities that serve different investment objectives and risk tolerances.

At one end of the spectrum are short-term Treasury bills, which are highly liquid and easily bought and sold. Because of their short maturity, they carry lower interest rate risk, making them a safe option for conservative investors.

However, the trade-off is that they typically offer lower yields, especially when the yield curve is normal, meaning that longer-term rates are higher than short-term ones. In contrast, during periods of an inverted yield curve, where short-term rates are higher than long-term rates, Treasury bills could offer more attractive returns.

Intermediate-term Treasury notes represent a middle-ground option that provides a balance between risk and return. These securities come in a variety of maturities, offering a good degree of flexibility for investors.

While they are more susceptible to interest rate changes compared to short-term Treasury bills, they generally carry less risk than long-term Treasury bonds. Their appeal is most evident during times of a flat yield curve, where the yield difference between short-term and long-term maturities is negligible, making intermediate-term options a sound choice for yield without taking on excessive risk.

On the other end are long-term Treasury bonds, which usually offer the highest yield among the different Treasury maturities. These securities can be an effective hedge against unexpected inflation, but they come with considerable interest rate risk.

The longer maturity makes them highly sensitive to changes in interest rates, which can lead to greater price volatility. Additionally, long-term Treasury bonds are generally less liquid than their shorter-term counterparts.

They are most advantageous when the yield curve is steep, allowing investors to capture a yield premium that compensates for the increased interest rate risk. However, in a flat or inverted yield curve scenario, these bonds may underperform compared to their shorter-term counterparts.

The beauty is that investors have a variety of ways to slice and dice an ideal fixed-income allocation in their portfolio. By targeting different portions of the yield curve, investors can adjust their desired yield and interest rate exposure to their risk tolerance.

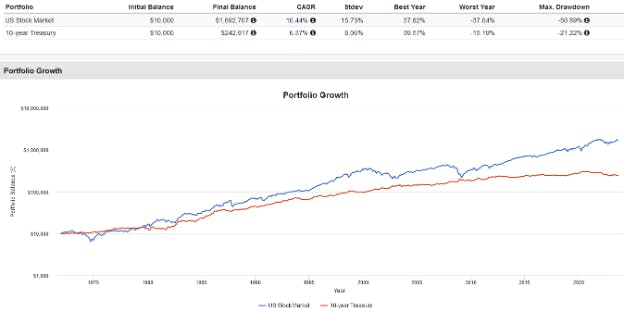

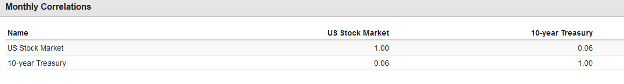

Finally, it is worth noting that from 1972 to present, U.S. 10-year Treasurys have historically recorded a low 0.06 monthly correlation with the broad U.S. market, while also producing competitive returns. With the exception of years like 2022, Treasuries have served as a strong diversifier for equity risk.

A great present-day example is the WisdomTree U.S. Efficient Core Fund (NTSX), which holds an allocation of 90% large-cap U.S. equities and 10% Treasury futures. By using futures, the ETF obtains leveraged exposure to a position equivalent to 60% in intermediate Treasuries, for a final portfolio exposure of 90/60 stocks/bonds, or 1.5x a normal 60/40 portfolio.

Other Types of U.S. Treasurys

One of the main weaknesses of nominal U.S. Treasuries is their vulnerability to inflation and rising interest rates. Inflation erodes the real value of the fixed interest payments that bondholders receive. Simply put, the money you get back in the future won't have the same purchasing power it does today.

In a similar vein, when interest rates rise, the fixed yield on existing bonds becomes less attractive compared to new bonds issued at higher rates. As a result, the market price of existing bonds drops to make their yield competitive with new issues, which means that investors holding onto these bonds could incur capital losses if they need to sell before maturity.

To combat these weaknesses, the U.S. government offers two other types of Treasuries: Treasury Inflation-Protected Securities (TIPS) and floating-rate Treasuries.

TIPS are designed specifically to hedge against inflation. Unlike nominal Treasuries, the principal amount of TIPS increases with inflation and decreases with deflation, as measured by the Consumer Price Index.

When these bonds mature, investors are paid the adjusted principal or original principal, whichever is greater. Interest payments are also adjusted according to inflation or deflation, which protects the real value of the income received over time.

Therefore, in an inflationary environment, TIPS can provide a more reliable return than nominal Treasuries, ensuring that the purchasing power of your investment remains relatively stable.

Floating-rate Treasuries, on the other hand, are designed to mitigate the risks associated with rising interest rates. Unlike traditional fixed-rate Treasuries, these securities have interest payments that adjust periodically in line with prevailing short-term rates.

Specifically, the interest payments are tied to the most recent 13-week Treasury bill auction rates. So, when interest rates rise, the coupon payments on floating-rate Treasuries will also increase, offsetting some of the price depreciation that normally occurs with fixed-rate bonds.

This makes them an attractive option for investors who are concerned about a period of rising interest rates, as it shields them from the capital loss they would experience with fixed-rate bonds.

Both TIPS and floating-rate Treasuries can be readily accessed via ETFs, with the WisdomTree Floating Rate Treasury Fund (USFR) serving as a popular vehicle for the latter.

This content was originally published by our partners at ETF Central.