Investing.com’s stocks of the week

The US avoided being sent over the cliff by a last-minute agreement in Washington but the half-baked solution has only postponed and not solved the twin budgetary and debt ceiling problems. Global stocks took off nevertheless and hit a five-year high while bonds rallied as taper expectations were further delayed. Commodities, meanwhile, ended in the black for a second week in a row having been led higher by precious metals.

The as yet unknown impact on the US economy of the shutdown has resulted in the tapering expectations being delayed further into 2014 and this left the dollar reeling. At one point, the USD hit its lowest level against the euro since February. And although the dollar's role as a global reserve currency will not be challenged by this latest debacle, it may trigger some concern among investors about how to treat the greenback in the future.

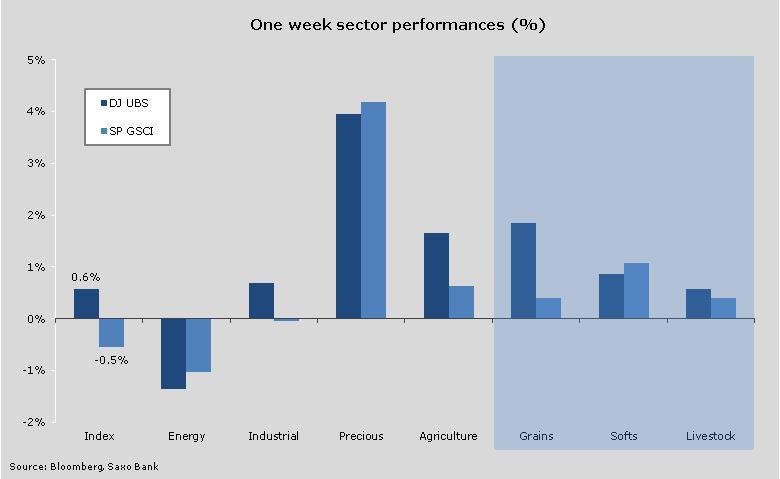

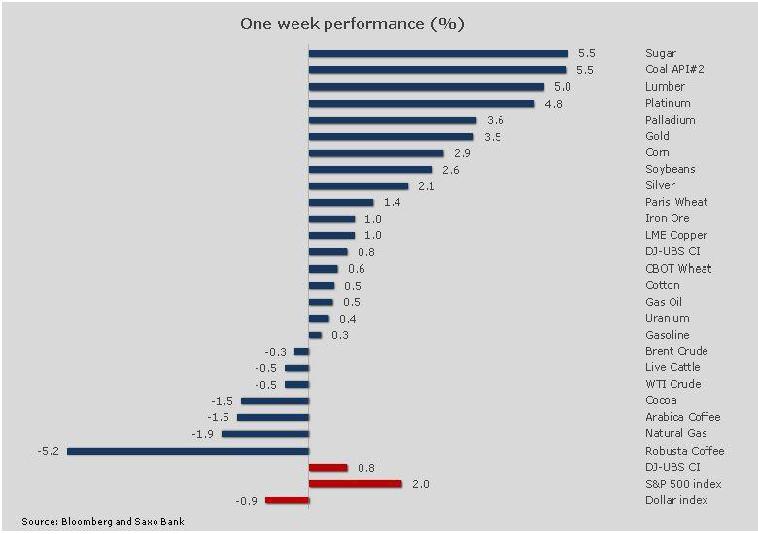

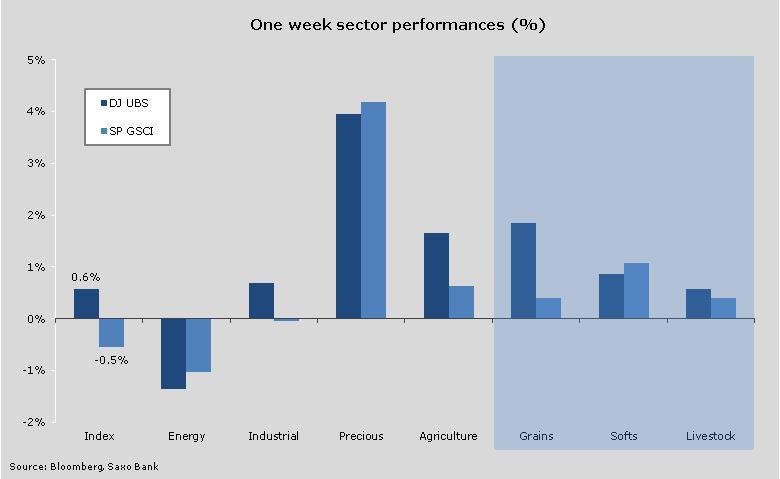

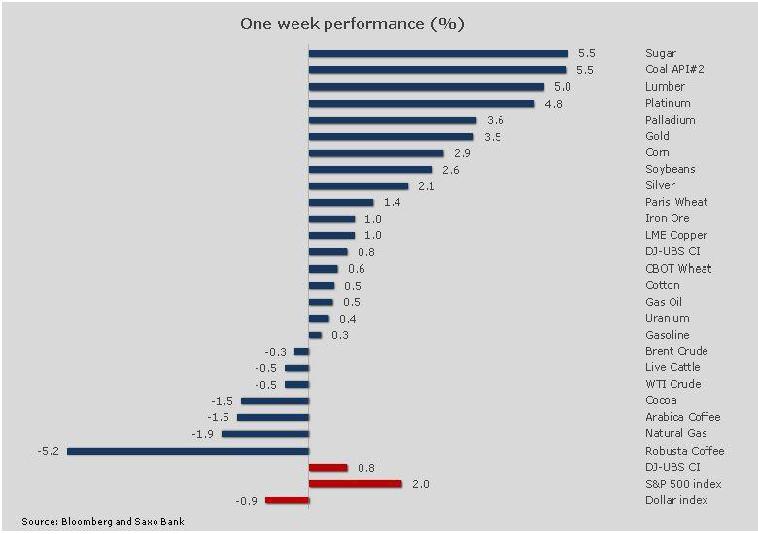

The DJ-UBS commodity index was higher for a second week in a row while the energy-heavy S&P GSCI was down for the first week in three. The best-performing sector was precious metals which found support from the falling dollar and bond yields. The energy sector was torn between supportive Chinese growth data and rising supply on the one hand and general uncertainty about near-term demand on the other.

Gold back to neutral as short sellers are punished

Gold managed to recover strongly from a position of weakness on the news that a deal had been reached on Capitol Hill in Washington. The metal had been trading lower within its established downtrend up until then. The rally following the deal announcement was driven by short covering and a weaker dollar. Additional support came from the fact that the solution is temporary and will expire in January. This has heightened expectations that tapering will now be further delayed as economic uncertainty will persist in the interim.

The downtrend in gold has now been broken by the sharp recovery and this points towards some near-term consolidation, potentially between USD 1,290/oz and USD 1,343/oz. The longer-term prospect will continue to depend on whether investment flows start to return to gold. Such flows will depend on investors' perceptions of where inflation, bond yields and economic activity are heading. The longer-term projections still point towards interest rates normalising as the economic growth rate picks up. On that basis we see the near-term direction in gold as mostly sideways while any upticks in the metal from current levels will continue to be viewed as selling opportunities, which would in turn limit the upside potential.

The risk to these expectations may come from an unexpected deterioration in the economic outlook in coming weeks as this could lead to indefinite quantitative easing. But unless we see a significant negative reaction in stock markets on the back of such a development, gold might not find enough support to challenge key resistance levels above USD 1,433/oz and USD 1,525/oz.

Chinese growth lent some support to oil

Both crude oils trimmed their weekly losses on signs that growth in China, the world's second largest consumer of the fuel, picked up during the third quarter. This quelled at least some of the current worries about China's ability to sustain its growth rates — something on which oil markets are keeping a close eye as the country remains the single biggest driver for oil demand growth.

WTI crude oil's discount to Brent remains elevated as US crude inventories rose on lower demand from refineries while seasonal maintenance work is underway. Looking ahead further, the upside seems limited and we maintain a neutral to bearish short-term view on both oils with any major pickup most likely to be met by renewed selling both from hedging and speculative long liquidation.

The resumption of government functions in the US should also lead to the return of a much-followed weekly report from the US Commodity Futures Trading Commission which gives traders an overview of how hedge funds and other large investors are positioned in the oil markets. The most recent available data dates back to September 24 and traders will be interested to see what impact the price weakness since then has had on hedge funds positioning which were relatively elevated back then.

Brent crude remained stuck around USD 110/barrel with a downside risk towards USD 105 the most likely path ahead. WTI crude continued to find support towards USD 100/barrel, a break through of which could signal further weakness down towards USD 98/barrel.

The as yet unknown impact on the US economy of the shutdown has resulted in the tapering expectations being delayed further into 2014 and this left the dollar reeling. At one point, the USD hit its lowest level against the euro since February. And although the dollar's role as a global reserve currency will not be challenged by this latest debacle, it may trigger some concern among investors about how to treat the greenback in the future.

The DJ-UBS commodity index was higher for a second week in a row while the energy-heavy S&P GSCI was down for the first week in three. The best-performing sector was precious metals which found support from the falling dollar and bond yields. The energy sector was torn between supportive Chinese growth data and rising supply on the one hand and general uncertainty about near-term demand on the other.

Gold back to neutral as short sellers are punished

Gold managed to recover strongly from a position of weakness on the news that a deal had been reached on Capitol Hill in Washington. The metal had been trading lower within its established downtrend up until then. The rally following the deal announcement was driven by short covering and a weaker dollar. Additional support came from the fact that the solution is temporary and will expire in January. This has heightened expectations that tapering will now be further delayed as economic uncertainty will persist in the interim.

The downtrend in gold has now been broken by the sharp recovery and this points towards some near-term consolidation, potentially between USD 1,290/oz and USD 1,343/oz. The longer-term prospect will continue to depend on whether investment flows start to return to gold. Such flows will depend on investors' perceptions of where inflation, bond yields and economic activity are heading. The longer-term projections still point towards interest rates normalising as the economic growth rate picks up. On that basis we see the near-term direction in gold as mostly sideways while any upticks in the metal from current levels will continue to be viewed as selling opportunities, which would in turn limit the upside potential.

The risk to these expectations may come from an unexpected deterioration in the economic outlook in coming weeks as this could lead to indefinite quantitative easing. But unless we see a significant negative reaction in stock markets on the back of such a development, gold might not find enough support to challenge key resistance levels above USD 1,433/oz and USD 1,525/oz.

Chinese growth lent some support to oil

Both crude oils trimmed their weekly losses on signs that growth in China, the world's second largest consumer of the fuel, picked up during the third quarter. This quelled at least some of the current worries about China's ability to sustain its growth rates — something on which oil markets are keeping a close eye as the country remains the single biggest driver for oil demand growth.

WTI crude oil's discount to Brent remains elevated as US crude inventories rose on lower demand from refineries while seasonal maintenance work is underway. Looking ahead further, the upside seems limited and we maintain a neutral to bearish short-term view on both oils with any major pickup most likely to be met by renewed selling both from hedging and speculative long liquidation.

The resumption of government functions in the US should also lead to the return of a much-followed weekly report from the US Commodity Futures Trading Commission which gives traders an overview of how hedge funds and other large investors are positioned in the oil markets. The most recent available data dates back to September 24 and traders will be interested to see what impact the price weakness since then has had on hedge funds positioning which were relatively elevated back then.

Brent crude remained stuck around USD 110/barrel with a downside risk towards USD 105 the most likely path ahead. WTI crude continued to find support towards USD 100/barrel, a break through of which could signal further weakness down towards USD 98/barrel.