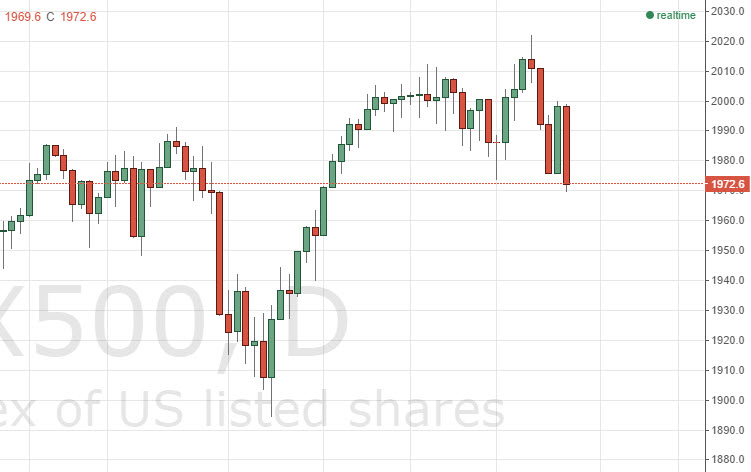

During the session on Friday, we don’t anticipate seeing much in the way of economic announcements moving the market during European or British trading. The Asian session will be quiet as well, so quite frankly it all comes down to the Americans for the session as far as we see. With that being the case, we are paying particular attention to the GDP numbers coming out of the United States, anticipated to be 4.6% quarter over quarter. This will have a drastic effect on the US stock markets overall, with particular interest being paid to the Dow Jones Industrial Average and the S&P 500.

With that, we recognize that the S&P 500 has been sold off fairly significantly during the session on Thursday, but the 1970 level did in fact look supportive. Besides, there are few numbers it can move the stock markets in the US like the GDP numbers. If that number comes out stronger than anticipated, we see no reason whatsoever why the S&P 500 won’t hit the 2000 level yet again.

The EUR/USD pair continues to offer plenty of put buying opportunities, every time it rallies. We will be paying attention to short-term charts in order to start buying this put yet again. The fact that we are below the 1.28 handle is significant, and suggests that we could very easily go to the 1.25 handle given enough time.

The FTSE looks absolutely horrible, and destined to hit the 6550 level. However, we have had a significant sell off over the last several sessions, so looking for short-term bounces to buy puts would be the way to go going forward simply taking little bits and pieces along the way. We feel that this market will find a significant amount support at 6550 though, so this is more or less an opportunity for short-term traders only.