European equities bobbed along buoyantly ignoring the dire figures from Spain and the lull is US investor confidence. Retail figures from Spain fell by 10.7% last month as the pressures from austerity and the increase in sales tax resulted in an understandably slow Christmas season. Falling from 7.8% the month previously, sales figures have now fallen for 30 consecutive months.

Coupled with 60% youth unemployment and a missed deficit target for 2012, GDP figures just released (albeit estimates) posted a -0.7 vs -0.6%(exp) decline for Q4. The last 2 days have done little to ease the pressure on Mariano Rajoy as Spain are likely to re-enter the spotlight in the coming weeks. On the upside there does seem to be a healthy appetite for Spanish debt at the moment. The news helped put the brakes on GBPEUR which closed out where it started the day, a rare occurrence recently.

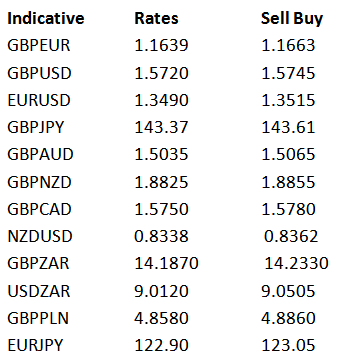

Similarly, the Dow was unphased by the sharp decline in US confidence. The US machine has been churning out fairly positive data as of late, risk appetite has returned to the markets, jobless figures are healthy, recent PMI figures are showing growth and a decent chunk of the fiscal cliff was averted. The 2% increase in payroll tax is clearly weighing heavier on the general public than the above. EURUSD climbed to a 13 month high of 1.3490, that’s an impressive climb of circa 11% since July of last year.

Data wise, the week really starts today. Q4 GDP for the US is due after lunch. Forecasts post an annualised 1.1% down from 3.1% previously in Q3. At first glance the figures look concerning but despite the fall, the composition of the increase is a lot more solid than the punchy Q3 figure previously. Q3 figures were facilitated by strong government spending other short term factors. Considering that Q4 did include Hurricane Sandy and the infamous fiscal cliff, figures were also going to factor in disruption. A stronger figure will see EURUSD fall off its recent highs and continue to push GBPUSD lower.

The first Fed meeting of the year is unlikely to bring much excitement with the new curtains and décor in the committee room likely taking centre stage. Business and consumer confidence figures for the Eurozone are out at 10am.

Have a great day

Join us online this Thursday, for an introduction to our market-leading online payments system featuring quicker trades and payments, live rate graphs, statements and more. Click here to register for our free webinar.

Coupled with 60% youth unemployment and a missed deficit target for 2012, GDP figures just released (albeit estimates) posted a -0.7 vs -0.6%(exp) decline for Q4. The last 2 days have done little to ease the pressure on Mariano Rajoy as Spain are likely to re-enter the spotlight in the coming weeks. On the upside there does seem to be a healthy appetite for Spanish debt at the moment. The news helped put the brakes on GBPEUR which closed out where it started the day, a rare occurrence recently.

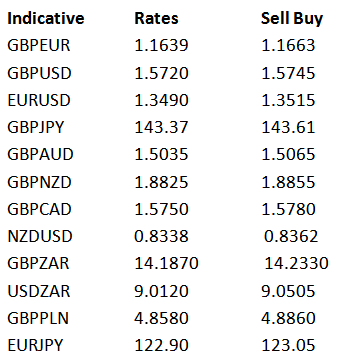

Similarly, the Dow was unphased by the sharp decline in US confidence. The US machine has been churning out fairly positive data as of late, risk appetite has returned to the markets, jobless figures are healthy, recent PMI figures are showing growth and a decent chunk of the fiscal cliff was averted. The 2% increase in payroll tax is clearly weighing heavier on the general public than the above. EURUSD climbed to a 13 month high of 1.3490, that’s an impressive climb of circa 11% since July of last year.

Data wise, the week really starts today. Q4 GDP for the US is due after lunch. Forecasts post an annualised 1.1% down from 3.1% previously in Q3. At first glance the figures look concerning but despite the fall, the composition of the increase is a lot more solid than the punchy Q3 figure previously. Q3 figures were facilitated by strong government spending other short term factors. Considering that Q4 did include Hurricane Sandy and the infamous fiscal cliff, figures were also going to factor in disruption. A stronger figure will see EURUSD fall off its recent highs and continue to push GBPUSD lower.

The first Fed meeting of the year is unlikely to bring much excitement with the new curtains and décor in the committee room likely taking centre stage. Business and consumer confidence figures for the Eurozone are out at 10am.

Have a great day

Join us online this Thursday, for an introduction to our market-leading online payments system featuring quicker trades and payments, live rate graphs, statements and more. Click here to register for our free webinar.