By Daniela Sabin Hathorn, senior market analyst at Capital.com

The US economy grew 1.6% in the first quarter of 2024. The actual figure was lower than the estimates of 2.5%, which caused some re-pricing of risk sentiment in markets after the data was released.

Albeit the data was lower than anticipated, the US economy still managed to grow in the first quarter, a stark contrast to what is expected in many countries in Europe. Growth was significantly above average in Q3 and Q4 of 2024, with GDP rising 3.4% and 4.9% respectively, which led markets to push back expectations of rate cuts from the Federal Reserve. The data released today is only the preliminary reading, meaning there can be – and often are – revisions to the final data.

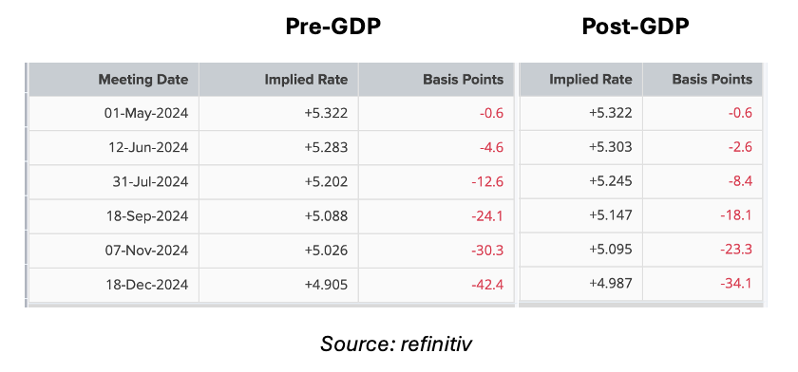

The immediate reaction in markets shows a move to push back even further the expectations of a 25bps rate cut from the Federal Reserve. This is an interesting takeaway given the weaker reading, but it could be evidence that markets see the fact that the US economy has managed to grow another quarter as a sign of strength, regardless of how the actual figure relates to expectations. It is also important to note that the release was accompanied by the GDP Price Index which measures the annualised change in the price of all goods and services included in gross domestic product. The reading came in higher than expected for Q1 at 3.1%, a significant rise from the 1.7% reported in Q4, which would have caused concern among investors about inflationary pressures, which is in large part to blame for the Fed’s inability to cut rates.

Before the weaker-than-expected reading, markets were pricing in a 56% chance of no rate cuts in July, versus 69% after the data release. Similarly, the current pricing shows a rate cut priced in for November, with the September meeting showing only 18bps of cuts being priced in. Before the data release, it was 24bps, meaning markets were pretty convinced the first rate cut would come then.

EUR/USD

EUR/USD attempted to rebound immediately after the release as the US dollar knee-jerked lower, but the momentum fizzled out almost immediately. That said, the bullish resurgence from the past few days remains at play even if the short-term bias remains lower. The weaker GDP data has proven not to be enough to convince traders to sell USD, especially as it has been accompanied by higher prices. The further pushback in rate cuts plays against EUR/USD as it favours the US dollar on a rate differential basis. Also, ongoing nervousness on a geopolitical level continues to limit the pair’s ability to advance. 1.07 seems to be the level to beat right now, with a close above this line necessary to even consider a continuation in the bullish recovery.

EUR/USD daily chart

Past performance is not a reliable indicator of future results.

GBP/USD

GBP/USD is attempting to hold on to some of the bullish momentum ignited with the US GDP release, but the pair has retraced back below 1.25. Monday’s bounce off the 23.6% Fibonacci retracement level (1.2297) has enabled a strong recovery in GBP/USD but the continuation seems to be taking a little more convincing. The 20-day SMA (1.2519) seems to have limited the daily advances but it is likely to be an easy level to breach if buyers focus their efforts over the coming days. Whilst the path of least resistance seems to remain lower, there is a strong possibility for recovery in GBP/USD depending on how the latest UK data compares to that of the US. The 50% Fibonacci level at 1.2588 could be an important target for buyers over the coming days if there is an attempt to consolidate the bullish momentum further.

GBP/USD daily chart

Past performance is not a reliable indicator of future results.

USD/JPY

USD/JPY has continued its relentless climb even after Japanese officials hinted at possible FX intervention to stem the depreciation in the Yen. The pair is pressured higher by the widening rate differential between both currencies which makes it more attractive to invest in dollars over yen. The Bank of Japan will have its first meeting this Friday after exiting its long-term negative rate regime last month. Markets are expecting the bank to keep rates unchanged this time around as it was pretty clearly stated that the previous hike was a “one-and-done” scenario. If confirmed, this could push USD/JPY even higher.

The thing is that many traders fear market intervention from Japanese officials, which is causing some indecision and making the climb a little slower. That said, even if they did intervene, it would likely have very limited long-lasting effects. It would serve to induce a short-term technical reversal in USD/JPY, which could be beneficial for new buyers as the pair has been overbought for a while.

Unless there is a commitment from the BoJ to deliver a consistent cycle of rate hikes then the bias is USD/JPY is likely to remain higher.

USD/JPY daily chart

Past performance is not a reliable indicator of future results.

***

RISK DISCLAIMER

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 80.84% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is no guarantee of future results. Professional clients can lose more than they deposit. All trading involves risk.

The present marketing communication is not intended for UK audiences.

RESEARCH DISCLAIMER

THE PRESENT MATERIAL MUST BE REGARDED AS MARKETING COMMUNICATION AND SHOULD NOT BE INTERPRETED AS INVESTMENT RESEARCH OR INVESTMENT ADVICE.

The content of this communication has been prepared solely for information purposes and should be considered as such. This communication does not constitute research in accordance with the legal requirements designed to promote investment research independence. While the information in this communication, or on which this communication is based, has been obtained from sources that Capital.com believes to be reliable and accurate, it has not undergone independent verification. No representation or warranty, whether expressed or implied, is made as to the accuracy or completeness of any information obtained from third parties.

The information provided as at the date of this communication is subject to change without prior notice. It does not take into consideration the investors’ individual circumstances or objectives and should not be construed as specific advice on the suitability of any investment decision. Investors should consider this report as merely one factor in making any investment decisions. To the extent permitted by law, neither Capital.com nor any of its employees or affiliates accept any liability whatsoever for any direct or consequential loss arising, directly or indirectly, from any use of this communication or its contents. Any person acting on the information does so entirely at their own risk. Any information that may be provided in this communication relating to past performance is not a reliable indicator of future results or performance.

Capital Com SV Investments Limited (“CCSV”) is registered in Cyprus with company registration number HE354252. CCSV is regulated by Cyprus Securities and Exchange Commission (CySEC) under licence number 319/17. . Capital Com Online Investments Ltd is a limited liability company (company number 209236B) registered in the Commonwealth of The Bahamas and authorised to carry on Securities Business by the Securities by the Securities Commission of The Bahamas (“SCB”) with licence number SIA-F245.