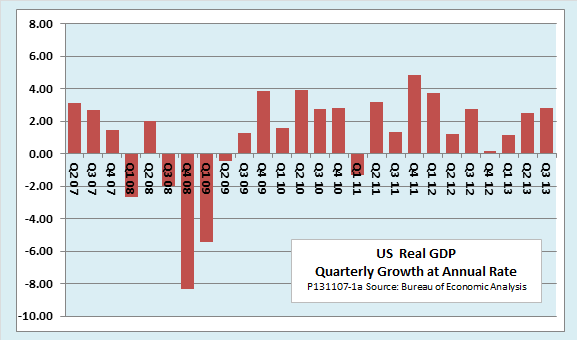

New data released today by the Bureau of Economic Analysis show that the U.S. economy grew at a respectable annual rate of 3.6 percent in the third quarter of 2013. That made it the first quarter since early 2012 for which growth was fast enough to make a significant dent in the output gap. The advance estimate released last month had put growth at 2.5 percent.

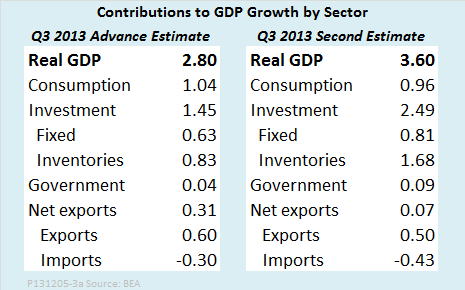

However, the upward revision must be interpreted with caution, since, as the following table shows, it was due almost entirely to an increase in the estimated growth of inventories. Faster inventory growth is an ambiguous indicator. In some cases, it can mean that businesses are stocking up in anticipation of higher future sales, but inventories can also grow when firms produce more than they had hoped to sell or order raw materials but fail to use them at the rate they had expected. On a more positive note, the contribution of fixed investment was also revised upward, with residential and nonresidential structures leading the way.

Today’s release reported downward revisions for the contributions of consumer spending and net exports. Exports increased slightly less than previously reported, and imports were slightly stronger. (Note that imports enter into the national account with a negative sign, so the revision in the contribution of imports from -0.3 percentage points to -0.43 percentage points indicates more imports of goods and services than previously estimated.)

The federal government’s contribution to GDP was negative, as it has been for most of the past three years. However, decreasing federal government consumption and investment was more than offset by growth in state and local government spending.

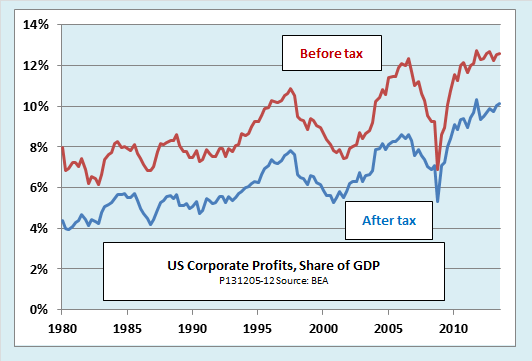

Today’s report also gives the first look at corporate profits for the third quarter. Nominal corporate profits rose at an annual rate of 7.5 percent, and after-tax profits grew at a 10.7 percent annual rate. Both measures of profits reached record highs, and both grew faster than GDP. As the next chart shows, corporate profits as a percentage of GDP have been higher over the past two years than ever before, a fact that no doubt helps to explain the recent strong performance of stock prices.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

US GDP Growth For Q3 Revised Up To 3.6 Percent

Published 12/05/2013, 06:51 PM

Updated 07/09/2023, 06:31 AM

US GDP Growth For Q3 Revised Up To 3.6 Percent

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.