Unfortunately, for the already vulnerable U.S. Energy Market, the worst is still yet to come. As one energy analyst forecasted, we may see a negative $100 for oil. While this may sound totally insane, domestic oil producers still haven’t cut anywhere near the amount necessary.

As the U.S. Shale Oil Industry continues to pump more than 7+ million barrels per day (mbd) of oil, the availability of storage capacity dwindles considerably each passing day. And with the 50 million barrels of oil from Saudi Arabia heading to the United States, the energy situation will go from bad to worse and then to absolutely horrible.

I hate to be so pessimistic, but the data doesn’t lie. If we take a look at two U.S. petroleum stock indicators, we are already firmly entrenched in the "worse" category.

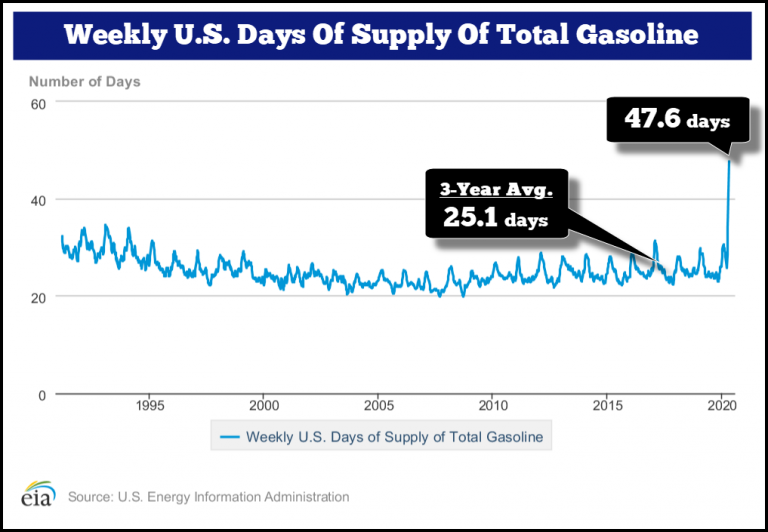

According to the EIA, U.S. Energy Information Agency, weekly U.S. Daily Gasoline stocks are the highest in recorded history. As of the EIA’s lasted update posted Wednesday, total U.S. Daily Gasoline stocks surged to 47.6 days, up from the three-year average of 25.1 days:

In just the past few weeks, U.S. gasoline stocks have added 22.5 days worth of inventory. The major factor pushing the days of gasoline supply higher is the collapse in demand. Here are the weekly change in U.S. Daily Gasoline stocks:

Days of U.S. Gasoline Stocks

April 3 = 34.0 days

April 10 = 40.9 days

April 17 = 47.6 days

You will notice that U.S. Gasoline stocks are increasing about 6-7 days worth of supply each week.

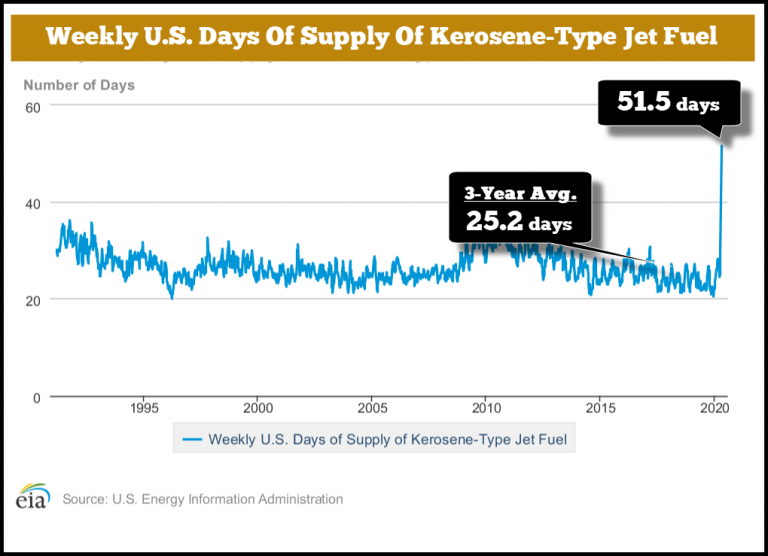

And what about Jet Fuel stocks?? With 96% of U.S. Airline traffic offline, jet fuel consumption has totally collapsed. The U.S. Jet Fuel stocks are now at a stunning 51.5 days of supply vs. the three-year average of 25.2 days:

In just the past few weeks, U.S. jet fuel stocks have doubled by an additional 26.3 days worth of inventory. Here are the weekly change in U.S. Days of Jet Fuel stocks:

Days of U.S. Jet Fuel Stocks

April 3 = 29.4 days

April 10 = 40.1 days

April 17 = 51.5 days

Jet fuel inventories are added about ten days of supply each week. Soon, the U.S. Refinery Industry will be forced to cut back considerably on the refining of these petroleum products.

Again, the major reason for surging gasoline and jet fuel days of supply has to do with the collapse in daily demand. However, I don’t see the demand for jet fuel increasing significantly anytime soon.

Furthermore, what will the U.S. Refining Industry do if it must provide gasoline products, but it no longer needs any jet fuel products as the inventories are at full capacity?? This will be a major challenge for the U.S. Refining Industry.

Lastly, while the U.S. WTI oil price experienced a nice rally yesterday to a high of $18, don't get used to it. The fundamentals for the U.S. Energy Market will go from worse to absolutely horroble before any recovery can occur.