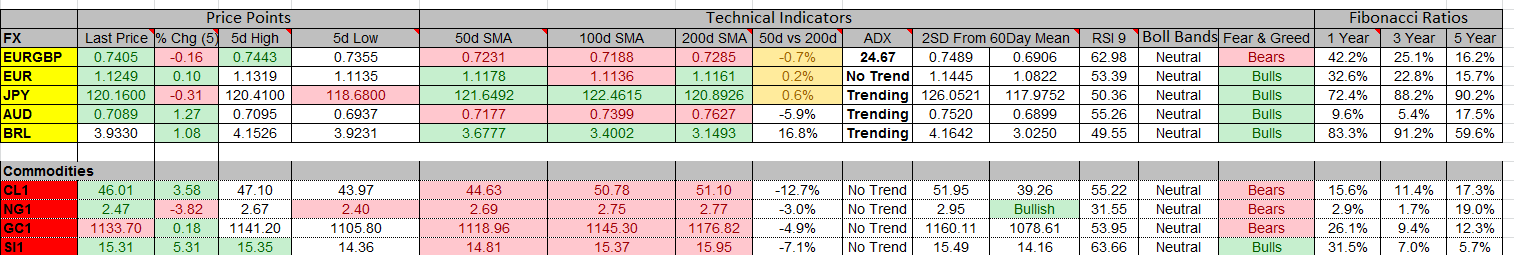

Currencies

- EUR/USD: The pair has formed a wedge pattern on a 60 minute time frame. The next resistance is at 1.146 and the support is at 1.1024.

- USD/JPY: The pair is trading in a symmetrical triangle pattern on a 60 minute time frame. The next resistance is at 124.13 and the support is at 115.92.

- GBP/USD: The pair is trading below its 50 and 100 day moving average on a 60 minute time frame. The resistance is near the 1.5232 and the next support is at 1.508

Indicators

- Asian Markets closed higher by adding gains on top of yesterday. The Nikkei index was the best performing index with a gain of 1.00% and over the last 5 days it is up by 0.70%.

- European markets are trading lower during the early hours of trading. The FTSE MIB index is the worst performing index during the session and it is trading lower by 0.64%. The index is up nearly 2.24% nearly during the past five days.

- US futures are trading lower ahead of the trade balance data. The S&P index was the best performer during the last session and it closed higher by 1.56%.

TOP News

- The Australian trade balance data came in at -3.01B while the forecast was for -2.4B.

- The Royal bank of Australia kept the interest rate unchanged.

- The German factory order fell short of expectations with the reading of -1.8% while the forecast as 0.5%.

Things to Remember

- Use your stops and manage the risk

Market Sentiment

- Crude Oil: The black gold is consolidating in a side way pattern on a 4 hour time frame. The next support is at 43.50 and the resistance is at 49.

- Gold: The precious metal is trading below its 50 and 100 day moving average on a 4 hour time frame. The next support is at 1100 and the resistance is at 1130.

- The VIX index dropped nearly 6.69% during the last session.

Top Economic data

12:30 GMT

CAD – Trade Balance

12:30 GMT

USD – Trade Balance

17:00 GMT

EUR – ECB President Draghi Speaks

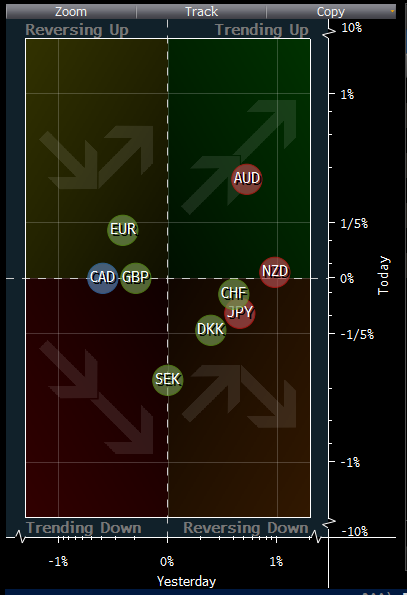

Trends

The below chart shows AUD,NZD, and EUR are trading higher against the USD.

DISCLOSURE & DISCLAIMER: The above is for informational purposes only and NOT to be construed as specific trading advice. responsibility for trade decisions is solely with the reader.

by Naeem Aslam