Despite the global turmoil brought on by COVID-19, from a mutual fund and ETF performance perspective, 2020 was a strong year. The average equity and taxable fixed income fund posted a 15.63% and 5.00% return during this period, respectively.

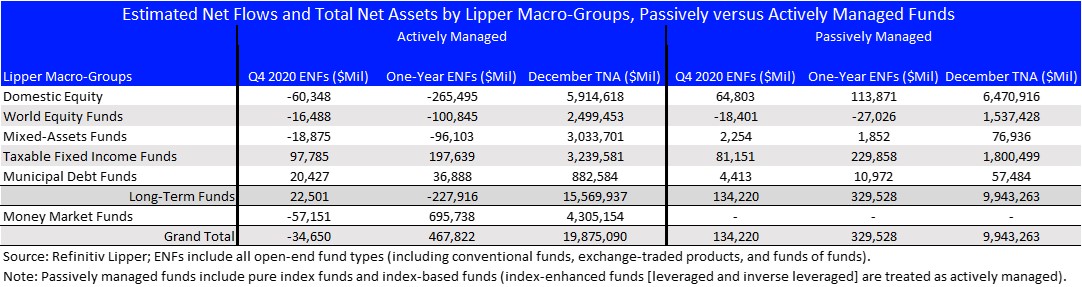

Mutual funds and ETFs attracted some $797.3 billion of net new money during the year, with actively managed funds—excluding money market funds (+$695.7 billion)—handing back $227.9 billion during the year. Meanwhile, their passively managed counterparts took in some $329.5 billion. Shrugging off the spectacular returns for the year, investors gave a cold shoulder to actively managed equity funds, appearing to prefer passively managed equity funds over their actively managed brethren.

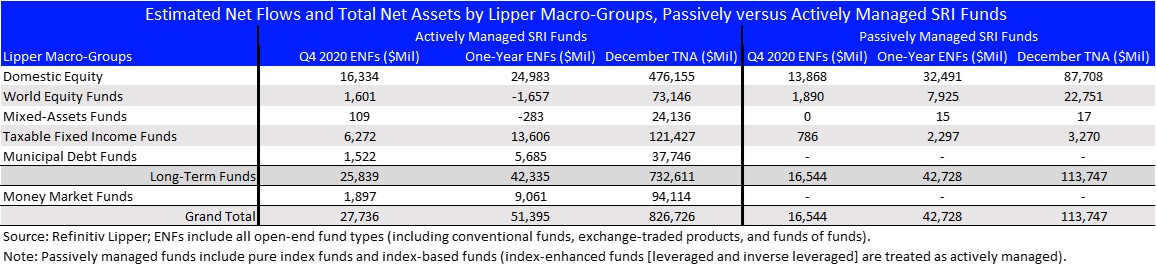

However, as the socially responsible investing (SRI) movement has gained steam over the last few years—with investors focusing on the relatively new movement toward environmental, social, and governance (ESG) focused investment/accounting practices—actively managed funds became the primary attractor of investors assets in this space for 2020.

Investors injected a little less than $44.3 billion into SRI and ESG focused mutual funds and ETFs (collectively, responsible investing [RI]) during Q4 2020, bringing the 2020 net inflows total to $94.1 billion. Assets under management for RI funds jumped 16.9% from $804.8 billion on September 30, 2020 to $940.5 billion on December 31, 2020.

Estimated net flows into long-term RI funds for 2020—excluding money market funds again—were about equally split between actively managed (+$42.3 billion) and passively managed (+$42.7 billion) RI funds, but in contrast to their non-RI funds, remained positive for both groups. We have written in the past about the stickiness of assets in this subset. Investors appear to be willing to put their money where their convictions are generally for the long haul when it comes to socially responsible investing practices.

Total assets under management still favor the actively managed RI funds (+$826.7 billion) over their passively managed counterparts (+$113.7 billion). This is more than likely a result of investors’ long-term commitment to SRI practices seen as early as 1920s in the U.S. when one of the first publicly available SRI funds (Pioneer Fund) used negative screening practices to exclude tobacco, alcohol, and gambling investments from its portfolio. Since then, socially aware practices have continued to evolve.

Like the estimated net flows into traditional funds and ETFs, investors continued to favor passively managed RI domestic equity funds over their actively managed counterparts, but only slightly. Whereas in line with the non-RI universe, investors continue to prefer actively managed RI taxable bond funds over their passively managed cousins.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.