The U.S. Federal Reserve, widely known as simply ‘the Fed,’ surprised the market over the 29-30 January meeting of its Federal Open Market Committee (FOMC) by delivering a dovish message that clearly shed light into the possibility of an early end to the current tightening cycle. The message has come amidst rising downside risks for global growth, muted inflation pressures and inflation expectations, and tighter financial conditions. It has contributed to support the market view that the Fed will pause with its rate hikes in 2019.

After nine rate hikes since the start of the tightening cycle in December 2015, the Fed has decided to maintain the target range for the federal fund rate at 2.25% to 2.5% for the time being. More significantly, the Fed has clearly signaled a patient wait-and-see approach to monetary policy, which is miles away from previous confidence on the need to continue the slow, but steady, interest rate hikes. The new message signals a partial convergence with market expectations and in some ways carries the brunt of the market response to the previous meeting in December 2018. On that occasion, markets did not interpret the “dovish hike” as dovish enough to tackle the tsunami of weak global demand data and the pains of a correction in equity markets and responded in a way that further tightened broader financial conditions.

Our analysis delves into the FOMC’s policy statement and discusses the significance of the latest changes in terms of language, outlook and policy guidance. Our view is that there are three key developments in the statement.

First, the updated policy description of the U.S. economic performance has changed somewhat, with carefully selected words and sentences being shifted to express a slightly less benign backdrop. The characterization of overall growth was downgraded to ‘solid’ from ‘strong,’ even if the labeling of the job market, household spending, unemployment rate, and business fixed investment remained the same as in previous statements. While the statement highlighted that inflation and core inflation are still near 2%, the FOMC introduced a new line in which it acknowledged that market-based measures of inflation compensation ‘moved lower’ in recent months.

Second, the policy outlook section has changed significantly. A line about ‘global economic developments’ and ‘muted inflation pressures’ was included to justify the FOMC’s patience ‘as it determines what future adjustments to the target range for the federal funds rate may be appropriate’ to supports its dual mandate of maximum employment and price stability. Importantly, the statement indicating ‘some further gradual increases in the target range for the federal funds rate’ was removed altogether, implying less confidence about the future direction of the policy rate. Fed Chair Jerome Powell’s remarks in the post-meeting press conference emphasized that the case for raising rates has weakened and that the length of the ‘patience period’ or pause is going to depend entirely on incoming data and its implications for the outlook.

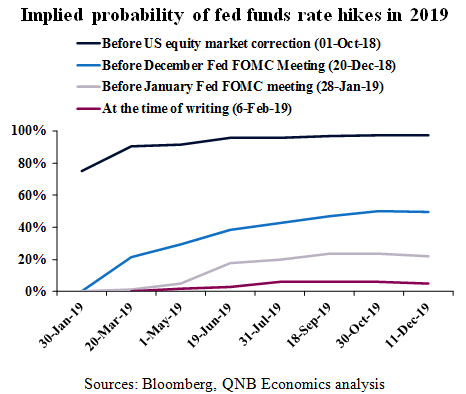

Implied probability of fed funds rate hikes in 2019

Sources: Bloomberg, QNB Economics analysis

Third, the revision of the guidance about policy implementation and balance sheet normalization has taken place. The statement has formalized that the Fed intends to conduct policy under the so-called “floor” system of monetary control, i.e., a system in which the interest on excess reserves is the main operational tool to maintain the federal funds rate within the FOMC’s target range. This means that the FOMC is expecting to keep an ample supply of reserves in the future and therefore will not need to return to the small balance sheets of the past (prior to the Great Financial Crisis). Moreover, the statement mentioned that the FOMC is ‘prepared to adjust any of the details for completing balance sheet normalization in light of economic and financial developments.’ This is in sharp contrast to previous communications in which the balance sheet was regarded as a passive tool on auto-pilot. While the bar is high to slow down or halt the quantitative tightening, the odds for more active management of the balance sheet have increased. According to Chair Powell, the FOMC should find the appropriate endpoint of balance sheet normalization by ‘approaching that point quite carefully,’ which should take place in a rather ‘gradual’ fashion.

All in all, the latest FOMC meeting expressed that the Fed has turned significantly more dovish in recent weeks. As fed funds rate are closer to estimates of the neutral rate or the rate that separates accommodative from restrictive policy, the Fed is expected to be more cautious and avoid a leading role in shaping expectations. The idea is that incoming data should move markets and then align expectations with future policy moves. In fact, the implied probability of rate hikes in any of the remaining 2019 FOMC meetings has plummeted from more than 90.0% in October 2018 to less than 6.0% at the time of writing.