The Federal Reserve (Fed), the US central bank, is under pressure from both President Donald Trump and financial markets to stimulate the US economy by cutting interest rates. However, the Fed only recently switched from a path of steady interest rate hikes to a“wait and see” stance (see “US Fed in full pause but rate cuts unlikely” 31 March 2019). Since then, economic conditions have deteriorated remarkably little despite the outlook becoming much more cloudy. We expect the Fed to wait for clear evidence of economic weakness before cutting interest rates, particularly given Trump’s attack on its independence.

The Federal Open Market Committee (FOMC), which makes the Fed’s monetary policy decisions, released updated economic projections after its meeting on 19 June. The FOMC’s projections have softened, which we believe is mainly due to a combination of the US-China trade war, and recent weaker economic data. However, we fear that Trump's insistence on lower interest rates may also have played a role despite the Fed’s independence.

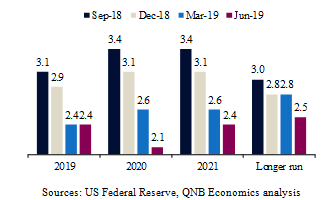

Fed’s interest rate projections

(federal funds rate, % expected by year end)

The Fed publishes a“dot plot” showing year-end forecasts for the Fed's benchmark overnight lending rate, the federal funds rate. The June “dot plot” shows that the median forecast for the fed funds rate has shifted from one hike in 2020 to a single cut in 2019. That is much less aggressive than the two-to-three cuts that were priced into interest rate futures before the meeting.St. Louis Fed President James Bullard is the only Fed policymaker who has said a rate cut may be needed "soon" and he even voted for one at Wednesday’s meeting. Whereas, several other policymakers have indicated that they are willing to move from their “wait and see” stance if necessary. Indeed, Fed Chairman Jerome Powell has promised the Fed will act "as appropriate" in response to risks.

There are four main issues influencing the case for interest rate cuts. Our assessment is that they are broadly balanced, with some downside risk.

First, the US labour market remains robust, with unemployment has near a 50-year low of 3.6%. Job creation dipped to only 75k in May but has still averaged 164k per month so far in 2019, down slightly from 230k over the same period in 2018.

Second, although inflation continues to undershoot the Fed's 2% target, Powell has been clear that inflation is currently depressed by temporary factors.

Third, fading fiscal stimulus and mounting concerns of slowing growth in Europe and China are headwinds for the US economy. Economic growth (GDP) is slowing, but remains robust, with the Atlanta Fed forecasting GDP growth of 2.1%at an annualized rate in Q2, down from 3.1 in Q1. Growth is then expected to stabilize around its potential trend of 1.9% from Q3 onwards.

Fourth, trade uncertainty has undoubtedly increased with Trump using the threat of tariffs to force Mexico to do more to prevent immigration into the US from other Central American countries via Mexico. This is a particularly concerning development as pure trade negotiations can be difficult enough without mixing in other difficult issues. Trump has also promised more tariffs on Chinese imports if a trade deal is not reached when he meets Chinese President Xi Jinping at a Group of 20 summit at the end of June in Japan.

The softening data and pressure on the Fed have prompted us to revise our view.

We now consider further interest rate hikes unlikely, given our expectations of gentle moderating growth in both the US and the global economy. However, a sharp slowdown in the US or global economy unlikely in the absence of a negative shock. Therefore, we do not yet see the need for much lower US interest rates.

We suspect that the Fed may make one cut by the end of 2019 to appease both Trump and financial markets. However, to protect its independence, the Fed is likely to avoid signaling any move to cut rates until it has clear evidence that the risks are actually leading to a sharper slowdown in the economy.

Of course, if economic conditions do deteriorate significantly, then we would expect the Fed to respond aggressively with deeper interest rate cuts and possibly even further asset purchases.

Despite domestic and external headwinds, bond market expectations about deep rate cuts in 2019 are, in our view, exaggerated and are unlikely to be necessary.